Turn a switch; a light comes on. Mass generation of electricity has been taking place in the United States since 1881. Electricity, the movement of electrons, is caused by moving a magnetic field across a wire coil. The mechanical force to cause this movement was originally provided by flowing water (moving a turbine) or combustion (generally coal) to generate steam, which in turn provided the needed mechanical energy.

Turn a switch; a light comes on. Mass generation of electricity has been taking place in the United States since 1881. Electricity, the movement of electrons, is caused by moving a magnetic field across a wire coil. The mechanical force to cause this movement was originally provided by flowing water (moving a turbine) or combustion (generally coal) to generate steam, which in turn provided the needed mechanical energy.

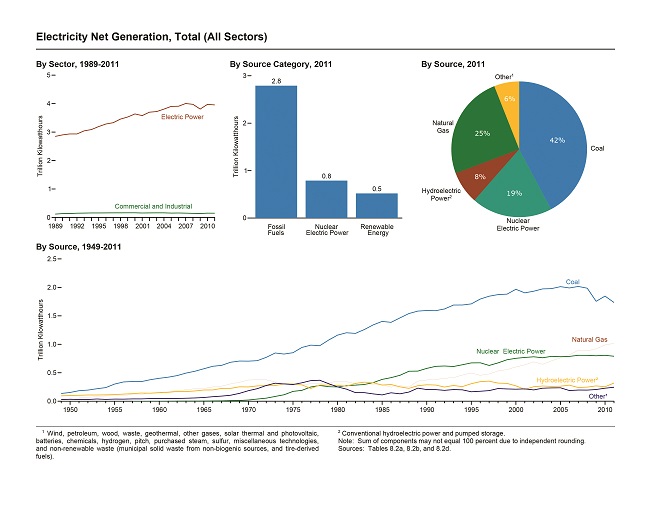

Over time, additional fuels were added to the generation mix to provide thermal energy, including natural gas, petroleum derivatives, biomass, geothermal, nuclear, other sources of mechanical energy (wind) and more recently, direct generation from the sun (solar). Some fuel choices reflected geography; proximity to rivers and fuel (e.g., coal reserves), however, another key driver has been fuel cost and availability.

During the late 1970s, coal was considered one of the most desirable fuel types. While domestic production of oil and natural gas was declining and proved reserves were limited, the U.S. had very substantial coal reserves. Coal reserves are found in many states, and coal is relatively inexpensive to mine and transport. Accordingly, the National Energy Act, passed in 1978, included limits on the use of oil and gas for electrical generation.

So, why is it that more than 150 coal and other fossil fuel power plants may be decommissioned over the next few years? Reportedly, plants with the capacity to produce more than 34 gigawatts of power, enough to power 17 million homes, are set to retire in the United States in the near future. In the meantime, natural gas power plants, previously operated as peaking plants during high electric demand periods, are being converted to base load plants that run continuously or nearly all the time.

The answer lies in the economics. Aging facilities, with the need for additional capital maintenance, combined with lower fuel prices for natural gas and tightening environmental regulations, have heralded the death knell for many legacy coal-fired generation stations.

Let’s take them one at a time.

The cost and availability of natural gas. Relatively recently, the natural gas industry underwent a seismic change with the successful application of horizontal drilling and hydraulic fracturing (or fracking) to produce natural gas from tight formations (primarily carbon-rich shales). While hydraulic fracturing was first used in the 1940s, it wasn’t until the mid-2000s that it was being applied successfully in multiple shale plays across the U.S. and becoming a major factor in domestic natural gas production. The quantity of proven producible natural gas reserves in shale formation has risen exponentially since then, with a corresponding fall in natural gas price.

In an ironic twist, it has been reported that the coal-fired plants are not only being harmed by the falling cost of natural gas, but also by a pricing model that may be embedded in coal generation pricing agreements. This model ties the price paid for electric power to the price of power that would be generated in a natural gas fueled plant. While perhaps intended to provide price protection for coal plants by factoring in the variability of natural gas markets that at times have risen well above $10/therm (as compared to current pricing more typically ranging around $4/therm), it has instead had the opposite effect of decreasing prices paid to coal plants to below sustainable levels.

Regulatory forces. Delayed for years by fierce industry opposition, regulations affecting the allowable levels of toxic pollutants from coal plants such as mercury and conventional air pollutants, such as particulates and NOx, are now being implemented. An example is the BART (Best Available Retrofit Technology) rule. These and other regulations necessitate installing pollution-control devices on existing power generation units, with associated costs that may run into hundreds of millions of dollars. Other regulatory programs may impact the cooling water intakes, in some cases necessitating expensive changes from once-through cooling to recirculation systems, or even dry cooling, both of which are costly and decrease the operating efficiency and effective generation capacity of the plant.

Aging inventory. Some plants are very old. Approximately 58 percent of the coal generation units were built prior to 1970 (more than 40 years ago) and 75 percent were built prior to 1980 (more than 30 years ago). Power plant combustion units, rotating and other equipment require periodic replacement due to age and erosion (or corrosion) of contact surfaces or other elements. The cost of undertaking these necessary refurbishment activities may be enough to make a generation facility financially unviable, particularly if the plants are small and disadvantageously sited for current demand centers or local grid needs.

Aging inventory. Some plants are very old. Approximately 58 percent of the coal generation units were built prior to 1970 (more than 40 years ago) and 75 percent were built prior to 1980 (more than 30 years ago). Power plant combustion units, rotating and other equipment require periodic replacement due to age and erosion (or corrosion) of contact surfaces or other elements. The cost of undertaking these necessary refurbishment activities may be enough to make a generation facility financially unviable, particularly if the plants are small and disadvantageously sited for current demand centers or local grid needs.

Disincentives for retirement. In some cases, owners may continue operating financially underperforming facilities for a few reasons. First, retiring a plant may precipitate overly costly decommissioning and deconstruction activities. Asbestos, PCBs, lead and other hazardous materials, once considered safe, are common at such facilities. Coal pile runoff and coal fines may have affected surface soils. Transformers may have leaked PCB-containing oil. Historic releases of diesel fuel may have impacted soil and groundwater.

Second, the transfer of an operating “asset” to a retired plant may necessitate a financially painful disclosure. This is particularly true for investor-owned utilities where there may be adverse stock price and market value implications.

Last, the impact on communities, for which the power generation plant has been a major source of tax revenue and employment, can be devastating.

One Person’s Trash is Another’s Treasure

However, there are also substantial incentives to moving forward with the decommissioning of underperforming, aging power generation assets. What seems like a dark cloud for both the operator and the community can have a very bright silver lining. Often, these power plants are located on sites that, if properly remediated, are the real estate equivalent of a treasure chest for other industrial operations. The transportation and utility infrastructure associated with these sites, along with the large parcels of flat land, are very attractive to corporations seeking new heavy industrial operations.

Logistics infrastructure. Virtually all coal-fired power plants have excellent rail infrastructure, which was used to bring coal to the site. Some of them are also located along navigable waterways that served in a similar capacity to the rail. In addition, industries that use coal as a raw material such as plastics, concrete and paper and coke manufacturing can benefit from the coal-handling infrastructure such as conveyors, the barge end loader, crushers and pulverizers. In fact, coal and coal by-products are found in everyday items such as rubber bands, baking powder, sugar substitute and tennis rackets.

Utility infrastructure. Coal plants have a large source from which to draw water for cooling, boiler makeup and for wet scrubbing. As water becomes more and more of a precious resource, industrial sites with the ability to draw large amounts of water are increasingly sought after. Industries that use large quantities of water in the process, as cooling water or to make steam as a heat source are manufacturers of pulp and paper, foods and beverages, semiconductors and chemicals such as fertilizers.

Utility infrastructure. Coal plants have a large source from which to draw water for cooling, boiler makeup and for wet scrubbing. As water becomes more and more of a precious resource, industrial sites with the ability to draw large amounts of water are increasingly sought after. Industries that use large quantities of water in the process, as cooling water or to make steam as a heat source are manufacturers of pulp and paper, foods and beverages, semiconductors and chemicals such as fertilizers.

In addition to water, these plants have an abundant supply of electric infrastructure such as high-voltage transmission lines and substations. As power plants, this infrastructure was used to export electricity to consumers. But electrons flow in either direction meaning that the same infrastructure may be used to import electricity used in the new industrial operation. Not surprisingly, the same industries that are water intensive are also typically energy intensive and can save millions of dollars on infrastructure by locating at a former power plant site. Examples of industries with large electrical needs are smelter operations, steel manufacturing, pulp and paper, glass production and chemicals such as polysilicon manufacturing.

Workforce and community support. While the necessary infrastructure must be present, it is the workforce and support of the community that helps make an operation highly successful. Many coal-fired power plants are located in communities where the power plant has been a main source of tax revenue and employment. The benefit of this to incoming operations is that the local workforce is reasonably well trained and eager to find new jobs. In addition, the community will be keen to replace the aging assets of the power plant with new investment and to turn what could be an unsightly, abandoned industrial site into a new source of activity and growth. Unlike other communities without such plants, which may be hesitant to welcome a heavy industrial operation and all the perceived adverse accompaniments such as truck traffic and air emissions, these communities are likely to see the new operation with state-of-the-art control technology and more sustainable practices as a dramatic improvement to the legacy power plants.

The Upside for the Power Companies

To be certain, utility companies, especially those that are investor owned, are making decisions based on the long-term return on investment for shareholders as all responsible companies should do. So, what is their motivation for assisting in the adaptive reuse of these decommissioned sites? For one, they get a new customer. As stated earlier, large industrial operations that are well suited for these sites are energy intensive. A heavy industrial user with a demand load of 50 megawatts will spend anywhere from $17 million to $35 million per year on electricity. An American family spends about $1,400 per year. So, the revenue from one large heavy industrial user is equivalent to between 12,000 and 15,000 homes.

And this has a compounding effect. Just like indirect jobs that will be created by a new industrial operation by suppliers and the service industry, additional electricity will be consumed in the area because of the goods and services that are produced to serve the needs of the operation.

There’s also a benefit to selling or leasing used assets. This includes selling off old equipment and materials but also selling the land and infrastructure that will remain at the site and be used by the new industry.

Last, the utilities also get the benefit of the goodwill created in the community by bringing in new jobs and investment. We sometimes forget that the people who live in the community are not just the employees and their friends and relatives of the power company, they are also their customers.

When a Door Closes, a Window Opens

When a Door Closes, a Window Opens

So, the power companies and communities have a product that is well suited for investment by energy, water and transportation-intensive industries. A few years ago, that may have gone relatively unnoticed. The United States was in the grips of the worst recession since the depression and the news was all about the flood of manufacturing jobs fleeing to low-cost locations like China and even less-developed economies. But the tide has turned due partly to the fracking revolution that has lowered energy costs in this country relative to its competitors and is putting coal plants on the chopping block.

At the same time, labor and other costs are growing in China. And many products such as tissue and other paper products are just too costly to ship over long distances. These changing dynamics coupled with the real-world experience of the hidden costs of doing business in less-mature economies (lower productivity, bureaucracy, intellectual property issues, longer lead times, etc.) are drawing manufacturers back to the U.S.

The United States has once again become an attractive place to manufacture products. While it may first seem that the decommissioning of these aging coal plants is yet another example of U.S. job losses, these are actually excellent opportunities for renewal and a revitalization of these sites with industrial infrastructure and the economies of the communities in which they are located.