This article highlights location trends within the metalworking sector. The main focus will be on applied metal products, which range from forgings to machine tools. In the article we will not address the basic metals sector (e.g., smelting) as site selection criteria are more unique (e.g., abundant/low-cost energy).

This article highlights location trends within the metalworking sector. The main focus will be on applied metal products, which range from forgings to machine tools. In the article we will not address the basic metals sector (e.g., smelting) as site selection criteria are more unique (e.g., abundant/low-cost energy).

Industry Composition

The metalworking industry as it pertains to this article covers NAICS codes 332 (Fabricated Metal Products), 333 (Machinery) and 3315 (Foundries). These industries comprise mostly capital goods, displaying similar marketplace trends, production requirements and location criteria. It should be noted that electrical equipment/appliances, motor vehicles and aerospace are sometimes lumped into metalworking. But their operational needs are different and hence, for purposes of this article, are excluded.

In the U.S., the metalworking industry (NAICS 3315, 332 and 333) employs 2.63 million workers. Most businesses are small to mid-size (under 100 employees). Annual sales over the last four quarters registered an estimated $748.5 billion. Exports accounted for about 15 percent of gross revenue volume.

Market Conditions

Steady growth has been exhibited by the U.S. metalworking industry since 2011. Fueling growth has been the gradual economic rebound in North America, increased capital spending by U.S. businesses and solid exports (in part due to favorable currency exchange rates).

Over the next three years, growth should persist at a moderate pace. The U.S. economy will continue to expand. Additionally, Europe seems to be coming out of the economic doldrums. Asia should also perform well even if China’s economic growth is more moderate than earlier in the decade.

Unless the U.S. dollar dramatically rises against other major currencies, exports should remain healthy. A majority of economists believe that the USD will advance by no more than five to seven percent versus other key currencies over the next couple of years. Furthermore, companies in emerging countries will accelerate investment in new technology, which should help U.S. exports. Five major reasons U.S. metalworking companies are globally competitive embrace:

Innovation (product enhancement and new products)

Process improvement (introduction of the latest technologies)

High-quality products (perform well with minimal defects)

Ability to customize products on relatively short notice

Better management of the end-to-end supply chain (cost, efficiency, flexibility, risk).

These market forces bode well for new plant creation and existing facility expansion in the U.S. Many of the new production entities will serve regional markets as customers demand rapid delivery, customization and minimal inventory carrying costs.

Foreign producers will also play a conspicuous role in the coming production capacity increase in the U.S. As before, the major players will be companies from Germany, UK, Nordic countries, Japan and South Korea. Importantly, there will also be significantly more inward investment activity from BRIC (Brazil, Russia, India and China) metalworking manufacturers.

Industry Geography

Historically, this industry has been concentrated in states with the densest clustering of manufacturing, transportation and utility industries. This pattern still holds true but two other dynamics have opened up other doors. These are lower-cost states within reasonable distance of major customers and/or centers of fast growth energy development (including alternative energy and shale gas).

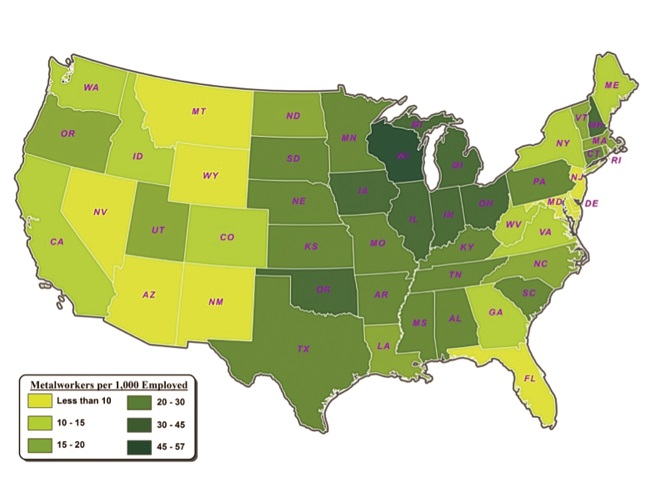

The map below shows the proportion of metalworking employment per 1,000 workforce for all states. The most significant clustering occurs in the Midwest and Upper South. West of the Mississippi River, Texas and Oklahoma are well represented. States shown on the following list have an above average presence of the metalworking sector (as measured by employment per 1,000 workers).

Ratio of Metalworking to Total Workforce (per 1,000 Employees) | ||

|

|

|

WI |

| 57.0 |

IA |

| 43.2 |

MI |

| 38.7 |

OH |

| 37.7 |

IN |

| 37.3 |

OK |

| 36.0 |

NH |

| 32.8 |

IL |

| 32.5 |

MN |

| 29.1 |

CT |

| 27.3 |

SD |

| 27.3 |

SC |

| 26.6 |

KS |

| 25.5 |

AR |

| 25.1 |

PA |

| 25.1 |

TN |

| 23.6 |

TX |

| 22.6 |

MO |

| 22.5 |

AL |

| 22.5 |

KY |

| 22.4 |

NE |

| 20.5 |

MS |

| 20.2 |

United States |

| 20.1 |

Future metalworking site selection will occur throughout the U.S. Among the highest growth regions will be the Southeast, selected Midwest states, Great Plains (energy-producing states) and the Gulf Coast. Best performing states will be those characterized by market proximity, moderate business cost, favorable business climate, surplus labor pools and superior transportation infrastructure.

Location Criteria

The emphasis placed on various location criteria will vary by each company’s unique needs/requirements. However, there are a number of criteria which tend to be important to very important for most metalworking site selection projects. These are as follows:

Market proximity

Frequently within next-day delivery, by motor carrier, of key customers

In siting new plants, it is important to also determine if there will be any future changes in the geography of customers

Additionally, if there are multiple plants, which customers are most optimally served from each facility (including the new one)

Transportation resources

Within reasonable drive (perhaps 15 minutes) to a limited access, four-lane highway

Uncongested access road to the worksite (beware of railroad crossings with heavy rail traffic)

Ample motor carrier service (TL or LTL with local terminals) including backhaul opportunities (filling empty trailers can result in substantial price discounts)

In some cases, if parts or raw materials are imported, within several hours’ drive of a seaport

For about 15 percent of projects, a rail siding (if a small user such as less than 100 cars a year, be sure the RR will accept that volume)

Maximum drive time to a commercial airport (usually 60-90 minutes)

If parts shipped by air, proximity to a regional small package processing center

Available modern building

Many firms strongly prefer a vacated building to speed up initial production and lower one-time capital cost

Building should be readily expandable

Ceiling heights often 28 or more feet

Open column spacing

Minimum 6” reinforced concrete floor

Ready-to-go site

Properly zoned

All utilities in place

Compatible with nearby land uses

Environmentally clean (Phase One assessment completed)

Acceptable soil load bearing and water table

Outside the 100 year (and ideally 500 year) flood plain

Good public services

Acceptable fire insurance rating

Elevated water storage

Good access roads

Quality appearance

Excess infrastructure capacity

Surplus electric power

Reliable electric power

In some cases, dual electric power service (from two substations)

Natural gas available

Sufficient water and sewer treatment capacity

Adequate labor supply

Comprises one of the biggest challenges for the industry

Imperative to make certain there is now and will likely be a surplus of requisite skillsets

Requires a quantification of employment by occupation within a 30-45 minute commute and input from local employers on applicant flow/ease or difficulty of hiring (entry-level trainees and experienced workers)

Surplus conditions should exist for positions such as:

CNC machine operator

Machinist

Machine maintenance

Tool and die

Welder

Quality control

In some cases, engineers (industrial, mechanical, electrical)

High school and post-secondary training programs for advanced manufacturing trades

Labor quality

Basic skills

Computer literacy

Problem solving

Work ethic

Productivity

Absenteeism

Turnover

Proportion of applicants failing tests, e.g.,

Drug

Background

Aptitude

Unionization

Right-to-work state often desirable (but beware of making this a pre-condition)

Percent private-sector workforce organized

Union organizing activity

Union status of comparable employers

Presence of selected unions, irrespective of industry

Environmental

Reasonable regulations

Air quality attainment

Good water quality

Hazardous waste storage/transport

Outside storage

Permit approval times

Business operating costs

Wages (most companies prefer to be lower than the U.S. average for most populous positions)

Determine effective starting rate

Ascertain rate of progression to remain competitive in the local market

Gauge whether incentive compensation will be required to successfully staff the new plant

Critical to determine if there will be future wage escalation pressure due to imbalance of supply/demand

Worker’s compensation

Unemployment insurance

Shift premium (necessary to staff off-shifts and weekends)

Overtime policy (e.g., over eight or 40) and ability to staff overtime

Electric power

Other utilities (e.g., natural gas)

Freight

-- Inbound

-- Outbound

Taxation

-- Corporate income rate and apportionment formula

-- Property (including exemptions)

-- Sales (including exemptions)

-- Franchise

-- Gross receipts

Potential incentives (that can be used by the company), e.g.,

-- Investment tax credit (is it refundable)

-- Job creation tax credit (is it refundable?)

-- Sales tax refunds

-- Property tax abatement

-- Deal closing grant

-- Low interest or forgivable loan

-- Tax increment financing (TIF)

-- Economic development rider for electric power

-- Land/building cost write-down

-- Subsidized pre-employment training (see if funds go directly to company)

-- Applicability of federal incentives (e.g., Work Opportunity or New Market tax credits)

-- Determine eligibility (e.g., wage threshold) and any recapture/claw-back provisions for each incentive

Natural disaster risk (e.g., earthquakes)

Typically the best locations will be those that score high on qualitative factors (e.g., labor market) and offer a moderate-cost environment. Furthermore, there should be confidence that a location’s most compelling advantages will hold up well into the future.

Choosing the Optimal Location

Choosing the Optimal Location

The aforementioned criteria must first be assigned appropriate weights by the project team. Also at the outset of a site selection exercise, it is necessary to delimit year one and future operating requirements. These include headcount, real estate, capital investment, utilities, etc.

Once this spadework is completed, a two-phase process should be followed to select the best location. The process is highlighted below.

Phase One location screening comprises an iterative process wherein areas are systematically eliminated until a short list emerges. Research input embraces tapping databases in early stages and once a manageable number of locations surface, reaching out to economic development groups for more customized information.

Early stage, desktop screen is undertaken in a series of rounds. Statistical thresholds (e.g., population growth rate) are established for each round. Areas are then rejected or retained depending on whether they pass the statistical test. This should lead to a longlist of semifinalist locations (maybe eight-12).

In a second stage effort, prepare a Request for Information (RFI) to send to the lead economic development agency. Here you would be looking for information not found in databases. Examples would embody major employers, new/downsizing employers, available sites/buildings, electric power cost, wage rates from local surveys, motor carrier service, etc.

Statistical and RFI results should be combined to rate/score each area. The weighted model might include categories such as:

Proximity

Labor market

Utilities

Sites/buildings

Transportation

Disaster risk

Quality of life

Business costs.

The top-rated locations (often three to five) are then carried forward to field investigation (Phase Two). Principal research input involves community visits. The visits are arranged by the economic development group. While in the field, the project team engages in the following:

Orientation briefing by the economic development organization

Confidential interviews with manufacturing companies

Confidential interviews with other pertinent entities such as

Utilities

Staffing agency

Government officials

Transportation representatives

Education/training officials

State career center (Labor office)

Others as appropriate

Tours of available sites/buildings

Community/quality-of-life tours

Request for and discussion of incentives applicable to the project in question

Request for the economic development agency to provide appropriate details on factors such as sites, permitting, taxes, etc.

The project team compares each short listed area on business operating conditions. Areas are ranked/scored on qualitative and cost factors. Typically a couple of locations are chosen as finalists. The team then conducts due diligence negotiation (e.g., real estate and incentives) in the finalist areas. This leads to selection of the ultimate location (community) and site (property).

Conclusions

The metalworking industry is thriving in the U.S. Both domestic and foreign producers are building new facilities to serve the U.S. and in some cases export markets.

Nearly all regions of the U.S. have and will see new metalworking investment. But areas that are close to customers, display strong labor markets, have excess infrastructure capacity, allow the option of an available building and comprise modest cost alternatives will flourish the most.

While the challenge for companies to find optimal sites can be daunting, adhering to a systematic approach is the only way to go. While many factors are key, there will typically be none more critical than labor supply/quality/cost. To ensure long-range success of a new metalworking plant it is essential that the chosen location can yield an adequate pool of qualified labor at an affordable cost.