For years, debates swirled around what counted as “traditional industry” versus “advanced manufacturing.” In fact, an article in Trade and Industry Development from 2013 titled “Traditional Industrial vs. Advanced Manufacturing—Is There a Difference Anymore?” by John Schuetz still ranks among the most read on the website. The distinction is largely moot today. Virtually every sector—from autos to aerospace to consumer goods—now relies on advanced technologies, automation, and digital integration to stay competitive. The real question for American industry is no longer about if manufacturing is advanced, but how it will adapt to the pressures of tomorrow: global competition, supply chain resilience, sustainability, and a workforce that must keep pace with rapid technological change.

Regaining America’s Competitive Edge in Manufacturing: Then and Now

On Dec. 1, 1913, Henry Ford revolutionized the world with the first moving assembly line, reshaping how goods were produced and making cars—and eventually countless other products—accessible to the masses. That moment marked the dawn of modern mass production and set the United States on a path to manufacturing dominance. After World War II, America’s factories powered global growth. For decades, the United States led the world in manufacturing output. But by the late 20th century, technology gaps, offshoring, and rising competition from Asia began to erode America’s edge. Today, the lines between “traditional” and “advanced” manufacturing continue to blur, driven by digital tools, global pressures, and policy shifts that have reshaped the industrial landscape.

Why Manufacturing Still Matters

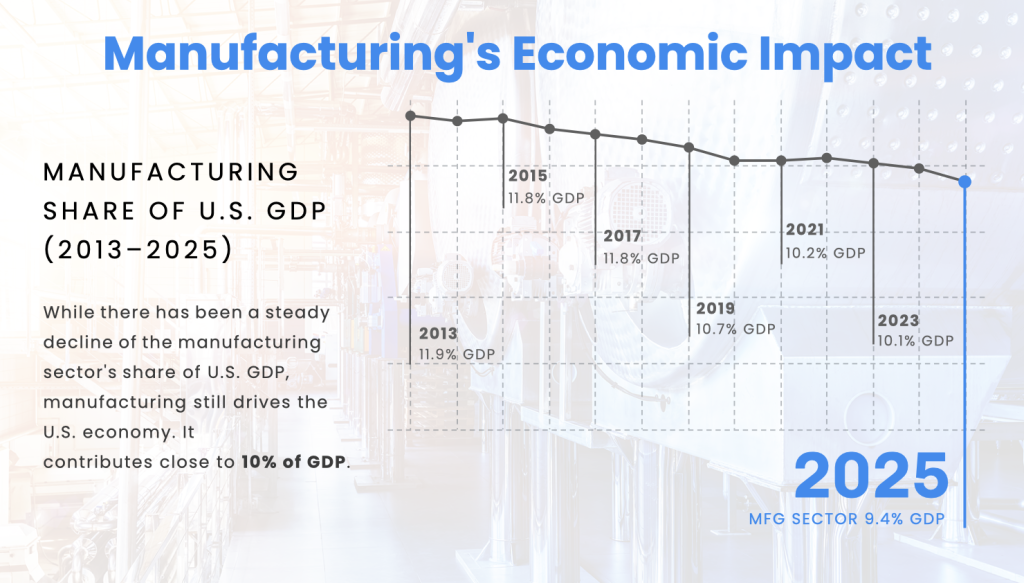

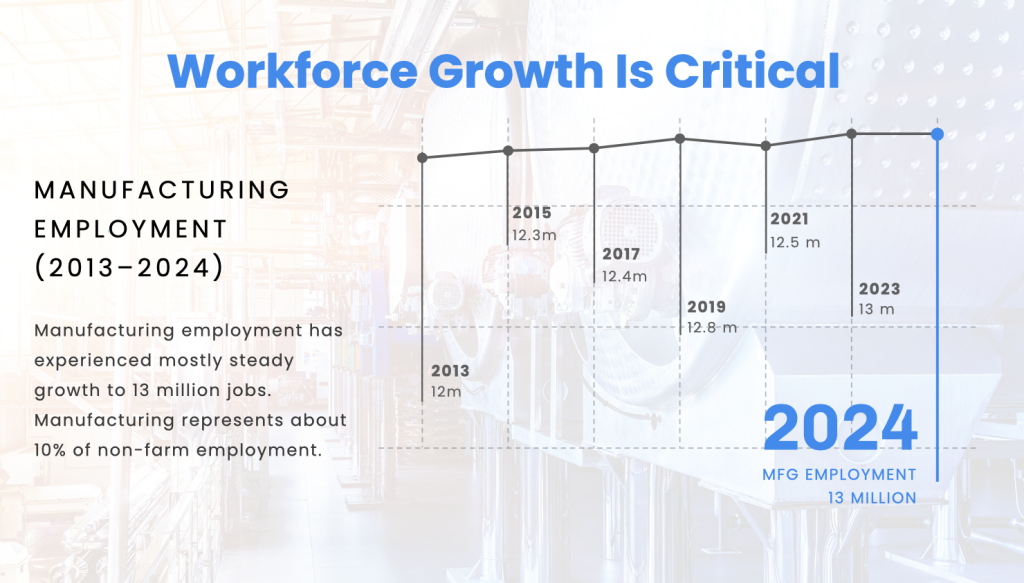

Manufacturing remains a cornerstone of the U.S. economy—not just for the products it creates, but for the ecosystem it sustains. According to the National Association of Manufacturers (NAM), the sector contributes close to 10% of total U.S. GDP and supports millions of jobs directly and indirectly. For every $1 invested in manufacturing, more than $2 ripple across the economy.

What has changed since 2013 when we all debated advanced manufacturing versus traditional industry is the competitive environment. While manufacturing workers still earn above-average wages and the United States leads the world in productivity, pressures from global supply chains, automation, and policy have forced American companies to rethink their strategies. The COVID-19 pandemic exposed vulnerabilities in global sourcing, while Trump-era tariffs and trade wars with China have reshaped supply chains and accelerated discussions on reshoring. The conversation has shifted from simply “competing” to “resilience” and “strategic advantage.”

Advanced Manufacturing in Today’s Context

Historically, “traditional manufacturing” referred to industries like steel, automotive, and heavy equipment, while “advanced manufacturing” meant process innovation in computing, automation, robotics, and biotechnology. That distinction still exists, but today nearly every manufacturer is “advanced.” Key features of today’s advanced manufacturing include:

- Digital Integration: AI, machine learning, and predictive analytics are transforming factories into smart facilities capable of self-optimizing production.

- Automation and Robotics: Once viewed as a cost-saving measure, automation is now essential for filling labor gaps and meeting demand for precision.

- Sustainability and Resilience: Environmental pressures, ESG requirements, and consumer expectations mean manufacturers must innovate while reducing carbon footprints.

- Flexible Production: Just-in-time has given way to just-in-case, with companies redesigning supply chains to balance cost efficiency with resilience.

The auto industry is a prime example: once the bastion of traditional assembly lines, it now pioneers electric vehicle platforms, battery production, and autonomous systems, all driven by advanced manufacturing technologies.

The Policy and Global Pressure Landscape

Manufacturers today face unique headwinds and opportunities shaped by both domestic policy and global dynamics:

- Trump-era Trade Shifts: Tariffs on steel, aluminum, and Chinese imports forced companies to rethink sourcing. While some manufacturers faced higher costs, others benefited from reshoring incentives and domestic demand.

- China and Global Competition: China’s dominance in critical minerals, electronics, and solar panels highlights the strategic importance of manufacturing independence. The U.S. response has been increased investment in domestic capacity, from semiconductors to EV batteries.

- Government Investment: Initiatives like the CHIPS and Science Act (2022) and Inflation Reduction Act (2022) funnel billions into domestic manufacturing, clean energy, and workforce training. These represent a continuation—and expansion—of the Obama-era Advanced Manufacturing Partnership (AMP).

The competitive equation has shifted: instead of chasing the lowest-cost labor globally, U.S. manufacturers now pursue high-tech innovation, strategic resilience, and supply chain security.

The Talent Pipeline Challenge

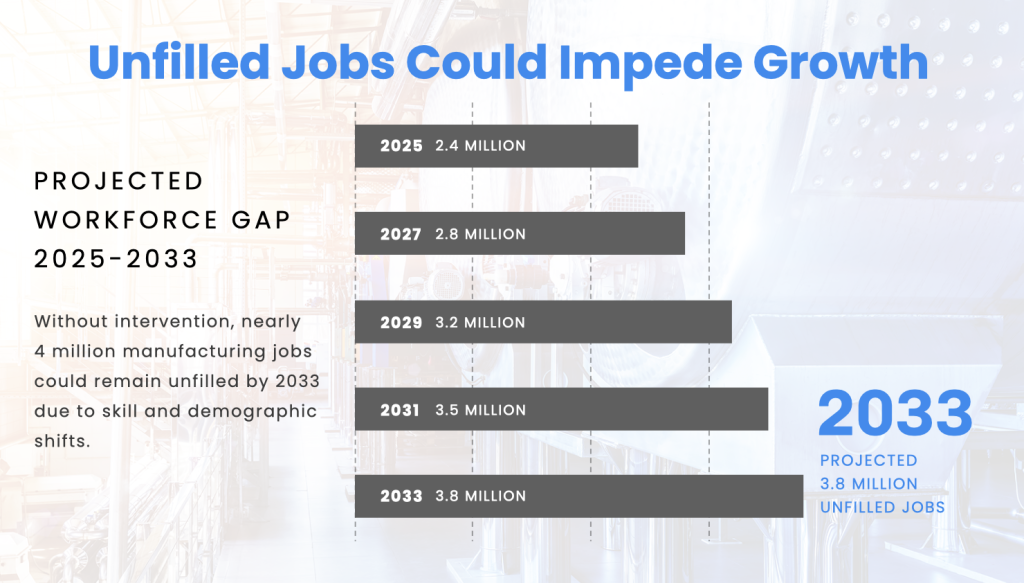

One of the biggest obstacles to sustaining U.S. manufacturing growth is talent. The NAM projects that 2.1 million manufacturing jobs could go unfilled by 2030 due to skills gaps. Technical proficiency in automation, AI, and robotics is now as essential as machining or welding once was. Skills in demand include:

- Advanced technical training (robotics, CNC programming, mechatronics)

- Systems thinking and digital fluency (AI, data analytics, digital twins)

- Supply chain management and global logistics

- Continuous improvement and lean operations expertise

Companies like Boeing and Tesla exemplify the new workforce model, where employees must operate not only complex machinery but also digital platforms that integrate design, production, and logistics. The future factory worker looks less like a “line operator” and more like a “systems technician.”

Public-private partnerships, apprenticeships, and stronger STEM pipelines are critical. Immigration policy also plays a role, as high-skilled labor shortages cannot be solved by domestic training alone.

The Business Climate

Manufacturers continue to cite regulatory complexity, high corporate tax rates (despite cuts in 2017), and rising input costs as barriers. However, the business climate is evolving:

- Regionalization: Companies are investing closer to end markets. The U.S.-Mexico-Canada Agreement (USMCA) reinforced regional supply chains in North America.

- Cluster Development: EV and semiconductor hubs in states like Arizona, Texas, and Ohio are creating concentrated ecosystems of suppliers, talent, and infrastructure.

- Reshoring Incentives: Federal and state programs now aggressively court manufacturers with tax breaks, workforce training, and infrastructure support.

Where the 2013 discussion emphasized competitiveness, today’s narrative is more about resilience, sovereignty, and national security. Manufacturing is no longer just an economic engine—it’s a strategic necessity.

More than a century after Ford’s first assembly line, U.S. manufacturing remains at the heart of economic growth and technological progress. But the meaning of “advanced manufacturing” continues to evolve. Once defined by automation and IT, it now encompasses AI-driven factories, green innovation, and resilient supply chains. Perhaps Tom White’s observation from a decade ago still holds true: “Advanced manufacturing, by its very nature, defies definition.” What is clear, however, is that America’s manufacturing edge will depend on how well it balances innovation, workforce development, and global strategy. The stakes are higher than ever—not just for economic competitiveness, but for the nation’s security and future prosperity.