If it is not advanced, it is not manufacturing. From food packaging and processing to semiconductors and biotech, nearly all manufacturing today is sophisticated, either in terms of machinery, operational processes or skills – often all three.

If it is not advanced, it is not manufacturing. From food packaging and processing to semiconductors and biotech, nearly all manufacturing today is sophisticated, either in terms of machinery, operational processes or skills – often all three.

How then do site seekers distinguish across this vast spectrum, in terms of criteria and selection methodology, and economic developers, in terms of business attraction? This article intends to provide some challenges and insights into this question, focusing within the nomenclature of the life sciences and semiconductor industries.

Challenge One: Defining advanced manufacturing

To slice and dice of the operational facets that fall within ‘advanced manufacturing’ is perplexing. Snapshots of the life sciences and semiconductor industries illustrate this complexity.

Life sciences cover a spectrum ranging from core scientific research and development to commercialization and manufacturing to medicine and patient care to information management to the business side of all of these. Some of the key sectors include:

• Biotechnology: The application of engineering and technology to life sciences - includes the use of biological processes, organisms or systems to produce products intended to improve human life quality.

• Bioinformatics: The ‘dry science’ of biotechnology…the application of information technology to the field of molecular biology.

• Medical devices: Production of biomedical instruments for patient diagnostics, treatment and care as well as simulation equipment and training; these range from the simple, e.g., tongue depressors, to the exceptionally complex, e.g., biorobotics.

• Pharmaceuticals: Traditional “big pharma” companies which are the key commercializers and integrators of biotech innovation.

• Personalized medical management: A broad range of clinical activities, training and healthcare IT in support of improved patient care ranging from personalized drug and treatment therapies to physician training and certification.

• Electronic health records management: Digitizing medical records has vast potential to save time, money and patient lives. It also is said to have the ability to positively impact drug discovery and clinical development through more efficient and quick interface with medical information.

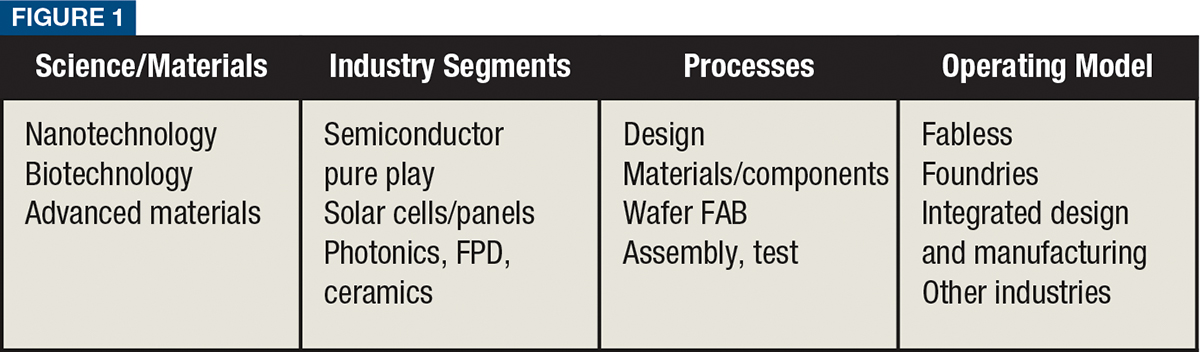

Likewise, what is generally defined as the ‘semiconductor’ industry presents a complex web of overlapping sciences, industry segments, processes and operating models, each of which optimize to different location clusters and geographies. Examples include the industries in Figure 1.

Likewise, what is generally defined as the ‘semiconductor’ industry presents a complex web of overlapping sciences, industry segments, processes and operating models, each of which optimize to different location clusters and geographies. Examples include the industries in Figure 1.

Furthermore, the manufacturing processes pertaining to semiconductors cross other industries with potential target investment from sectors as diverse as telecommunications, aerospace, automotive and others.

Key takeaway: Focus on the niche, not on the general concept of the industry.

Challenge Two: Advanced manufacturing location decisions vary by each of the overlapping facets

Challenge Two: Advanced manufacturing location decisions vary by each of the overlapping facets

Cutting-edge research, discovery and commercialization are clearly the core of life sciences. The semiconductor industry is driven by a globally connected supply chain which intersects multiple business activities, operating models and functions. And, of course, all technology and manufacturing activities are underpinned by corporate functions such as headquarters, finance, marketing /sales and servicing. Each of these is driven by different types of location strategies.

In general, location strategies fall somewhere between two distinct poles. At one end of the spectrum are cost-driven decisions; at the other end are performance-driven decisions. A cost-driven strategy is one that emphasizes reductions in operating expenses. A performance-driven location strategy is one where cost containment is secondary to overriding value enhancement factors related to innovation and the strategic viability of the enterprise.

Most of the R&D, commercialization, financing and headquarters functions – and much manufacturing – in advanced technology companies are located within the context of performance-driven factors. Communications and collaboration synergies to ensure creativity, leverage market trends and gain intelligence often keep these functions located together and geographically clustered with similar organizations. Such functions are typically located according to factors such as talent and skills availability (usually in conjunction with a superior quality of life environment to attract knowledge workers), presence of synergistic organizations, business and tax climate which supports innovation, and sites that have both the appropriate infrastructure for the particular activity and which project an intangible sense of image that communicates cutting-edge discovery. Intellectual property protection is also particularly important, in a global context.

The supporting business functions will tend to be sited by cost factors and workforce availability. And, as technology companies evolve from startup to mature organizations, the business backbone requirements increase proportionally, and these requirements are often cost driven. Established and often global technology and bioscience companies have large (in some cases, huge) enabling and supporting organizations beyond their core technology businesses and manufacturing activity. These include internal finance, human resources, training, marketing, regulatory, corporate governance and customer servicing.

Location selection for specific advanced manufacturing activities generally fall somewhere between a cost and performance focus, depending on the technical talent required, sophistication and degree of automation of the manufacturing process and commensurate skill needs, intellectual property sensitivity, site and infrastructure requirements, and the need to be proximate to markets, suppliers and other corporate functions. The track record of localities in supporting the type of operation is another important consideration.

Key takeaway: Site selection criteria will vary greatly within advanced manufacturing industries, depending on the requirements of specific functions and processes.

Challenge Three: Location decisions also vary by business maturity

Challenge Three: Location decisions also vary by business maturity

Life cycle changes are continuous from product conception to growth, maturity and eventual decline until new discoveries/innovative solutions and resultant services and products are introduced…and so the cycle continues. As the enterprise grows, the geographic and facility footprint need to be flexible to support changing conditions. The stages of this cycle are illustrated as follows.

• Stage One: Startup. Siting priorities include business incubation and acceleration support, angel/venture capital sources, collaborative networks and patent protection.

• Stage Two: Growth. Location priorities include access to knowledge and talent pools, tax structures to minimize profit exposure, facilities infrastructure, market presence and intellectual property protection.

• Stage Three: Maturity. As enterprises mature, cost and rationalization gain importance – managing the size of supporting internal services and the efficiency of multiple workplaces. Innovation often springs from acquisitions and mergers.

• Stage Four: Decline. Companies in decline tend to be concerned about quick-hit cost reduction, such as layoffs, divestiture of unprofitable or non-core businesses and capital asset monetization.

Key takeaway: Flexibility to changing business conditions is an important consideration when companies are making location investment decisions.

Challenge Four: Convergence of related industries.

Challenge Four: Convergence of related industries.

Seemingly disparate technologies are converging, such as information technology, nanotechnology and biotechnology. Convergence challenges the very definition of traditional industries, but provides the site seeker (and economic developer) new alignments of talent and industry clusters to achieve business needs.

Key takeaway: Geographic clusters of like activities provide a hedge for future patterns of technology innovation, evolution and convergence.

Challenge Five: Competitive areas for investment vary within the facets of the industry.

As technology advances, morphs and converges, it becomes increasingly difficult to align all the moving parts into precise industry niches, which themselves continually evolve. Different site and communities appeal to different end-user targets given location, infrastructure, development track record and other factors. In the case of semiconductors, the industry is globally complex and dynamic. Location requirements vary by specific manufacturing process within the value chain of semiconductor manufacturing (e.g., design, FAB, assembly). Location requirements and trends also vary significantly by company operating model (e.g., fabless, foundry, integrated design-manufacturing). For example, in the ‘fabless – foundry’ model, most advanced manufacturing (for example, 300-mm wafer fabrication), now occurs in Asia: Taiwan, Singapore and Malaysia, with China and Vietnam entering this space as well.

In contrast, integrated device manufacturers continue to invest in FAB manufacturing in the U.S. Furthermore, a study by the Semiconductor Industry Association in 2015 indicated that U.S semiconductor companies perform most of their manufacturing within the U.S. and that semiconductors are one of the USA’s three leading exports, behind only aircraft and automobiles.

Key takeaway: Knowing the competitive geographic landscape of the industry subsector helps to focus search areas of realistic siting alternatives.

Challenge Six: Talent needs in advanced manufacturing.

Challenge Six: Talent needs in advanced manufacturing.

The talent strategy of the advanced manufacturing company needs to align with the overall business strategy, pace of innovation, market development and the corporate real estate footprint among other factors. In making location and siting decisions, companies will look at:

• Skills and experience in place now across the company’s geographic footprint

• Skills and experience needed in the future to sustain competitive advantage and technical innovation as technologies and markets change.

• Marketing/sales skills: solutions and value propositions to customers and prospects, based on the technical advantage or efficiencies enabled through innovation.

• Enabling and servicing skills that driving the engine of the company forward: HR, finance, corporate, shared services, supply chain and related functional skills.

Key takeaway: The talent strategy combined with the go-to-market strategy sets the stage for workforce planning at the individual site level fine-tuned to job/ families/grades/and skill sets needed.

Challenge Seven: Site and infrastructure Constraints

Sites for advanced manufacturing may have differing and distinguishing characteristics relative to:

• Site development characteristics and robustness of critical infrastructure, such as power, water and broadband.

• Talent and labor market access to sites, from a commuting perspective.

• Stages of site development readiness relative to the specific advanced manufacturing industry sector.

• Neighboring compatible uses.

• Potential cost differences relative to power, water, labor and other factors.

• Permitting environment.

• Site development time to delivery.

• The local community’s track record in attracting the specific industry and activity. The regulatory and facility planning and permitting implications of some new technologies, such as nanotechnology are not fully charted. In areas such as gene therapies and nano-biotechnology, a local track record in permitting these complex and pioneering niches is often a critical siting requirement.

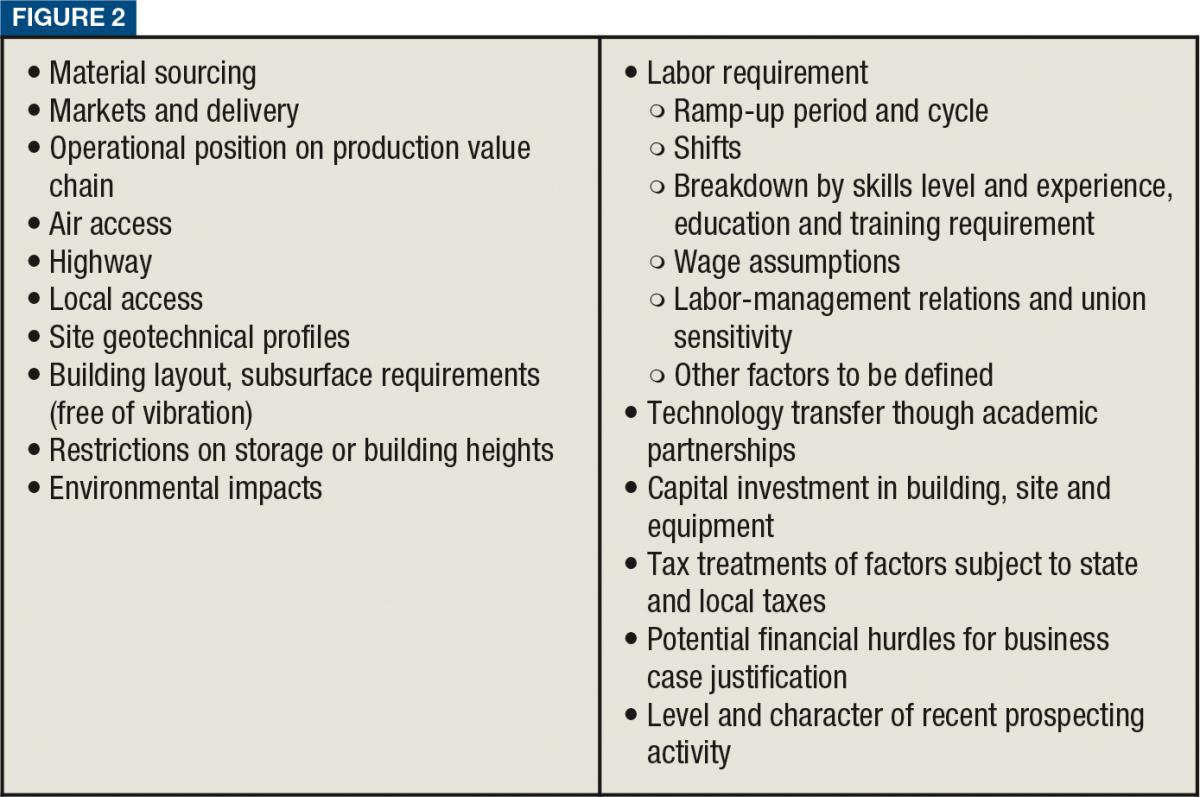

Other elements typically considered in the site search for large advanced manufacturing plants might include the elements included in Figure 2.

Other elements typically considered in the site search for large advanced manufacturing plants might include the elements included in Figure 2.

Key takeaway: Certified sites, available building and readily demonstrable workforce skills and local training competencies are becoming essential location assets to attract advanced manufacturing investment.

Guidelines for Finding a Successful Location

Here is a list of useful tips to guide organizations in advanced manufacturing industries through a successful business location process.

1. Start with a vision. Determine what the critical factors that drive the business and the functions within are. Is the operation in question performance-driven or cost-driven? How critical is the project delivery timeframe? How specific are the facility and infrastructure requirements?

2. Prioritize objectives. Before thinking about specific locations, know what must be achieved. How will critical talent be sourced and how much will that cost? How easy will it be to startup a new operation? Will future markets be the same as present markets? How much will it cost to move? These all affect the magnitude and search area of a location decision and the tier of locations that should be considering before beginning an exhaustive search.

3. Determine the investment costs. Place all costs into perspective. For example, if 15 percent a year in labor savings can be achieved in a new location, but if the upfront costs of the investment take 10 years of savings to pay back the upfront costs, the strategy may need to be reworked.

4. Place all factors into perspective. Don’t be lured by a low-cost environment if it can’t meet technology, workforce or other requirements; place incentives into perspective, and not too early in the process

5. Document the process. A logical, defensible decision-making methodology is the best way to ensure that organizational consensus on the location is achieved. T&ID