The current state of the North American supply base is fundamentally strong with great near-term opportunities. Suppliers have shown great fortitude through the recession of 2008-2009, great resilience through the Japanese and Thailand natural disasters, and will show resourcefulness in meeting the 2013 North American light-duty vehicle production demand. For suppliers, it is not an issue of hitting the forecasted 15.9 million units of production in 2013, a 600,000 incremental increase over 2012. Suppliers will ship the required parts. For suppliers, it is an issue of “How do we get there?”

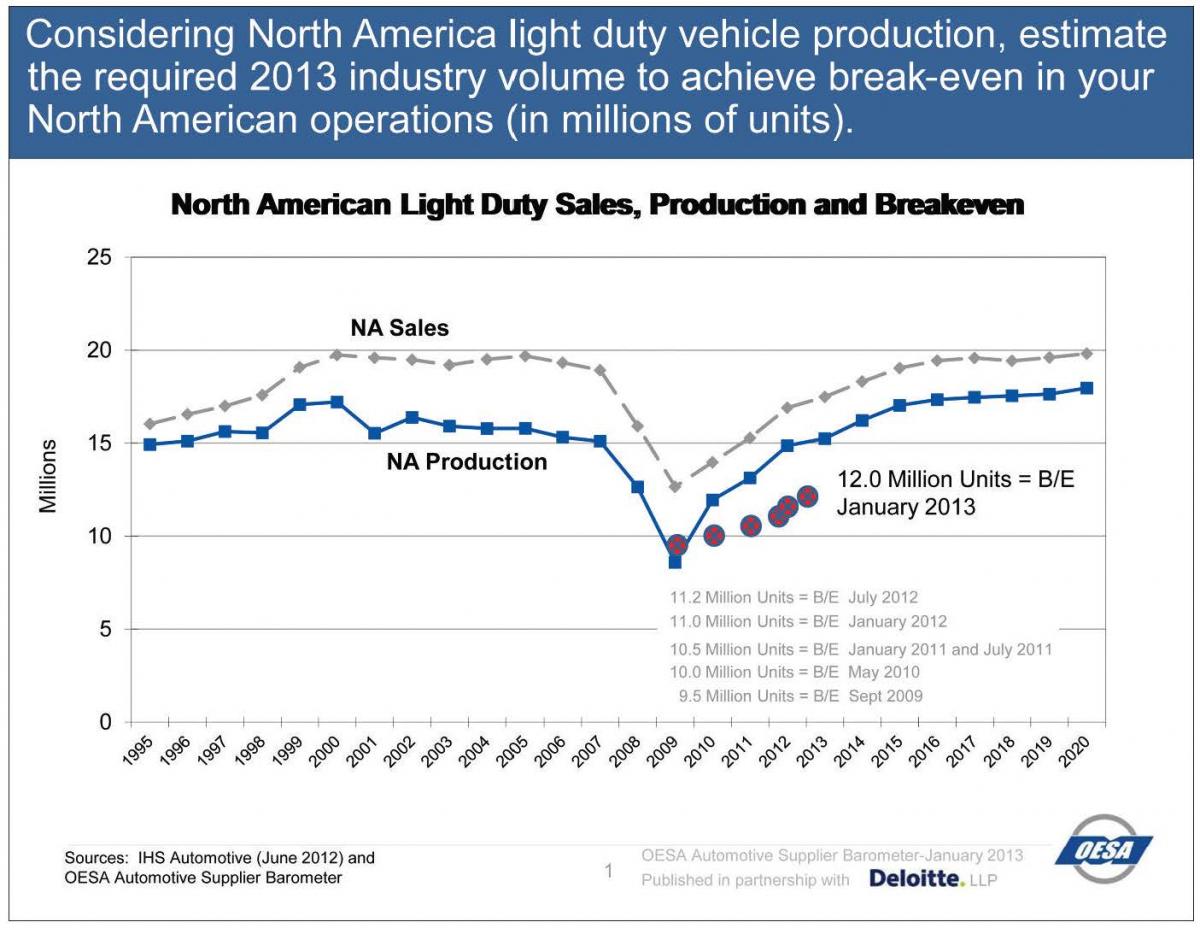

OESA members have noted that North American industry-level break-even points have grown from 9.5 million units in 2009 to 12 million units in 2013, or 21 percent. This increase pales in comparison to the 85 percent increase in production that occurred between 2009 (8.6 million units) and anticipated for 2013 (15.9 million units). This will help protect supplier margins, at least in the North American region. For bankers looking to lend into the industry, there is another way to look at these numbers and that is as an industry stress test: industry volume would need to decline by 25 percent (15.9 million to 12 million units) for the overall supplier industry to run up against their break-even point.

While North American production volumes are strong, suppliers do face major issues over the next three years as they near pre-recession, record production levels and support a record number of new vehicle launches. Overall, the supplier industry is running at approximately 82 percent capacity utilization. The top 25 percent of OESA members – as judged by capacity utilization – are running their operations well over 90 percent of capacity. These tight capacity-utilization rates indicate there will continue to be production constraints within the supply chain. These constraints will not be systemic but will show up as various “pinch points” throughout the supply chain. On the positive side, unlike past years where suppliers’ responses might have been to push overtime and machine operating time, investment decisions are not being delayed or scaled back and production and engineering capacities are being added in North America. For 2013, suppliers are adjusting workforce shifts, adding plants and equipment, optimizing production throughput, increasing supplier development activity and improving schedule and release information and communication. Even with this increased effort, there is a general expectation that material markets, powertrain/engine components and chassis systems will remain tight in supply. There will also continue to be constraints in electronics and capital equipment, two sectors that have shown constraints since the 2010 recovery.

Showing flexibility, fewer OESA members believe they will face increasing outbound and inbound expedited freight, component shortages and raw material shortages in 2013. However, compared to 2012, a greater number of suppliers believe they will face production overtime premiums, skilled labor shortages and internal manufacturing capacity constraints. Most concerning, 24 percent of the respondents to the January 2013 OESA Automotive Supplier Barometer indicate concern about available liquidity in their sub-tier supply base.

Showing flexibility, fewer OESA members believe they will face increasing outbound and inbound expedited freight, component shortages and raw material shortages in 2013. However, compared to 2012, a greater number of suppliers believe they will face production overtime premiums, skilled labor shortages and internal manufacturing capacity constraints. Most concerning, 24 percent of the respondents to the January 2013 OESA Automotive Supplier Barometer indicate concern about available liquidity in their sub-tier supply base.

In a major change from 2009, suppliers generally report a significant improvement in the credit markets and believe there is available credit to support short-term production increases and long-term structural improvements. Again, pulling from the January 2013 OESA Automotive Supplier Barometer, 71 percent of respondents indicate that the bank-lending environment is favorable or without any significant issues (this compares to 55 percent that responded in the same way in 2012). Likewise, the percent of suppliers identifying continued constraints in the lending environment declined from 32 percent in 2012 to 17 percent in 2013. What remains as a red flag is that 24 percent of respondents to the January survey are worried about the liquidity of their sub-tier suppliers. Liquidity concerns are a combination of operational inefficiencies as well as the supply of credit. Suppliers who see this in their sub-tiers are increasing sub-tier monitoring, supplier development actions as well as providing direct injections of capital.

Overall, suppliers show confidence that they can access capital for the broad range of their needs. Offshore manufacturing operations and M&A actions are the only two areas suppliers show less confidence in their access to credit. Generally, smaller firms have less confidence in their ability to tap the credit markets for needed capital than larger firms. As one OESA member recently noted, “It is still hard to get credit, the banks are still steering clear of smaller automotive parts suppliers.”

In summary, while suppliers face numerous issues as they fulfill increased production orders and launch new programs, suppliers are showing their absolute resolve, adaptability and resourcefulness to meet customer demands. Compared to just three years ago, we have to ask, would you rather be a part of an industry that is:

Running at 40 percent under-utilized across the board or dealing with 20 percent of the industry that is running full-out;

Announcing three major reductions in workforces in a week or fighting for the candidate with three completive job offers; or

Dealing with 50 percent of the suppliers that are frozen out of the capital markets or running the workarounds to deal with five percent of the suppliers that are on watch lists while simultaneously launching 50 new products and supporting 600,000 units of incremental production?

The answer is easy. And in the context of an improving economy and the result of a great deal of hard work by the suppliers, OEMs, dealers and others up and down the value chain, we can say, “the current state of the North American supply base is fundamentally strong with great near-term opportunities.”

About OESA

Formed in August 1998, the Original Equipment Suppliers Association (OESA) provides a forum for automotive suppliers by addressing issues of common concern through peer group councils, serving as a reliable source of information and analysis, providing an industry voice on issues of interest and serving as a positive change agent to the automotive industry. With 440 members having global automotive sales exceeding $300 billion, OESA represents more than 70 percent of North American automotive supplier sales.For more information, visit http://www.oesa.org. OESA is an affiliate of the Motor & Equipment Manufacturers Association.