To gain a big picture view of the composition of the aerospace industry, it’s worth looking at it by sector and examining current, prominent trends shaping industry performance. In this article, we will explore existing geographic concentrations and their implications on siting new aerospace facilities. To begin, we will offer an overview of what constitutes the aerospace sector. We will then disaggregate the industry into subsets, including aircraft manufacturing, aircraft engines, aircraft parts, satellites, unmanned aerial vehicles (drones) and maintenance and repair operations (MROs).

Industry Composition

Based on the North American Industry Classification System, the aerospace industry embraces multiple categories including Aerospace Product and Parts Manufacturing (NAICS 33641), Search, Detection, and Navigation Instruments (334511), Support Activities for Air Transportation (4881, which includes Maintenance & Repair Operations Maintenance & Repair Operations, 48819), 48819), and Space

Research and Technology (927).

Industry Trends

The global aerospace market took a big hit during COVID-19; among the predominant negative influences, there was a precipitous decline in air passenger travel. In 2021, when estimated revenue was $900 billion, the market began a gradual rebound. Projections call for global industry revenue to top $1.2 trillion in 2025, reflecting a yearly growth rate of more than seven percent.

There are several dynamics that will fuel the growth of aircraft manufacturing and, hence, the industries serving airline and defense sectors. Among these growth drivers are:

• Renewed demand in the tour and travel sector (i.e., a rebound in air passenger traffic)

• Growth of emerging economies

• The need to swap outdated planes with new and more fuel-efficient planes

• The imperative to reduce airplane weight including utilization of lightweight parts to enhance energy efficiency

• Growing demand for air cargo services due to trade globalization

• Increased investment in defense aircraft in part due to rising territorial conflicts and potential instability.

Technology will also play a pivotal role in both growth and profitability over the near-to mid-term future. According to the California Manufacturing Network, prominent technology trends involve the following:

• R&D and innovation in advanced materials for lighter weight, more agile, and less fuel-consuming aircraft

• Smart automation and blockchain. The blockchain can arrange for the interchange of data among internal and external players throughout the entire value chain. Secure, auditable, traceable and shareable data is distributed throughout the supply chain

• Greater resilient and dynamic supply chains. Strategies include onshoring, vertical integration, and better cyber defenses. OEMs and suppliers will leverage digital tools, including automating internal processes/streamlining workflows, implementing smart management systems, and injecting more data analytics

• Internet of Things (IoT), especially for predictive maintenance of parts and equipment. Adoption of this technology will introduce substantial efficiency throughout the supply chain

• Artificial intelligence (AI) and machine learning to address complex problems with far greater efficiency. Coupled with IoT, we will witness a transformation in both supply chain management and manufacturing processes.

The one common theme is digitalization as data analytics and innovation will become prevalent throughout all supply chain ecosystems.

Industry Sectors - Aircraft

The above growth factors apply to aircraft manufacturing. There is a significant amount of crossover within the aerospace industry as most companies engaged in aircraft production also manufacture components and provide services.

Aircraft manufacturing is indeed global, but the U.S. constitutes the industry’s major force. Among the largest aircraft manufacturers are:

The global aircraft manufacturing sector generated approximately $410 billion in revenue in 2021. Sales are projected to reach $573 billion by 2030, reflecting a 3.7 percent annual growth rate.

During this timeframe, we expect to witness significant expansion of major assembly plants and the establishment of new facilities to manufacture specialty aircraft. Recent examples include:

• Airbus expansion of its assembly plant in Mobile, AL, adding 1,000 jobs

• Boom Supersonic establishing a plant in Greensboro, NC to build supersonic jets (1,750 jobs)

• Bombardier adding a new final assembly operation to its plant near the Toronto Airport

• Kopter Group AG’s new helicopter plant in Lafayette, LA, taking on a former Bell Helicopter facility and creating 120 jobs.

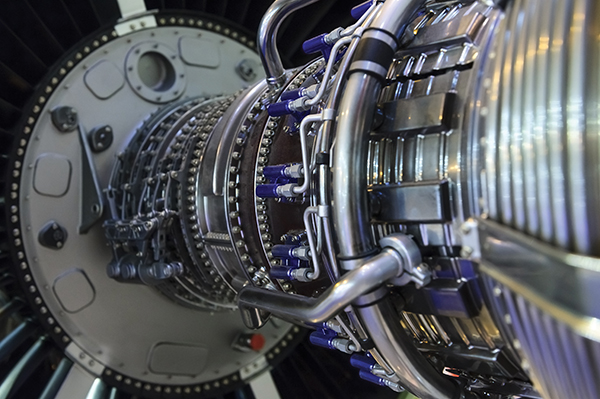

Aircraft Engines

The global aircraft engine market registered an estimated $67 billion in revenue at the end of 2021. By 2029, revenue should approach $105 billion, reflecting a yearly growth rate of over five percent. The industry recorded a disastrous 2020 due to COVID-19, but as the pandemic approaches the rearview mirror, renewed growth could not come at a better time.

Demand for new aircraft is rising as air travel rebounds and air cargo freight is on the upswing. Aircraft engines with higher efficiency, compact size and lighter weight comprise the strongest engine demand. Consequently, as engine manufacturers adopt advanced production techniques such as additive manufacturing, we foresee notable site selection activity in the industry. This activity will embrace both on-site expansion and location of new manufacturing plants. Recent examples include:

• GE (jet engines) in Lafayette, IN

• Honeywell expansion of Phoenix, AZ plant (engines for the U.S. Army’s Chinook helicopters)

• Pratt & Whitney in Asheville, NC (aircraft engine parts)

Aerospace Parts

Excluding engines, the global aircraft parts market had global revenue of approximately $485 billion in 2021. By 2028, market size should approach $742 billion with an annual growth rate exceeding six percent. Underlying forces contributing to solid growth forecasts for the aerospace parts sector mimic those for the engines sector.

Extensive technological change such as additive manufacturing and blockchain technology are injecting both cost savings and production efficiencies for parts suppliers. One significant restraint facing this sector is a labor shortage. This shortfall could impede the ability of suppliers to meet new orders in a timely fashion. Consequently, we will likely witness realignment in the facility footprint of many companies which could entail either relocation or the establishment of new operations in more favorable labor markets.

Thus, WDG Consulting believes there will be a moderately high level of location activity within the aircraft parts industry. A few recent examples include:

• Arcturus Aerospace relocation from California to Little Rock, AR (machine parts)

• Saab (airframe sections) in Lafayette, IN

Satellites

The satellite industry reached $271 billion in 2021. It was one of the few aerospace sectors that saw growth during the height of the COVID pandemic in 2020, with a 1.4 percent growth rate. Robust growth is forecast for the next few years (averaging 6.5 percent per annum), with revenue topping $390 billion by 2028.

Given an insatiable demand for stronger digital connectivity, space activities by both governments and private enterprises will continue to ascend. Demand for high coverage satellite networks emanates from a variety of end users including military applications, imagery, weather forecasting, visual media, mobile communications, science and human exploration. Consequently, the number of satellite launches will markedly increase for the remainder of this decade.

A substantial volume of new production capacity will translate into a surge of location activity within the satellite industry. Highest rates of growth will be in the small satellite segment (those weighing less than 1,100 pounds). Consider a few recent examples:

• Boeing (small satellites) new factory in El Segundo, CA

• Northrop Grumman (small satellite) manufacturing expansion in Gilbert, A

• Raytheon expansion in Tucson, AZ

• Terran Orbital new satellite manufacturing facility at Florida’s Space Coast

• York Systems (small satellites) “mega” manufacturing facility in Denver, CO.

Unmanned Aerial Vehicles

An unmanned aerial vehicle is an aerial transportation medium that operates without on-board crew or passengers, guided by remote control, autonomously or both. UAV comprises the next generation of aircraft technology for surveillance, assessment, logistics and photography. The growing adoption of smart technology for such activities on several fronts will boost demand for UAVs (also referred to as drones) in sectors such as military/defense, agriculture, civil/commercial, logistics/transportation, healthcare, construction, mining and possibly retail.

Industry revenues totaled $26 billion in 2022 and could reach $71 billion by the end of this decade (with annual growth hovering in the 13 percent range).

WDGC believes there will be a significant number of new drone manufacturing plants established over the forthcoming years. Recent examples are listed below.

• Aquiline Drones’ new plant in Hartford, CT

• Boeing expansion in Metro St. Louis, MO

• Northrop Grumman expansion in Moss Point, MS

• Strix Drones (Israeli) new operation in Dayton, OH

• Teal Drones new operation in Salt Lake City, UT.

Maintenance Repair Operations (MROs)

The global MRO market recorded sales of about $87 billion in 2021. By 2028, revenue is projected to reach approximately $120 billion, reflecting annual growth close to five percent.

Three segments comprise this industry: airlines, OEMs and independents. Airlines will continue outsourcing MRO activities, which will benefit both OEMs and independents. The latter should experience the highest growth due to cost and flexibility advantages. Furthermore, the rebound in air traffic and ever-increasing emphasis on safety and efficiency will also fuel growth. It is anticipatedstrong location activity, both for new and expanding operations. New MROs established include the following:

• Air Transport Components in Tulsa, OK

• Boeing in Jacksonville, FL

• Gulfstream in Phoenix, AZ

• MHIRJ in Central GA

• PHI (Petroleum Helicopter International) in Lafayette, LA

• Stevens Aerospace in Macon, GA and Smyrna, TN

• ST Engineering in Pensacola, FL

• United Airlines in Tampa, FL.

Key Siting Factors

Aerospace operations have a notable presence in multiple states; however, the industry does display agglomeration tendencies. Nationally, the industry employs over a quarter of a million workers and states with the greatest employment concentration tend to have an aircraft assembly presence. The states with the highest industry employment include California (121,400), Washington (84,100) and Texas (76,000) followed by Florida (54,000), Arizona (40,400) and Connecticut (32,500). See the Aerospace Industry Employment Table and map graphic for complete listings of aerospace employment by state.

In terms of future site selection across industry subsets, a noticeable proportion will gravitate toward areas with a sizeable aerospace industry ecosystem, but this will not be a prerequisite for all companies. Assembly plants can be located in areas without a well-established ecosystem provided that other requirements can be met, such as a deep labor pool, large-scale and ready-to-go sites, excess utility infrastructure, the presence of an engineering school, national recruiting appeal and extensive transportation resources.

Assembly plants over time create their own ecosystems (e.g., supplier base). Many tier-one suppliers will prefer to be within reasonable proximity of areas with an established aerospace presence. Some MROs also need to be close to customers. Satellite manufacturers often, but not always, prefer to locate near an industry presence. UAVs, some MROs and tier-2 and tier-3 component suppliers can often relax the aerospace proximity request. But again, the basics such as surplus labor market, available buildings or ready-to-go sites, colleges with advanced manufacturing and engineering programs (and, ideally, aerospace programs), reliable and moderately priced electric power, and good highway and air access must be in place.

For all players, the predominant dynamic on where to site new aerospace facilities embraces human resources. According to the Aerospace Industries Association (AIA), workforce challenges have a cascading effect on many companies within the industry. In assessing and selecting a location, tradeoffs will need to be weighed. For instance, companies may identify an area with a lower-cost, surplus labor market that lacks an available building. Is the extra time and cost associated with new construction justified, given a significant HR advantage?

Analyzing the Flight Path Ahead

The aerospace industry suffered through a precipitous decline in revenue and profitability during COVID-19, but at last, aircraft manufacturing is on the rebound. Consequently, the future looks bright throughout the supply chain including engines, components, satellites, drones and MROs.

Digitization, additive manufacturing, artificial intelligence, cloud analytics and blockchain are transforming businesses in the aerospace sector. Lightweight and more fuel-efficient aircraft represent the future.

Technology and innovation will require higher skilled workers. This requirement comes at a time when there is a serious national shortage of qualified labor. This constraint places a premium on (a) identifying labor markets that are at least in equilibrium from a supply/demand standpoint, (b) installing HR policies to earn/maintain employer-of-choice status, (c) promoting an exciting brand including green/sustainability (national and local promotion), (d) competitive wages, (e) career mobility, (f) listening to employees, (g) training partnerships with technical schools, and (h) internships and apprenticeships.

When siting a new facility within an industry ecosystem, beware of over-saturation from a labor market perspective. If an overheated market is rejected, then opt for another area that features the basics for successful operation, including reasonable access to the customer base, utility infrastructure, available sites/buildings, and fast track construction and permitting.

The industry will display strong location activity in the foreseeable future. To have confidence that a chosen location will maximize the success of the business, a structured analytical process must be followed. T&ID