Financial institutions are part of a highly connected network that reverberates with global events. The COVID-19 pandemic has been no exception. Throughout the pandemic, financial institutions across the globe have been carefully monitoring the effects of shut-downs, lockdowns, inflation, employment, real estate and many other factors. They are looking to understand both immediate challenges and the potential fallout for years, if not decades, to come. They are using their expertise to help themselves and their customers to make good decisions in today’s highly volatile operating environment.

Financial institutions are part of a highly connected network that reverberates with global events. The COVID-19 pandemic has been no exception. Throughout the pandemic, financial institutions across the globe have been carefully monitoring the effects of shut-downs, lockdowns, inflation, employment, real estate and many other factors. They are looking to understand both immediate challenges and the potential fallout for years, if not decades, to come. They are using their expertise to help themselves and their customers to make good decisions in today’s highly volatile operating environment.

Below, we’ll review some of the many challenges facing financial institutions today, particularly with regard to site selection, expansion and relocation.

Back-Office Operations

Understandably, the COVID-19 pandemic has presented a challenge for business process outsourcing, or BPO. Many financial services institutions rely on third-party back-office services for call centers, help desks, payroll and more. With the virus proliferating in tightly packed office environments, this has meant that many financial services firms are finding it difficult to attain the service levels they need from BPO partners, particularly those located in nations with limited access to vaccines.

Financial companies should look for BPO partners that have been able to rapidly adjust to pandemic-related challenges. BPO companies that have adopted a flexible model, with some (or all) agents working from their homes are a good choice. If your back-office services provider is struggling with shutdowns, infections and low staffing levels and high turnover, it may be time to make a switch.

BPO companies that have adopted digital platforms are also a good idea, not only for business continuity during the pandemic, but to provide customers with the digital-first experience they want. As many BPO professionals are currently working remotely, digital adoption for BPO companies is a must. Digital resources must now accommodate every business process, communication channel and operation, and it is important that these processes and channels are properly integrated to avoid creating silos that do not communicate with one another, which leads to poor customer service experiences and inefficient workflow for employees.

It’s also critical to choose a BPO partner that has stringent security measures in place. With an increase in agents working from their homes, the chances of exposing consumers’ personal data skyrocket. Ensure your back-office partner is using the latest encryption technologies and network protection to lower the chances of exposure of customers’ personal information, either accidentally or through data theft.

Access to Labor

Financial services operations happen in large metro areas, according to conventional wisdom. Increasingly, however, companies are having to relocate to where the talent is. Workforce may continue to be the primary factor in location decisions for companies that seek the best talent, but remote-work trends accelerated by the pandemic may reframe site selection priorities for IT-heavy projects, according to EY U.S. Economic Development Advisory Services National Director Amy Holloway.

“With the likely dispersal of technology workers out of high-cost centers in California and the Northeast due to the pandemic, technology companies may be selective about whom they bring back to the office,” wrote Holloway. “Non-critical workers may be left as ‘remote-optional,’ allowing workers to fill positions from anywhere in the U.S. (and potentially anywhere in the world) and allowing companies to offer competitive salaries (although potentially reduced) to match housing costs where these workers choose to live.”

Downsizing Physical Locations

Even before the pandemic, digital banking was quickly becoming a preferred method for millions of Americans, according to Forbes. Once the pandemic-related shutdowns began, both consumers and financial institutions found it necessary to adapt to a primarily digital environment for their financial service needs. Consumers have responded to these changes by largely adopting and embracing digital banking, including the use of apps.

“The trend of online banking and the acceleration in some sectors of moving to a cashless society would appear to create less need for physical bank branches,” wrote Forbes’ Brett Holzhauer. “In 2019, there were 5,000 fewer commercial bank branches open than in 2010. In 2021, several institutions have made recent announcements regarding branch closures, including KeyBank, PNC Bank, U.S. Bank and Wells Fargo.”

Analysts believe that while there is still a need for financial services and banking branches, the look, feel and purpose of them will be much different in the future. Chris Manderfield, executive vice president and head of product management at KeyBank, has predicted a shift to appointment-based banking.

“Value-based and higher-level services will be going on in branches,” he noted. But check deposits, balance checks, withdrawals and other simple transaction are likely to be largely carried out either online or at ATM machines. The future of banking and financial services at the consumer side is likely to include fewer tellers, more bankers, functionality changes and adjustments to what can be done in the branch.

Working from Home

With many people working remotely for extended periods of time, workers have come to enjoy the efficiencies gained by losing the daily commute, participating in virtual meetings and the flexibility of being able to work from anywhere. Likewise, many employers have determined operational productivity has not suffered and, in some cases, has increased. With these factors in mind, for many financial services operations, now is the time to reevaluate physical footprint needs and operational objectives. The balancing act is to ensure that opportunities for team building, creativity, mentoring and productivity remain intact, while the health of team members is preserved.

Emerging trends show occupants of high-rise office towers are creating outposts in the suburbs to accommodate employees who are not comfortable commuting into the city via public transportation or being near dense populations. Given these trends, suburbs with urban amenities may be the winners of new financial services relocations.

Even in companies maintaining physical offices, there are challenges in adapting to the COVID era. Many organizations have had to rethink their interior layout to include more separation between workspaces, enhanced video conferencing capabilities, the creation of shared areas that are easier to clean, and an increase in hoteling spots to accommodate telecommuters.

Planning for the Long Term

When the COVID19 pandemic first struck, many companies believed it to be a short-term crisis and they acted accordingly by prioritizing immediate financial and operational measures to protect liquidity and cash flows. While this was understandable at the time, two years later, these same companies are learning from mistakes they made in not planning for the future. Today, many financial services companies have learned that the pandemic may drag on for far longer than they believed, necessitating a shift in their planning mode from short-term disaster recovery to a longer-term strategy to accommodate the new normal.

In order to reduce pandemic-related financial strains on businesses, some financial regulators have gotten more accommodating in an attempt to relieve the pressure by, for example, postponing activities such as financial stress tests, reducing capital buffers and delaying implementation dates and non-critical supervisory reviews whenever possible.

Positioning for Social Changes

PricewaterhouseCoopers (PwC) believes that financial services companies will need to respond to lasting social changes, including how consumers select channel preferences, products, and banks for their individual financial needs. Behavioral changes may accelerate the shift of the branch concept away from transactions toward a more complex, high-value operation. Decisions across distribution, as well as product relevance, will likely be key to this transition. Until now, most banks have marketed products using broad demographic segmentation. But customers are increasingly expecting personalized offerings, tailored to their individual needs, and financial services executives will need to use data to fine-tune their customer experience, product offerings and pricing strategies to meet those expectations.

A crisis such as a pandemic often comes with renewed scrutiny on corporate behavior by the public and regulators. The financial services industry is in a unique position to play a vital role in supporting communities and projects that benefit them. This might mean making accommodations to workers that companies might not normally consider, changing paradigms to make it easier for customers to seek services remotely or reaching out to financially underserved people in the community with pandemic-relief programs.

During the last national crisis – that of the 2008 economic meltdown – financial services institutions were widely seen by the public to be the cause of the catastrophe. This time around, it makes sense for financial companies to burnish their reputations as a force for good.

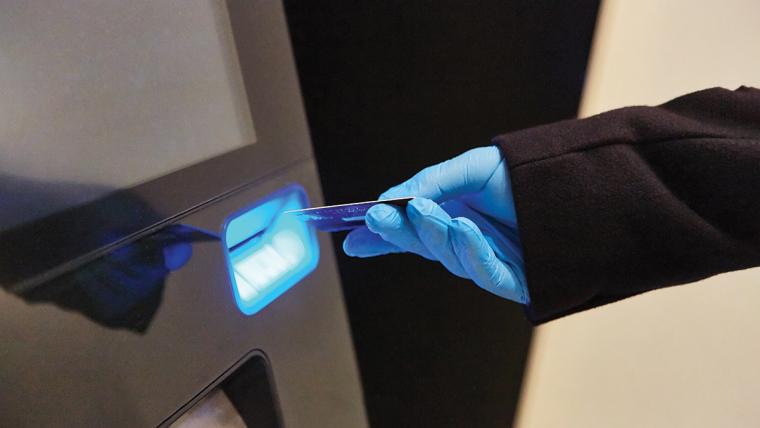

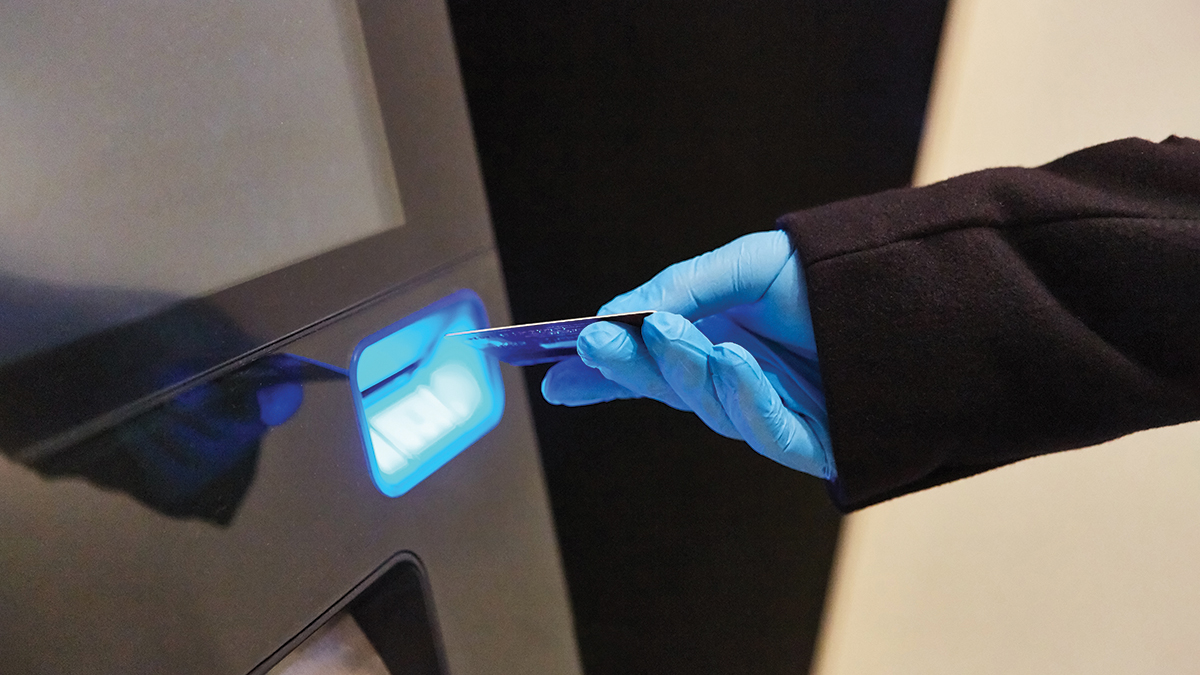

Financial Fraud

The global pandemic has been something of an open season for fraudsters, particularly with more workers working from non-traditional locations such as homes and public-shared workspaces. Essentially, where there is money or valuable customer data, there will be fraud. In March 2020, Congress passed the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act, designed to provide emergency financial assistance to the millions of Americans who are suffering the economic effects caused by the COVID-19 pandemic.

Anticipating the need to protect the integrity of these taxpayer funds and to otherwise protect Americans from fraud related to the COVID-19 pandemic, the Department of Justice immediately made efforts to provide tools that allow financial services companies to identify, investigate and prosecute such fraud.

Since many of these programs are new, financial services companies may not have the tools in place to detect and prevent the fraud, according to PwC. For example, losses related to misrepresentations are often found in credit losses or overdrafts, and the liability for scams in those areas is often put back on the victim.

“As a result, [financial institutions] should adjust to this new battleground — and do so quickly,” according to PwC. “This includes making sure that both employees and customers are well-informed of emerging and evolving threats, implementing cyber and access controls for an increasingly remote workforce and tuning payment controls needed to help prevent and detect unauthorized disbursements of funds. In addition to shoring up existing controls, the current crises provide financial institutions with opportunities to rethink traditional fraud management approaches and innovate new ways to help protect their customers.

The COVID-19 pandemic has proven to be a global stress event that continues to test companies’ financial, operational, and commercial resilience. Going forward, the financial services industry will need to adapt quickly and at scale to overcome current constraints and market conditions. T&ID