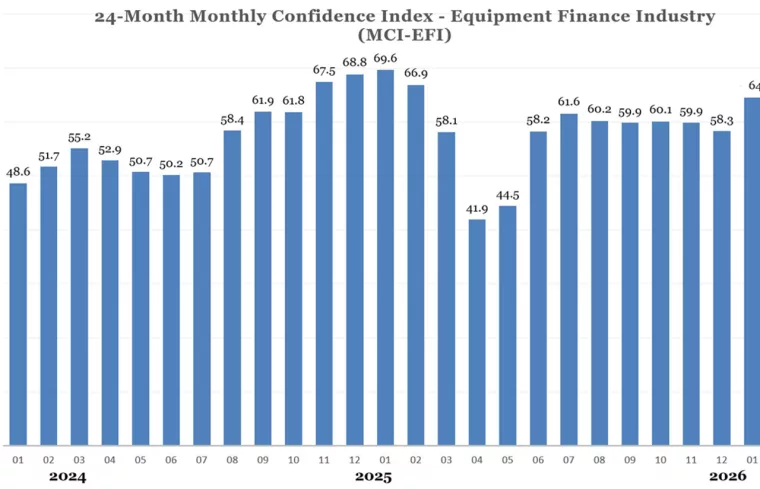

The Equipment Leasing & Finance Association (ELFA) recently released its January 2026 Monthly Confidence Index for the Equipment Finance Industry (MCI), revealing confidence in the equipment finance market rose to 64.6, up from 58.3 in December, and the highest level since February 2025. The index provides a qualitative assessment from key executives in the $1.3 trillion equipment finance industry.

January 2026 Survey Results:

- Business Conditions – When assessing the next four months, 34.6% of responding executives believe business conditions will improve, up from 12.5% in December. Those who believe business conditions will remain the same declined to 57.7% from 75% the previous month. The percentage of executives who believe business conditions will worsen also declined to 7.7% from 12.5% in December.

- Capex Demand – For the next four months, 40% of the survey respondents believe demand for leases and loans to fund capital expenditures (capex) will increase (up from 20.8% in December). Additionally, 56% expect demand to remain the same (down from 75%), and 4% believe demand will decline, relatively unchanged from December.

- Access to Capital – Over the next four months, 32% of respondents expect greater access to capital to fund equipment acquisitions, an increase from 25% in December. The majority (68%) anticipate the “same” access to capital to fund business, a decrease from 70.8% the previous month. None expect “less” access to capital, unchanged from December.

- Employment – Regarding employment over the next four months, 38.5%% of executives expect to hire more employees, a decrease from 50% in December. Also, 57.7% foresee no change in headcount (up from 45.8% last month), and 3.9% expect to hire fewer employees, down slightly from 4.2% in December.

- U.S. Economy – Of the respondents, 3.9% evaluate the current U.S. economy as “excellent,” up from none in December; 96.2% assess it as “fair,” down from 100% last month; and none evaluate it as “poor,” unchanged from December.

- Economic Outlook – Over the next six months, 30.8% of respondents believe that U.S. economic conditions will “get better,” a marked increase from 12.5% in December. Another 61.5% expect the U.S. economy to “stay the same,” up from 58.3%; and 7.7% believe economic conditions will worsen, a dramatic decline from 29.2% last month.

- Business Development Spending – Over the next six months, 34.6% of respondents believe their company will increase spending on business development activities, down from 35.7% in December. Those who believe there will be “no change” in business development spending increased to 65.4% (up from 58.3% in December), and none believe there will be a decrease in spending (down from 4.2% last month).

(Click to Expand)

There are no comments

Please login to post comments