The automotive industry is no stranger to transformation, but 2025 has introduced a new level of complexity. Shifting consumer preferences, tariff policy uncertainties and technological advancements are compelling automakers to reevaluate their plant location strategies. The era of single-energy vehicle production is giving way to flexible, multi-energy facilities that can adapt to market demands and regulatory landscapes, making the location of these facilities even more important as companies consider everything from workforce characteristics to government incentives.

Decisions are also being affected by the slowdown in electric vehicle (EV) adoption — particularly among middle- and lower-income consumers. This, paired with faster growth in hybrid and plug-in hybrid vehicle sales, has automakers reconfiguring production facilities to reflect shifting demand. Changes to federal incentives, like the freeze on Inflation Reduction Act benefits, make EV investments even less predictable. Now more than ever, there is a need for agility and resilience in the automotive industry as companies seek the best location strategies for their facilities.

The EV Slowdown and the Rise of Multi-Energy Plants

EV adoption in the U.S., while continuing to grow, has not yet met ambitious projections by many analysts and policymakers. While EV sales grew by seven percent in 2024, hybrid and plug-in hybrid electric vehicle (PHEV) sales surged by 37 percent and 10 percent, respectively, according to Bureau of Transportation Statistics (BTS)1. This trend indicates that consumers — especially middle- and lower-income — are seeking more affordable and practical alternatives to fully electric vehicles, which often come with higher upfront costs and still face limits on charging infrastructure in the U.S.

Many automakers are responding by transitioning from EV-only facilities to flexible plants capable of producing internal combustion engine (ICE), hybrid and EV models. Hyundai’s $7.4 billion Metaplant in Georgia, initially designed for EV production, is now being adapted to include hybrid and ICE vehicles2. Similarly, General Motors has shifted its Toledo, Ohio plant — originally intended for EV component production — back to manufacturing parts for gas-powered vehicles3, and Honda is retooling its Marysville Auto, East Liberty Auto and Anna Engine plants in Ohio for production of ICE, hybrid and electric models15. These moves reflect a broader industry trend in pausing or adjusting EV expansion plans in response to weaker-than-expected EV adoption and unclear federal support.

Policy and Regulatory Uncertainty

Another factor that has automakers rethinking strategy is policy and regulation change. The U.S. government’s freeze on Inflation Reduction Act (IRA) incentives has introduced significant uncertainty into the EV market by making EV-only strategies less attractive for manufacturers and consumers alike. Additionally, the global EV market’s reliance on China for battery manufacturing and critical raw materials presents geopolitical risks. In 2024, China accounted for nearly 80 percent of global EV battery cell production, as well as 85 percent of the world’s cathode active materials and over 90 percent of anode active materials4.

Proposed tariffs on Chinese batteries and critical minerals could increase domestic EV production costs, potentially slowing the pace of electrification and undermining investment. Tariffs on auto parts from Mexico5,6 and Canada6, as well as existing tariffs on steel and aluminum, further complicate the production environment. Tariffs also stand to affect European automakers, making facility location decisions all the more important for U.S. automakers as they consider supply chain costs and material availability. These factors are causing automakers to delay or diversify investments to mitigate policy risks.

Regional Demand and Infrastructure Disparities

In 2021, the Bipartisan Infrastructure Law passed and included the National Electric Vehicle Infrastructure (NEVI) Program, which allocated $5 billion to fund the deployment of fast EV chargers along key transportation corridors in the U.S.7 By the end of 2024, however, only around $30 million had been spent on operational chargers according to the U.S. Energy Information Administration (EIA), leading to concern about the program’s pace. In January of 2025, Executive Order 141548 paused the disbursement of remaining NEVI funds to allow for a comprehensive review of the program’s processes, policies and grant selection criteria.

This uneven rollout of EV charging infrastructure across the U.S. is influencing automaker strategies. While some states have made significant progress, others, particularly in the South and Midwest, lack the readiness to support widespread EV adoption by consumers. As a result, manufacturers are maintaining or expanding ICE and hybrid vehicle production in these regions. Toyota, for example, is investing an additional $88 million in its West Virginia plant to produce next-generation hybrid transaxles, aligning its operations with local demand and infrastructure realities9. This strategic realignment underscores the importance of regional considerations in plant location decisions.

Supply Chain Proximity and Vertical Integration

The EV industry’s reliance on critical minerals like lithium, cobalt and nickel for battery production has reshaped supply chain strategies in recent years. Automakers are increasingly co-locating vehicle assembly and battery production facilities to reduce reliance on foreign suppliers and mitigate geopolitical risks, as battery manufacturing remains the core of the value chain.

Tesla’s Gigafactory in Sparks, Nevada, exemplifies this approach. Launched in partnership with Panasonic, the facility is primarily focused on producing lithium-ion battery cells, packs and electric drivetrains for Tesla vehicles and energy products. Since 2014, it has grown into 5.4 million square feet of operational space. Its strategic location offers access to low-cost renewable energy, proximity to lithium mining operations and favorable tax incentives from the state government. This vertical integration allows Tesla to reduce supply chain costs, accelerate innovation and achieve greater control over battery technology while also contributing to Nevada’s clean energy and advanced manufacturing sectors10.

Labor Market and Workforce Considerations

Labor market dynamics are playing a crucial role in automotive plant location decisions. According to FDI Markets data, Michigan leads in both workforce size and industry concentration, making it very attractive for automotive investment. Southern states with labor flexibility and established infrastructure are also attractive to manufacturers, aligning with trends of OEMs and Tier 1 suppliers increasingly relocating to the South. States such as Tennessee, South Carolina and Alabama also offer a combination of low union membership, significant automotive employment and favorable labor conditions.

Tennessee, for instance, has a unionization rate of 4.8 percent and more than 142,000 automotive employees11, making it a prime location for expansion. Low union presence isn’t always a dependable factor, however, as some low-union states exhibit high turnover rates, which can increase training costs and impact productivity. As they consider locations, automakers must balance the weight of union presence with the operational stability risks tied to workforce turnover.

Case Study: Hyundai’s Metaplant in Georgia

The Hyundai Motor Group Metaplant America (HMGMA) located in Ellabell, Georgia represents a $12.6 billion investment and is the company’s first dedicated EV and battery production facility in the U.S. The plant integrates EV assembly for Hyundai, Kia and Genesis brands with a nearby $5 billion battery cell plant being built in partnership with SK On12, enhancing supply chain efficiency and production.

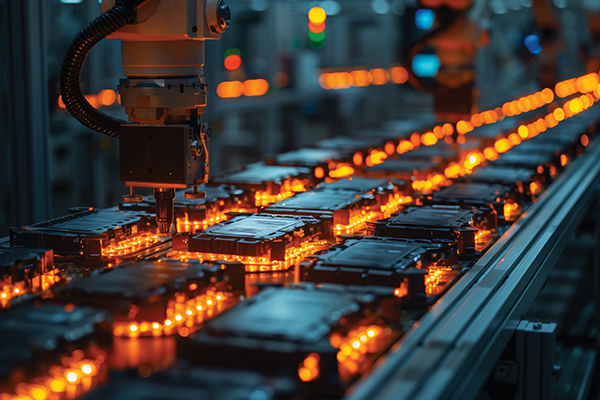

The facility is expected to create 8,500 direct jobs, with broader economic ripple effects generating nearly 40,000 total jobs across the state. Hyundai has partnered with Georgia’s technical colleges to train workers through an on site Georgia Quick Start training center. The Metaplant also incorporates advanced automation technologies like automated guided vehicles and robotic quality inspection to boost productivity and support Hyundai’s sustainability goals.

Case Study: Ford’s BlueOval City in Tennessee

Ford’s BlueOval City in Stanton, Tennessee is a flagship EV and battery complex representing a cornerstone of the company’s electrification strategy. The site brings together EV assembly, battery production and key supplier operations in a single mega-campus, streamlining logistics and increasing operational efficiency in a flagship example of vertical integration13.

BlueOval City is co-located with a battery plant operated by BlueOval SK, a joint venture between Ford and South Korea’s SK On. This vertical integration allows Ford to streamline its EV supply chain and accelerate production timelines. However, Ford has delayed the launch of BlueOval City to 2027, signaling a more balanced approach between EVs and traditional powertrains14, and allowing local governments more time to address infrastructure challenges in anticipation of population growth and industrial activity. Despite the delay, the project remains central to Ford’s long-term EV strategy, with the potential to create over 6,000 jobs in Stanton, Tennessee and 5,000 jobs in Glendale, Kentucky13.

Case Study: Honda’s EV Hub in Ohio

Honda is yet another automaker making the move towards multi-energy facilities and investment in nearby battery facilities. In February of 2025, Honda provided a first look at its revamped approach to manufacturing at its Marysville Auto, East Liberty Auto and Anna Engine plants in Ohio. Each of these facilities is being retooled in a more than $1 billion investment to allow for production of ICE, hybrid electric and EV models, with company leaders specifically noting a need for rapid response to shifting customer needs15.

In another example of vertical integration, Honda has also partnered with a battery manufacturer — LG Energy Solution — to create a new JV battery facility in Jeffersonville, Ohio, committing to $3.5 billion in investments and creating 2,200 jobs in Fayette County16. The job creation, in addition to sustainable manufacturing practices, offers the opportunity for local and state incentives and represents part of Honda’s location strategy in Ohio, where it employs 12,000 people and has manufactured vehicles since 197915.

Conclusion

As automakers navigate the uncertainties of the evolving EV market, strategic flexibility and supply chain integration are becoming essential. The shift toward hybrid-friendly and multi-energy plants reflects a nuanced understanding of consumer preferences, economic realities and policy dynamics.

Case studies like Ford’s BlueOval City and Hyundai’s Metaplant demonstrate how manufacturers are investing in vertically integrated, future-ready facilities that balance innovation with risk management. These investments are strategically placed in regions offering favorable labor conditions, infrastructure readiness and economic incentives.

In this rapidly shifting landscape, the ability to adapt manufacturing strategies to real-time market signals is becoming a competitive necessity. Automakers that embrace flexibility, vertical integration and regional alignment are better positioned to weather policy shifts, supply chain disruptions and evolving consumer expectations — ensuring long-term viability in a complex and dynamic global market. T&ID

Sources:

1 www.bts.gov/content/gasoline-hybrid-and-electric-vehicle-sales

2 www.npr.org/2025/03/31/nx-s1-5342658/hyundai-georgia-plant-electric

3 www.cbtnews.com/gm-shifts-toledo-plant-back-to-gas-vehicle-parts-as-ev-demand-stalls

4 www.iea.blob.core.windows.net/assets/0aa4762f-c1cb-4495-987-a-25945d6de5e8/GlobalEVOutlook2025.pdf

5 www.restofworld.org/2025/mexico-ev-olinia-project

6 www.statista.com/topics/13335/automotive-trade-and-tariffs-in-the-united-states/#topicOverview

7 www.afdc.energy.gov/laws/12744

8 www.govinfo.gov/content/pkg/FR-2025-01-29/pdf/2025-01956.pdf

9 www.pressroom.toyota.com/charged-up-toyota-west-virginia-invests-88-million-in-new-hybrid-transaxle-line

10 www.tesla.com/blog/continuing-our-investment-nevada

11 www.tnecd.com/industries/automotive

12 www.hyundai.com/worldwide/en/newsroom/detail/hyundai-motor-group-and-sk-on-to-establish-ev-battery-cell-production-joint-venture-in-us-0000000237

13 www.corporate.ford.com/articles/electrification/blue-oval-city.html

14 www.thesiliconreview.com/2025/04/ev-plant-construction-shift

15 www.acuranews.com/en-US/releases/release-e4e72a01e246a738c5d003060c00bc34-honda-ev-hub-prepares-for-new-level-of-flexible-production-in-reimagined-manufacturing-environment

16 www.hondanews.com/en-US/honda-corporate/releases/lg-energy-solution-and-honda-break-ground-for-new-joint-venture-ev-battery-plant-in-ohio