This article addresses the site selection process for financial services back-office operations. We define back-office as administration and support for revenue-producing business units (often referred to as the front-office). Back-offices are process-intensive functions that typically include:

This article addresses the site selection process for financial services back-office operations. We define back-office as administration and support for revenue-producing business units (often referred to as the front-office). Back-offices are process-intensive functions that typically include:

1. Accounting

2. Financial transactions processing (e.g., credit card)

3. Mortgages (claims and servicing)

4. Shared services (if multiple function beyond financial or customer service might be more aptly defined as middle-office)

5. Settlements

6. Records maintenance

7. Insurance claims processing

8. Customer service

9. Inside sales

10. Telesales

11. Information technology

-

Infrastructure support

-

Database management

-

Help desk

-

Software development centers may or may not be included in a back office (often they will be part of what is referred to as middle office).

This article also briefly examines location activity in the often amorphously defined middle-market segment. Middle-office operations tend to be less routine than their “back-room” counterparts. Middle-office functions include software development, legal, human resources, compliance, risk, asset management and research.

For purposes of this article, financial services embrace three industry sectors. They are banking, securities and insurance.

In the remainder of this article the decision-making process to select optimal locations for financial services back-office operations is outlined. We begin with a brief discussion on the pace of location activity within this grouping.

Location Velocity

The early part of this century saw a robust level of new and expanded back-office facilities. Then activity dropped to a snail’s pace during the 2008/2009 recession. It wasn’t until 2012 that we began to see an uptick in back-office facility investment by financial services entities. Three underlying trends fueled the heightened level of site selection within the industry. In order of importance, these were:

1. Revenue and profitability growth

2. Consolidation driven by

-

Technology

-

Process efficiency

-

Cost reduction/containment

3. Relocation

-

From higher cost markets such as Tier 1 metros in the Northeast or coastal California to moderate-cost Tier 2 or 3 metros throughout the U.S.

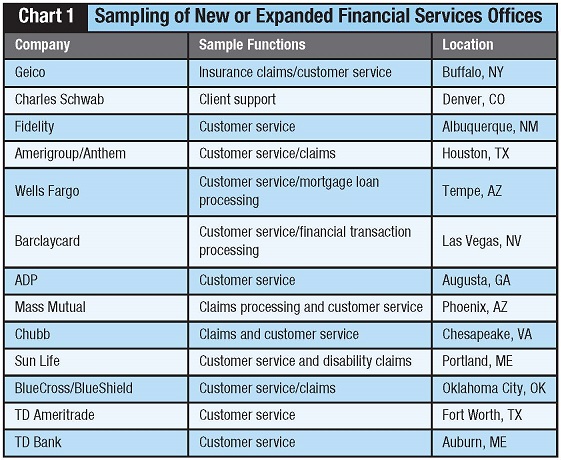

While some back-office functions serving U.S. customers were offshored (mainly IT and, to a lesser extent, other activities such as collections, customer service and legal research), the U.S. benefitted from plenty of new facility investment. Since 2012, this trend has become more pronounced. We look for continued growth of financial industry back-offices over the foreseeable future. A sampling of new or expanded back-offices within the financial services industry is highlighted in Chart 1.

While some back-office functions serving U.S. customers were offshored (mainly IT and, to a lesser extent, other activities such as collections, customer service and legal research), the U.S. benefitted from plenty of new facility investment. Since 2012, this trend has become more pronounced. We look for continued growth of financial industry back-offices over the foreseeable future. A sampling of new or expanded back-offices within the financial services industry is highlighted in Chart 1.

One Key to Successful Site Selection: Planning

The first and most critical step in the location decision-making process is defining the need, requirements and objectives. In this planning or discovery phase, the following must be addressed.

1. Why is a new back-office needed?

2. What functions would be housed in the proposed center?

3. Will the center represent additional capacity and/or a migration from existing sites?

4. If any migration is involved,

-

which functions

-

from where?

5. How would the new center fit into the current geographic footprint for comparable activities?

6. Are there any geographic constraints (e.g., time zone) that should be placed on the site search?

7. When should the new center be operational?

8. By function, what will be the composition and level of staffing?

9. The composition and level of staffing is very important, especially the mix of experienced versus entry level. If staffing is tilted toward experience, then the project needs to land in an area that has an industry/function cluster. This could have implications in labor supply/demand, cost and turnover.

10. Given P&L (profit and loss) reality, what is the maximum “affordable” salary level by position?

11. Additional HR considerations

11. Additional HR considerations

-

Ideal new hire characteristics

-

Training/recruiting

-

Turnover

-

Unionization

12. Office space

-

Available building only

-

Characteristics (e.g., size, floorplate, layout)

-

Amenities

-

Parking

-

Security

-

Lease or own

-

Utility redundancy

-

Green/sustainability

-

Furniture/fixtures/equipment investment

13. Other parameters

-

Air service

-

Natural disaster risk

-

Taxation

-

Going live date.

Once these building blocks are set, a multi-phase analytical process can be launched. Core dimensions of each phase are enumerated in the following paragraphs.

Location Screening

This phase of the analytical process involves sequentially eliminating areas, based on statistical criteria, until a short list (typically three) of the most promising locations emerges. The first step is to delineate the geographic search region. Often, geographic balance in the back-office footprint will dictate which time zone or states should comprise the search territory.

A three-stage exercise should then be followed to identify the best locational options. Stage one is composed of desktop research, tapping statistical databases (e.g., demographics). At the end of stage one, a long list (maybe eight to 10 areas) is produced. Stage two embodies issuing a request for information (RFI) to the lead economic development agency in each long-listed location. Here, additional insights on the viability of each area are obtained (e.g., compatibility of the major employer base). Stage three combines desktop and RFI analytical results into a scorecard ranking of the long list. More often than not, one or two locations of interest (such as an existing site) are carried through the location screening phase for benchmarking purposes.

To efficiently pare the long list down, create a scorecard. The scorecard would be divided into two main segments. They are qualitative (e.g., labor market) and cost (e.g., market-level salaries).

Within the scorecard, individual factors (e.g., talent pool depth) are aggregated into broad categories (e.g., labor market). Factors and categories are assigned relative weights (e.g., one carrying the least weight and 10 the most important). Each area is rated on specific variables and factor groupings. This produces weighted scores for qualitative and cost criteria.

The best locations will score highest on qualitative and lowest on cost. These will comprise the finalist or short-listed areas. Each short-listed area will be subjected to a field-based due diligence evaluation, as described by law.

Location Assessment

The rubber meets the road in this analytical phase. Field-based due diligence is undertaken by the project team in each short-listed location. The objective is to ascertain which area can best support the back-office’s most important operating requirements over the long-haul.

During field visits, the following tasks are generally performed:

1. Orientation briefing by the lead economic development organization

2. Interviews with financial services and other back-office employers with significant focus on labor market dynamics

3. Tour several back-office operations to get a sense of the internal work environment for area “best-practice” employers

4. Interview additional entities who can shed light on local labor market and other locational dynamics, e.g.,

-

Staffing agency

-

Career/job service office

-

Education/training

-

Real estate development

-

Trends

-

Submarkets

-

-

Mass transit (if pertinent)

-

Residential real estate (quality of life)

-

City and state government

5. Tour long-listed office space options

-

Be sure tour books are prepared

-

Examine options not just from real estate, but also labor recruitment/retention perspective

6. Prepare GIS commute zone maps to help delineate the optimal sub-labor market

The team subsequently needs to process and interpret results from field study. It helps to build a scorecard for ranking the short-listed locations.

When all is said and done, the final decision should hinge predominantly on labor market attractiveness. This includes the near-term environment and longer-range sustainability of the cost/supply/quality equation. There will be differences among the short-listed locations. If the labor market dynamic is a close call, then other factors can sway the decision. These include office space, air access and incentives.

Regarding incentives, consider them icing on the cake. It is far more important to land in a location that optimizes success from an HR standpoint. Incentives can enhance a favorable location. They will rarely vault an underperforming area into a top-tier alternative.

Nevertheless, incentives can help tip the scales when two or three locations display compelling scores. Importantly, the primary incentive (often payroll tax rebates) available to back-offices is wage dependent.

As an example, to qualify for the most meaningful incentives, full-time jobs need to meet a specific wage threshold. This could be at or slightly above the average county wage. It is conceivable that a back-office project might not satisfy the wage requirement and, hence, become ineligible for the main incentive.

Once the locational choices are narrowed to a couple of options (metro, submarket and two or three buildings) then final negotiations need to be completed. These include real estate and incentives. Last-mile due diligence on other factors also needs to be completed. This includes legal, tax, HR recruiting and IT. Subsequently, the team will recommend to executive management the preferred location for the new back-office.

Middle-Office Location

We have seen a mini-trend of companies either relocating or consolidating higher-end support functions to conserve on cost and achieve favorable HR recruiting/retention objectives. For financial services, middle-office activity often includes compliance, risk, legal, asset management, research, technology and business intelligence/analytics.

It is possible to colocate back- and middle-office. There will be tradeoffs, though, as the middle-office requires a more complex skill set. This drives the project to larger metros where such skills exist. However, these markets will usually be more expensive than smaller metros, which are more well-suited for the back-office.

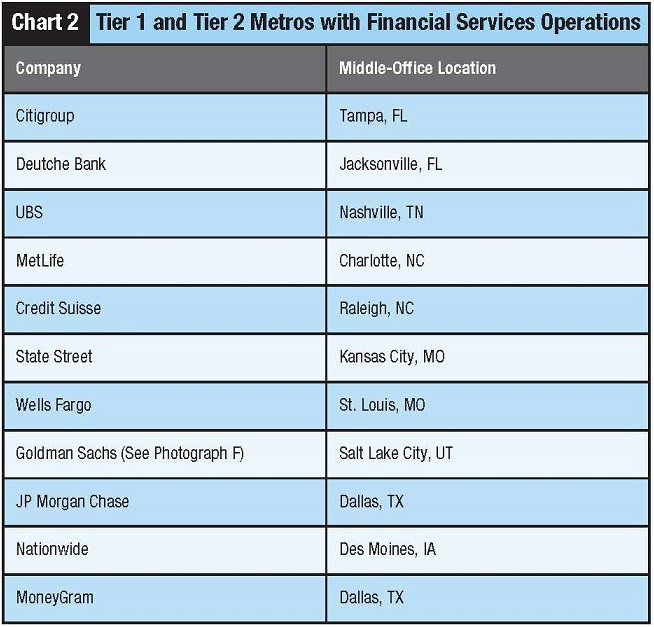

The preponderance of middle-office operations in the financial services arena has been gravitating to Tier 2 (under 2.5 million population) or lower-cost Tier 1 metros. Examples include the companies listed in Chart 2.

As with back-office, the overarching locational driver for middle-office is talent breadth/depth/cost. The location decision is thus an HR deal first and then a real estate deal second.

In Conclusion

Financial service back-offices will enjoy long-term success in locations where the enterprise will be viewed as a preferred place to work (employer-of-choice). A company’s site selection team needs to understand what it takes to achieve preferred employer status including compensation, HR practices, benefits, career advancement, work environment, on-site amenities, etc. Then be sure the company is willing to expend the resources necessary to become a labor market leader. If not, then it is probably a good idea to look for another locational alternative.

Remember this axiom: “It’s all about people.” Don’t get swayed by attractive real estate if it doesn’t sit in the best sub-labor market, conferring a recruiting/retention advantage. And don’t let other factors overshadow a powerful labor market advantage. Such factors could include ease of access to HQ, perceived image, strong incentives package, etc. Also, beware of the “too much of a good thing” syndrome. In most cases, an over-concentration of similar operations will have a desultory impact on labor supply and cost.

Last, if going offshore there are several considerations that must be given extra scrutiny versus U.S. site selection. These include loaded wage rate (including mandated/customary fringe benefits), time zone, labor legislation (especially hiring/firing), supply of top-quality talent by language spoken, financial/currency stability, social unrest, political risk, cyber security, expatriate/visitor security, foreign company taxation, intellectual property protection and utility infrastructure (especially telco and electric power reliability).