It was exactly four years ago that I wrote an article for Trade & Industry Development on the biotech and pharmaceuticals industries and the requirements for making sound site location decisions that would be most beneficial to the expansion and long-range profitability of the company. A lot has changed since 2010. We have gone through the Great Recession and are now coming out of the other side of the worst economic period since the Great Depression. This was a new experience for both pharma and biotechnology since they were still in their infancy in the 1930s. Surprisingly, the biotech industry seems to have not suffered the same recessionary fate as most of nonresearch industries in the last four years.

It was exactly four years ago that I wrote an article for Trade & Industry Development on the biotech and pharmaceuticals industries and the requirements for making sound site location decisions that would be most beneficial to the expansion and long-range profitability of the company. A lot has changed since 2010. We have gone through the Great Recession and are now coming out of the other side of the worst economic period since the Great Depression. This was a new experience for both pharma and biotechnology since they were still in their infancy in the 1930s. Surprisingly, the biotech industry seems to have not suffered the same recessionary fate as most of nonresearch industries in the last four years.

Battelle reported in June 2014, “The U.S. bioscience industry weathered the recession much better than the overall economy and other leading knowledge-based industries. While national private sector employment fell by 3.1 percent from the outset of the recession, bioscience industry employment fell a mere 0.4 percent. While (biotech/pharma) employment has almost returned to its pre-recession level, the economic output of the bioscience industry has expanded significantly with 17 percent growth, almost twice the national private sector output growth.”

With all this relatively good news, what were the negatives that did impact site location decisions as we pull out of the recessionary nosedive? Two new issues affect location decisions along with the traditional considerations:

Availability of capital investment

The effect of the acceleration of mergers and acquisitions in the biotech industry. There have been over 700 in the last three years according to Bloomberg.

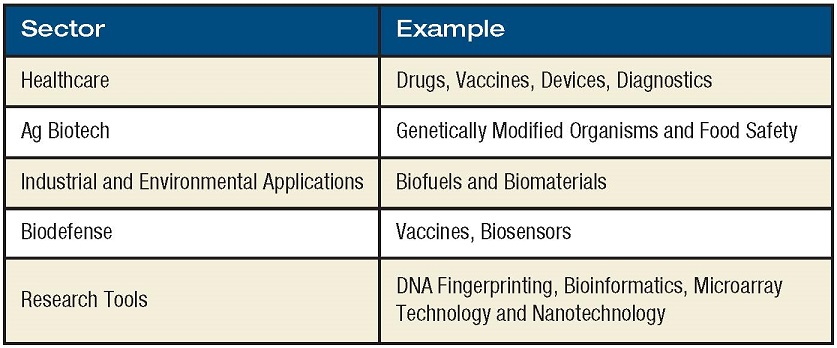

The rules of whom and what the biotechnology industry is remain the same. In 1919, the term “biotechnology” was created to describe the interaction of biology with human technology. Today, the term is broadly applied to an industry that uses knowledge of organisms and biological systems and the ability to manipulate those systems at the molecular level, to create, develop and market new techniques and products. The life sciences sector is divided into a number of distinct industry subgroups that encompass products that fall into the categories shown in the table.

According to the Biotechnology Industry Association, the United States is home to 1,473 biotechnology companies, of which 344 are publicly traded. Biotechnology revolutionized drug design and development by using specific scientific knowledge about living organisms, including genetic information that guides development and function.

According to the Biotechnology Industry Association, the United States is home to 1,473 biotechnology companies, of which 344 are publicly traded. Biotechnology revolutionized drug design and development by using specific scientific knowledge about living organisms, including genetic information that guides development and function.

Prior to the creation of biotechnology, pharmaceutical companies produced drugs and vaccines without the genetic and molecular information that is available today. Since many pharmaceutical companies now apply the same techniques utilized by biotechnology companies, the term “life science” is used to describe both industries.

The biotechnology industry touches all aspects of our lives and can be divided into several sectors on techniques and products. According to the National Biotechnology Advisory Committee, the life sciences industry can be divided into six segments of biotechnology and biomedical manufacturing:

Agricultural Biotech Sector

For thousands of years, farmers have used “selective breeding” to enhance preferred traits in animals and plants. Now, genetically modified organisms (GMOs) are created through the introduction of desired traits via genetic engineering.Industrial Biotechnology Sector

This sector uses living organisms to manufacture a variety of products that result in the reduction of pollution, resource consumption and waste. Silk worms have been engineered to produce human collagen. Products include bioethanol, industrial enzymes, biological fuel cells, enzymes for bioremediation, biodegradable plastics and much more.Medical Devices

Devices include pacemakers, cochlear implants, catheters, contact lenses, prostheses, hearing aids and more. Biosensors translate biological variables such as movement, chemical concentrations, etc. into electrical signals. These devices can be miniaturized and used to internally monitor biological systems. Diagnostics include a variety of testing equipment and techniques, including microarrays and test kits (HIV, pregnancy, drugs and genetic). Genetic testing aids in the early diagnosis of disease and possible prevention. Medical Equipment and Supplies

Medical Equipment and Supplies

This industry is made up of establishments that are primarily engaged in manufacturing medical equipment and supplies, including grinding eyeglasses and hard contact lenses to prescription, on a factory basis.

These establishments produce products such as laboratory balances, hypodermic needles and syringes, bandages and dressings, lab furnaces, blood transfusion equipment, lab furniture, catheters, contact lenses, medical and related instruments, orthopedic devices, dental furniture, prosthetic devices, safety appliances and equipment, gut sutures, sunglasses, hospital furniture and wheelchairs.Pharmaceuticals and Related Manufacturing

Pharmaceuticals include prescription, generic and over-the-counter drugs. Biologics are classified by the FDA as “products derived from living sources” as opposed to a chemical process. Biological products include bacterial and viral vaccines, human blood products, skin grown for burn victims and gene therapy.Research Services

Research tools support discovery and development of technologies used in biotechnology endeavors. Tools such as gel electrophoresis, thermo cyclers, DNA and protein sequencers and microarrays have revolutionized the industry. Research tools may also include the production of media to support cell growth, plasmids for use in genetic engineering and the synthesis of DNA and protein molecules.

Industry Trends

According to Eli Lilly, the estimated cost, on average, of developing and winning market approval for a new drug in the United States is currently $1.3 billion, and takes from 14-18 years from conception to market. Few investors were willing to take this type of financial risk given the global credit crisis precipitated by the melt down of capital markets during the recession. Consequently, many companies in the biotechnology industry are desperately short of cash to complete promising clinical trials, which would result in the introduction of significant new drugs that would benefit all of mankind. Because of the time required to bring a new human treatment to the marketplace, and to the reluctance of investors to supply capital during the recession for long-term projects, there has been a significant shift in the importance of capital investors in the location decision process.

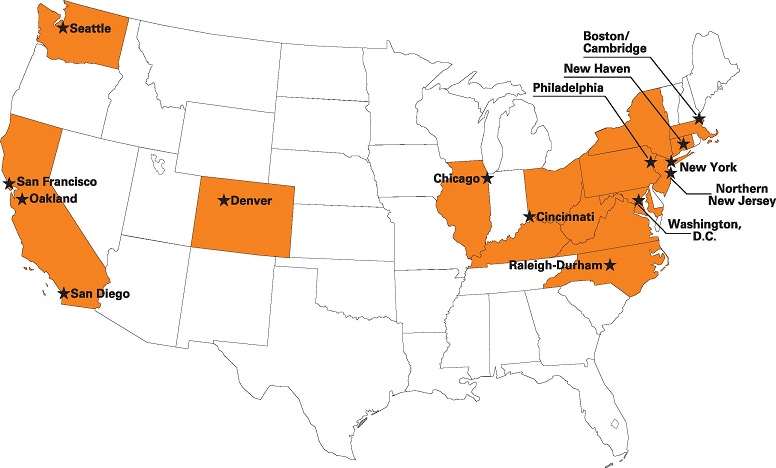

Top 15 Cities for Biotech Venture Funding

Anyone looking for capital to relocate or expand a biotech company should pay close attention to the map. Venture groups, entrepreneurs and increasingly Big Pharma have been concentrating their money and their attention in a few key places, only occasionally straying from the beaten path when funding a high-risk drug development effort.

FierceBiotech states, “It’s no surprise that San Francisco and Boston should vie for top spot on the list of deals and dollars for 2013 as assembled by the Nation Venture capital Association (NCVA). San Diego comes in a distant third, with Washington D.C. and Oakland — perhaps better fitted into the Bay Area roster — coming in fourth and fifth. The top three cities accounted for more than half of all biotech venture cash gambled last year in the U.S. according to NVCA’s figures. By the time you get into the second tier — Seattle, New York, Philadelphia, a New Jersey hot spot and then down into North Carolina — the cash pales in comparison to the top group. And the next five — Cincinnati, Denver, New Haven, Los Angeles and Chicago — the numbers become a mere fraction of the year’s healthy $4.5 billion total. With its $45 million take, Los Angeles accounts for only one percent of the total.”

Beside the availability of venture capital, these locations offer the availability of highly skilled and trained workers plus the synergy created with nearby major research universities. These concentrations of brainpower and collection of potential companies for mergers or acquisitions in one geographic location make these areas powerful draws.

However, there are downsides with these sites including expensive housing, quality of life issues and limited labor pool availability. Low unemployment numbers makes it difficult and expensive to find employees. For example, Genentech’s career site has 346 open positions in South San Francisco – mostly for experienced scientists and technicians. Hundreds of experienced biotech jobs are going unfilled in San Diego, Boston and other industry centers of excellence due a shortage of trained workers. UC San Diego and other educational institutions are trying to address these needs by offering extension certificated coursework in life sciences skills needs such as ADMET processes, biofuels processes, biostatistics, biotechnology project management, clinical trials administration, data mining, drug discovery and development, in vitro diagnostics, life sciences information technology, quality assurance and control, regulatory affairs for the biomedicine and SAS.

Studies show that approximately one quarter of workers in research, development and biotech fields earn $88,901 to $270,300 per year. Areas that are targeting biomedicine must be able to prove the availability of skilled and experienced life sciences professionals to attract these types of jobs.

Studies show that approximately one quarter of workers in research, development and biotech fields earn $88,901 to $270,300 per year. Areas that are targeting biomedicine must be able to prove the availability of skilled and experienced life sciences professionals to attract these types of jobs.

Site Selection Methodology

Too often, executives do not evaluate all of their alternative options near or close to these major hubs prior to committing their companies to a long-term location. They fail to thoroughly explore labor market, real estate, utilities and incentives programs that can make the difference between enterprise success and failure. On the other hand, some executives allow one factor, such as capital availability or incentives, to drive the entire location decision. Neither of these approaches is correct.

The best site selection approach for medical device manufacturers is to first identify the key criteria necessary for the success of the proposed facility, as well as the project’s location drivers. Some examples of location drivers include the following.

Availability of highly educated/abundant pool of scientists and other skill sets

Venture funding availability

Near universities and research labs

Opportunity for excellent networking and collaborative opportunities within the life sciences sector

Opportunities for continuing education

Suitable industrial land and buildings and favorable construction costs

State and local incentives

Located in a growing market area

Reasonable taxes and regulations

Abundant professional cultural and recreational opportunities

Vigorous business community with supporting business services

Availability of housing at reasonable cost

Modern and effective school systems

Good social and physical environments

Airport service and frequency.

Source: The RSH Group, Survey of Southern California Bio Tech Companies

Once these key drivers are identified, a company is better positioned to conduct a thorough analysis of potential site locations. Most times, a search should encompass multiple states or countries. Each state, area and country has thousands of elements of information that could be important in the site selection process, and the sheer volume of such information can be overwhelming to the site-seeking executive. By identifying key requirements up front, it is possible to focus due diligence efforts on those factors that are most important to the success of the proposed project.

There are a variety of state and local incentives available to the biotech industry depending on the geographic location, type of operation, investment, employment and tax impact of the company’s facilities. Such incentives include tax rebates, exemptions, moratoriums, reductions, credits, deductions, infrastructure improvements, relocation and cash grants, which can be used to offset both start-up costs as well as the cost of ongoing operations.

Total benefits provided to a company in a given region can range from a low of several thousand dollars per employee to cases in which employers have been offered incentives packages that amounted to millions of dollars per employee. Whether a company will be on the lower or higher end of this range — and whether available incentives are collected at all — will depend to a large extent on the knowledge and skill a company brings to the negotiating table.

With the capital-intensive nature of starting up research and development, it makes sense to make the most of every financial incentive and tax credit available. Negotiating incentives, however, is only half the battle.

Once you have chosen a location and agreed upon a financial incentive offer, you must go through several steps to collect the funds. You will want to have an incentive negotiator who also handles the collection process (compliance). Tracking and effectively managing the collection process for incentives is critical to the biotech field because many of these will be tax credit based.

By following these tips and exploring your options, you can generate several million dollars for your biotech company. Decisions to create new locations only come once in a while, so don’t miss the opportunity to improve your company’s profitability and competitive positioning through smart location planning.