Global Li-ion battery shipments are expected to continue growing strongly over the long term. The increase in use will be driven by global efforts to decarbonize electricity grids and transportation (via widespread adoption of electric vehicles), as well as declining battery costs, according to market intelligence specialist Interact Analysis.

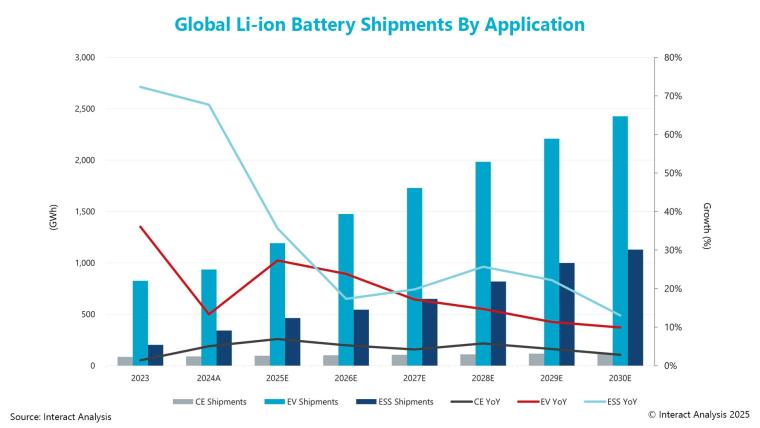

The company’s Li-Ion Battery & Manufacturing Equipment – 2025 report forecasts a compound annual growth rate (CAGR) of 16% in global Li-ion battery shipments from 2025 to 2030. Shipment power values are predicted to rise to 3,676 GWh over the forecast period. This follows sharp growth (23%) in 2024 to 1,368 GWh and a projected growth of 28% to 1,751 GWh in 2025.

Declining battery costs are expected to make purchasing electric vehicles more accessible over the coming years. However, the proportion of Li-ion shipments accounted for by EV batteries is forecast to drop slightly, from 69% of Li-ion battery shipments in 2024 to 66% by 2030, as the battery storage market grows. In 2024, ESS battery shipments had a total power value of 341 GWh, representing a 68% year-on-year rise and cementing it as the fastest-growing Li-ion battery industry segment. Between 2025 and 2030, energy storage (ESS) batteries are anticipated to record a CAGR of 19.5%, reaching a total power value of 1,130 GWh. Meanwhile, the consumer electronics (CE) market, which includes smaller, lightweight battery packs, will grow at a slower pace, with shipments predicted to climb by a CAGR of 4.5% to reach 120 GWh by 2030.

China, South Korea, and Japan lead the global Li-ion market

Both the Li-ion battery market and the market for Li-ion manufacturing equipment are dominated by companies from China, South Korea, and Japan. These countries have a near-monopoly over the Li-ion battery equipment industry, with all of the top 20 suppliers in 2024 originating from one of the three countries. Suppliers in South Korea and Japan are leaders in the electrode manufacturing segment due to their advanced coating and calendaring technologies. South Korean and Japanese suppliers also have a strong foothold in the Americas market thanks to joint ventures between battery giants in the US. Chinese suppliers, on the other hand, are far stronger in the Asia Pacific region.

However, recent years have seen rapid increase in demand for batteries, creating a market in flux, with a large proportion of new entrants and specialist vendors. This has created additional price pressures as a result of greater competition.

Shirly Zhu, Principal Analyst at Interact Analysis, explains: “Beyond the top tier, the global Li-ion battery equipment competitive landscape is relatively fragmented. Over the past three years, the industry’s massive wave of battery production capacity expansion created a surge in demand for manufacturing equipment.”

“This boom attracted a growing number of new entrants, including specialized startups, diversified industrial firms, and regional players, all seeking to capitalize on the market’s growth. The influx of these new vendors has intensified competition, leading to a more crowded and price-sensitive market environment.”

About the Report:

Li-ion Battery & Manufacturing Equipment – 2025

This report provides a deep-dive analysis of the li-ion battery supply chain, comprising:

Granular data analysis of Li-ion battery production and shipments, the end-user market landscape, supplier market shares and a highly-detailed factory database;

In-depth analysis of the lithium-ion battery manufacturing equipment market in different regions, as well as the equipment supplier landscape.

The report is available in both a standard and premium version. The premium version offers greater detail on market statistics, as well as a quarterly analyst briefing.

There are no comments

Please login to post comments