Henry Ford would have trashed this article. He didn’t trust suppliers.

Ford’s River Rouge Complex in Dearborn, Michigan, did almost everything on its own to manufacture cars, including generating its own electricity, making steel and glass, and eventually employing a hundred thousand people. Such a self-reliant attitude was a logical response to issues of that time, especially the questionable ability of outsiders to deliver in a way that met Ford’s standards.

Over time, the autonomous, everything-under-one-roof model became less appropriate. A large, high-cost assembly plant is not the right place to make products that do not require such high levels of skills and capital investment.

Today, most people and facilities engaged in making motor vehicles are in the components sector. OEMs are generally left to concentrate on engines and major structural parts of the vehicle — aspects most expressive of the car’s character and individuality, where proprietary designs are most important for branding and marketing purposes.

Vendors primarily produce interior features, such as seating, trim and climate control, and suspensions and transmissions where there can be fairly high commonality among different vehicles. They also produce some electrical, electronic and other items that are different from assembly plants’ core capabilities. More than half the value of most vehicles is now added by suppliers.

This division of auto production has created a great business opportunity for suppliers, although not without problems. The auto parts business is huge (fourth-largest among 86 manufacturing sectors of its type in the North American Industry Classification System), but has shown some of the greatest volatility in plants/employment and bankruptcies. An obvious cause is its dependence on a customer that has gone through much turbulence itself. For example, light vehicle sales rates that had been 16 to 17 million per year in the first part of the 2000s dropped to around 10 million by the end of the decade — and six big assembly plants closed.

Topping it off was the strained relations that often existed between many assembly plants and their vendors.

Better Conditions Ahead

As of early 2013, there is evidence that conditions have changed for the better.

The automotive business as a whole is in much-improved condition. Observations by industry experts, statistics, changes in business conditions and a scan of current site selection activity all point to expansion of this vital U.S. sector. According to the U.S. Commerce Department, the value of shipments from U.S. automobile assembly plants recently grew over 18 percent annually — good news following record hard times. Sales of cars and light trucks in 2012 hit 14.5 million units1.

Other conditions also point to better times for suppliers. Assembly plants belonging to overseas-based car makers (that, according to Center for Automotive Research, have held over half the U.S. market share since 20082) usually have a more collegial relationship with vendors. Suppliers provide systems that contain more design and engineering and are at a still-higher level of refinement and completion: more complete, customized kits and modules as opposed to miscellaneous aggregations of commodity parts.

These favorable circumstances suggest a probable increase in the number of U.S. auto supplier plants.

Auto Supplier Plant Location Trends

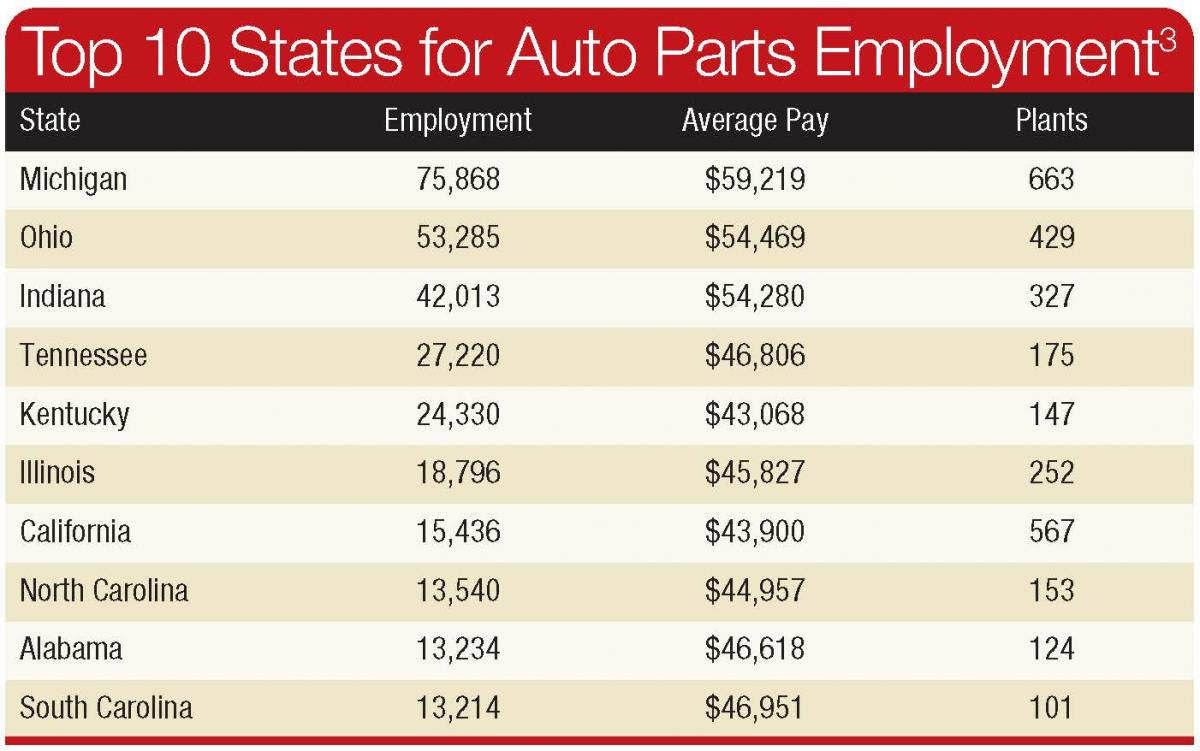

Virtually every state has some auto parts-and-components production plants, although 10 account for nearly 75 percent of U.S. auto parts employment:

At first, it appears that site selection patterns of suppliers simply reflect those of their customers — Michigan and Ohio continue to have the largest concentration of U.S. auto assembly plants — but important subtleties emerge as one drills down.

From the perspective of a customer — an assembly plant being served by a Tier 1 supplier or a Tier 1 plant receiving materials from a Tier 2 — it is desirable that supplier plants be close. A nearby location minimizes worries about cost and timing of deliveries. Proximity makes it convenient for engineers and accountants who visit supplier plants. Having suppliers nearby increases the economic development benefits credited to the main plant: jobs and capital investment of their suppliers are added to their own impacts.

From the perspective of the supplier, however, the situation may be different.

Being too near the customer plant forever condemns the supplier to a lower-profile role. In most communities, a $100 million supplier plant with 300 jobs would be the top dog, but not if you’re down the street from a $1 billion assembly plant.

Consulting firm BFPC LLC’s experience with its automotive supplier clients suggests that many prefer a location a couple of hours’ drive from their assembly plant customers — close enough for fast, efficient deliveries, rapid response to problems and convenient meetings, but far enough for some privacy and independence and a lower-cost environment. (If they can position themselves this way relative to multiple assembly plants, even better!) This radius opens up a large geographic region in which communities can reasonably compete to attract supplier plants.

While the concentration of parts plants follows intuitive expectations of paralleling assembly plants, every state has some. California and Florida are both significant players, proving that a location in the Midwest/Midsouth is not essential. Texas is an emerging participant; its San Antonio Toyota Plant was sited outside the major cluster of assembly plants and may have generated a new regional market for parts. Georgia is important in the parts industry, but not as big as some neighbors; its new Kia Plant is a spectacular success but may have been sited partly to exploit the supply chain already established by Hyundai and others next door in Alabama.

New Opportunities for the Auto Supplier Industry

As the automotive industry emerges from the recession, new conditions will lead to new auto supplier facilities, with the following five conditions being especially important:

1. Customer Relationships. Clearly one of the main causes for past volatility of the auto parts industry has been the tough terms often imposed on them by their OEM customers, especially the legacy U.S. automakers. The adversarial relationship will likely not go away entirely, but will be ameliorated and become more collaborative as suppliers move up the value chain and gain greater leverage over their assembly plant customers. They will be able to insist on longer-term contracts and a more collegial attitude in planning and supply chain management (as is already the case between many Asian and European OEMs and their suppliers). This will reduce some of the turnover that plagued the parts supply business in the past.

3. Shifting Roles for Assembly Plants. Suppliers are playing a more important role as assembly plants take on wider responsibilities. It used to be that a designated plant would produce a small number of models for a regional market; i.e., Chevrolets for the Northeast. Over the past 25 years, however, the number of large U.S. assembly plants has shrunk from about 65 to about 45 while, with the exception of some culling of brands during the recent recession, the number of models has increased. Assembly plants manufacture a wider range of products for a geographically larger market. Some, such as BMW’s South Carolina plant, are their company’s sole producer of certain vehicle types and ship them worldwide. Suppliers support their customers’ capacity to assemble a diverse range of vehicles, serving multiple tiers of consumer need (entry, midlevel, luxury), geographic differentiation (cars for a hot climate need more robust engine cooling and air conditioning) and other customization.

5. Locational Economics. The competitive nature of the auto retail market and never-ending pressure by consumers for maximum value mean that manufacturers and their suppliers must jointly control costs and increase productivity. To achieve both, auto manufacturers and suppliers seek locations with demonstrated community readiness: prepared people, sites and infrastructure. It is prudent to examine state/local finances so the business doesn’t have to worry about service shortfalls or tax increases. Finally, it is important to focus on areas that show the willingness to be a partner on creating a successful long-term fit, including, but not limited to, appropriate incentives.

Resources

1 The New York Times, “Automakers End 2012 with Sales at 5-Year High” January 3, 2013, http://www.nytimes.com/2013/01/04/business/car-sales-end-strong-year-on-modest-note.html?_r=0

2 Center for Automotive Research, “Contribution of the Automotive Industry to the Economies of All Fifty States and the United States,” http://www.oesa.org/Doc-Vault/Industry-Information-Analysis/CAR-Economic-Significance-Report.pdf, Page 3.

3 Unless otherwise specified, base data are from the U.S. Commerce Department, including its County Business Patterns and Annual Survey of Manufacturers series.