How far along are you on the road to mastering this valuable business data?

Recent research suggests that most commercial real estate executives are just getting started. Like learning karate or a musical instrument, mastering the analysis of real estate data takes time. And it wasn’t long ago that sophisticated skill in interpreting real estate data was a nice-to-have, not the necessity it has become. Today, understanding how real estate data informs the overall business is an important skill for all executives, and even more so for those involved in supply chain, location and workplace strategy.

Companies are investing in corporate real estate data, according to a new study by Forrester Consulting commissioned by JLL. Sixty-four percent of CRE teams experienced an increase in their data and analytics budgets in last fiscal year and expect a budget increase this year, too.

The most data-centric CRE masters are aggregating and analyzing both traditional data and unstructured data — think emails, social media posts, transaction logs, images or anything that doesn’t fit neatly into a chart. And they are wielding their insights to clarify decision making. The result? Better-informed site selection, workplace design and facilities management, and more sophisticated alignment with overall company strategy.

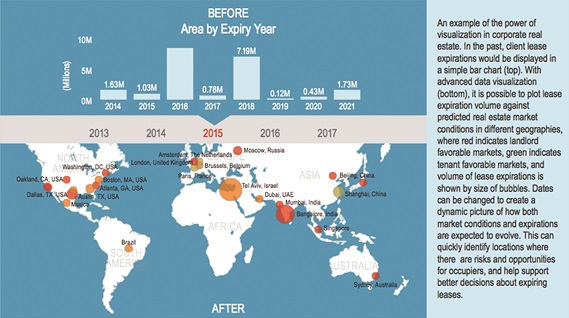

How do you tie arcane digital inputs — chemical levels detected by building sensors, anyone? — to informed data-driven decision making? It’s all in the analytics. Technological improvements have increased the capacity, and lowered the cost, of data and analytics platforms that aggregate information and provide human-friendly interpretations. From consolidating historical data in tabular reports to visually modeling outcome forecasts, executives in many companies now expect this real estate data to be included in data-driven business decision making.

The increasingly sophisticated use of analytics has led to powerful shifts in how companies make decisions, innovate and strategize. When a company integrates its real estate data into other functional information, it delivers an even sharper competitive edge. In a 2014 study by Sloan School of Management at MIT, 66 percent of executives reported a gain in competitive advantage derived from data and analytics, up from 37 percent in 2010. Similarly, a Harvard Business Review study found that companies among the top third in their industry for data-driven decision making are five percent more productive and six percent more profitable than their competitors.

However, real estate data has generally been among the last to be integrated into the C-suite dashboard. Even companies that have embraced data-driven decision making may still have a long road to travel to CRE data mastery. No wonder 56 percent of CRE executives say they aspire to become data-centric in the next three years, using CRE data and analytics in every aspects of their work. JLL’s 2013 Global Trends in Corporate Real Estate study showed that 78 percent of the more than 600 executives surveyed had improved their ability to extract real estate metrics since 2010. Almost a third said data and insights would be the most important future contribution of CRE to their organizations.

The following are some of the key ways real estate data and analytics technologies in the right hands are transforming business strategies.

Know Before You Go

Deep data leads to informed site selection decisions. Say you are a leader at a biotechnology company seeking to expand in an innovation-friendly location. Which is better for talent recruitment, an urban or suburban setting? Which is more cost-efficient, buying or leasing? Retrofitting or building from scratch? What is the cost premium for access to major research institutions?

Or, consider a third-party logistics company that is expanding its distribution center network. Which makes more sense, paying more for a premium site close to customers or a lower-cost location on the outskirts of the market?

Once you’ve become a master of real estate data and analytics, you can compile such factors as real estate costs, transportation channels, dock access and workforce availability into sophisticated risk and return-on-investment analyses. These inputs can help you locate operations where the labor availability and real estate options will support broad business goals such as speed-to-market and workforce expertise — in addition to keeping costs under control.

Retailers have long relied on the analysis of demographics, drive-by traffic and per-capita income data to determine the potential of a particular location or trade area. Today’s data and analytics tools kick it up a notch, enabling retailers to add psychographics — data about consumers’ buying habits — into the mix and pinpoint where and how consumers are most likely to shop for particular goods and services. Using high-tech maps overlaid with diverse data from local demographics to access roads to leasing costs and integrating it with tax records, expense projections and other financial data, a retailer can make site-selection savvy a competitive advantage.

Intel that HR Loves to Hate

Real estate shapes the working environment and can tell you a lot about key corporate priorities like employee engagement and innovation potential. It can also tell you what employees don’t report — like where the best work actually gets done.

Following the 2008 financial crisis, many companies were eager to consolidate facilities and unload excess space to reduce their real estate costs. For many companies, blunt cuts led to work environments that were too noisy, poorly equipped or simply unattractive and depressing.

To make better decisions without breaking the bank, a CRE data master can use data and analytics to determine how and where employees are working — and why. For example, sensor logs and mapping tools can reveal when and for how long employees are using a particular space. Real-time monitoring of space utilization can help companies optimize their real estate footprint, tailor services to employees and design spaces that match work patterns, thereby improving overall productivity. A life sciences company can analyze its R&D facilities to strategically allocate the right kind and the right amount of space for bench work, collaborative discussion or heads-down solo work, such as writing a research paper, enabling scientists and salespeople to be more productive while the company pays for less space.

In one classic example, a global pharmaceutical company used data and analytics to reduce its real estate and facilities costs by $200 million over the course of three years while improving productivity. Aggregating more than 100,000 portfolio and business data points with on-the-ground market intelligence, the CRE team used analytics, automated financial modeling and scenario tools to determine which facilities were the least productive or non-strategic. With robust data to guide its facility consolidations and disposition decisions, the team achieved its aggressive savings goal and freed up additional capital to invest in R&D.

Making “Smart” Buildings Even Smarter

Making “Smart” Buildings Even Smarter

Many of today’s facilities are equipped with computer-controlled “smart” building systems that generate millions of data points. They cover myriad issues, from how long a certain fan has been spinning to how much energy is being used by a single light bulb. Couple these smart systems with smart building management and control systems and CRE data masters can use sophisticated algorithms to pinpoint performance issues. Smart building management technology can detect a heating system that uses an above-average amount of energy or a compressor that is running at the wrong time in a single building or in hundreds of buildings at a time.

Facilities data scientists can analyze building data and use their findings to reduce energy waste, as well as using predictive analytics to prevent equipment failures or complete building shutdowns. These capabilities not only save money and improve building operating performance, but also support more accurate budget planning. A global consumer products manufacturing company, for example, used smart building technologies to slash energy spending by eight to 10 percent across a pilot portfolio of 12 different kinds of sites.

Challenging Assumptions: Which Building Sustainability Programs Make the Most Business Sense (and Cents)?

Many studies have linked green offices to improvements in productivity. But which green programs achieve the most immediate and significant productivity gains? New data and analytics tools can show how to increase returns on investment in green initiatives and help a company prioritize its spending.

A multi-national technology company seeking to “green” its corporate offices used a Web-based software tool to track approximately 100 detailed best practices relating to energy, water, carbon use and waste. Its team measured environmental characteristics against employee well-being and productivity markers such as thermal comfort, indoor air quality, visual comfort and other features. By benchmarking each facility in its portfolio and adopting best practices to improve acoustics, ergonomics, flexible workspaces and desk usage, the company was able to find more than $160,000 in annual productivity gains in a single facility. That number, if multiplied across a global portfolio of thousands of locations, clearly shows the power of analytics.

The amount of data a company can gather on any given day is expanding exponentially. Some estimate the data universe will grow tenfold by 2020. For many companies, gathering data is the easy part — the hard part is figuring out what to do with all the data. As one U.S.-based industrial manufacturing IT manager said in the JLL-commissioned Forrester Consulting study, "reports are coming in hourly rather than annually in the past; [we need] a way to make sense of this data."

And there lies a challenge. Where are these CRE data masters? In the study, close to 60 percent of CRE executives report uncertainty about whether or not their internal teams have the requisite skills for high-level use of data and analytics. So there’s some team-shaping that needs to be done.

For some, the answer is to look to their third-party real estate service providers. The most data-centric service providers are accustomed to helping CRE teams collaborate with their human resources, finance and technology departments to obtain data-driven insights that help everyone succeed.

Untapped CRE data means a company is missing out on opportunities to respond quickly to changing conditions and become more profitable. Data-centric CRE teams are becoming masters and wielding the power of data and analytics to advance overall business goals to the delight of employees and CEOs alike.