And while this report focuses on companies such as Walmart, General Motors, Apple and Walgreens, companies of all sizes are now getting into the solar market. And the reasons range from well-established national tax policy to a rapid reduction in costs to lesser-known financing innovations such as Property Assessed Clean Energy (PACE) loans.

To be sure, one reason for the vast growth of the solar sector has been the Solar Investment Tax Credit (ITC), which Congress in December 2015 extended effectively until the end of 2023. The ITC provides a 30 percent tax credit on all solar installations over the next three years before it gradually steps down. It is hard to argue that for solar this is not the single most important piece of policy ever passed by Congress.

And the tax credit helps support any manner of commercial and industrial installations. But new financing tools are increasingly becoming available that expand the opportunities for solar development in all sorts of commercial developments

Up to now, most deployment in the commercial sector has been constrained to properties where large, creditworthy entities own or have long-term leases and sufficient control of the property to support the credit requirements of solar project developers and their financiers.

PACE loans can be repaid via a property tax assessment and they stay with the property, not the tenant. This allows projects to financially qualify with a short-term tenant or other unrated off-taker.

PACE loans can be repaid via a property tax assessment and they stay with the property, not the tenant. This allows projects to financially qualify with a short-term tenant or other unrated off-taker.

“PACE improves the collateral quality of the property, improves the cash flow strength of the borrower by reducing their energy costs, reduces mortgage default rates (because properties are self-selected and screened to meet high-quality underwriting standards) and increases resale value,” said Stacey Lawson, president and CEO of Ygrene, one of the largest PACE providers.

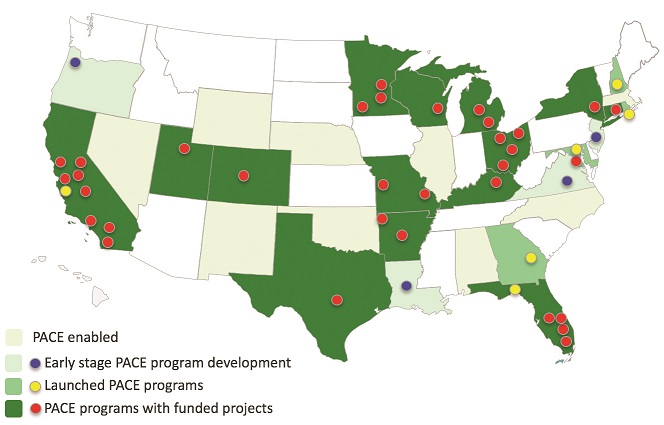

According to PACENation, an association dedicated to opening PACE financing, PACE financiers invested $252 million in 734 commercial buildings across 14 states. Fully 54 percent of those projects have included renewable energy improvements. GTM wrote in December 2015 that over $1 billion has been invested in entities that finance commercial PACE, or Commercial Property Assessed Clean Energy (C-PACE, projects, so there should be ample investment capital for good projects in PACE-friendly locations.

Traditional financing structures – third-party-owned power purchase agreements (PPAs) and leases – often don’t meet the differing needs of property owners and tenants whereby capital improvements are paid by property owners and energy bills are paid by tenants, thus negating any incentive for property owners to invest in energy-saving technologies. This incongruity is frequently known as "split incentives.”

PACE works particularly well in commercial real estate because it leverages the general alignment of energy and property taxes: property owners pay both in owner-occupied buildings and under gross lease structures and pay neither under commonly applied “triple net lease” structures where property taxes and similar assessments, insurance, and other utility and maintenance costs are the responsibility of the tenant.

A cost-effective solar installation combined with a PACE loan could provide immediate benefit to building owners and/or their energy and tax-paying tenants. By doing so, PACE could help open a new swath of the commercial building stock for solar deployment not unlike how zero-dollar-down leases have transformed the residential solar market.

PACE-financed “prepaid PPAs” are a variant of the innovation that combines PACE with the third-party ownership benefits of power purchase agreements, the most common contract form between solar developers and commercial off-takers. SEIA member Demeter Power Group was the first to pioneer this innovative combination through its PACE Lease and PACE PPA products.

Pre-paid PPAs enable PACE to tap the growing market for tax-equity finance and combine it with the secured underwriting consistent with property tax assessment. Demeter Power was a 2013 recipient of a Department of Energy SunShot Incubator Award.

-

PACE loans are non-recourse (do not impact the creditworthiness of the current tenant)

-

PACE loans are transferable upon sale of the property

-

PACE loans do not accelerate (which would require the asset to be paid in full if there were a foreclosure or bankruptcy)

-

PACE interest payments are tax-deductible

-

PACE loans offer a cost of capital well below a real estate owner’s blended cost of capital considering equity hurdle rates prevalent in the industry

-

Depending on the accounting treatment applied, the PACE loan may also be considered an off-balance-sheet form of financing for the property owner.

In sum, C-PACE offers an extraordinary opportunity to invest in solar and other property improvements, earn a highly profitable return, minimize the impact on a real estate owner’s balance sheet and ability to raise capital and reduce tenants' electricity cost. It doesn’t hurt that the cost of solar installations has plummeted by 70 percent just since 2009.

The largest barrier to C-PACE for solar deployment remains with education of lenders, real estate owners and the solar industry itself. Lenders are a critical target audience for two reasons: 1) as a source of PACE loans that are repaid through the property tax assessment, and 2) because convincing the existing mortgage holder on the property to allow a lien senior to their position, referred to as “lender consent,” is a key issue in the industry.

Despite the exciting potential for this form of financing, education, consistency and best practices in underwriting would facilitate critical trust to scale PACE broadly. Such best practices would include “providing a comprehensive package to each lender with PACE educational materials, an overall project summary for proposed energy production and savings, and a thorough analysis of other key elements that will impact building owners,” said Matthew Dawson, VP of market development for SolarCity.

“Helping lenders understand the benefits of PACE and working to standardize PACE underwriting guidelines will be very important as we scale.” In 2015, SolarCity, the market leader in residential installations and a top competitor in commercial installations, partnered with Renew Financial to offer PACE financing to small-medium size businesses that were difficult to otherwise underwrite.

“Helping lenders understand the benefits of PACE and working to standardize PACE underwriting guidelines will be very important as we scale.” In 2015, SolarCity, the market leader in residential installations and a top competitor in commercial installations, partnered with Renew Financial to offer PACE financing to small-medium size businesses that were difficult to otherwise underwrite.

Last year, SEIA launched the SEIA Finance Initiative, designed to open several untapped sectors for solar deployment and identified C-PACE as one of the best mechanisms to open commercial markets, and is now working on outreach to the PACE financing, real estate and lending industries.