Once the “what” consideration has been resolved, the next question to address is “why?” In other words, what are the primary drivers motivating top management to even consider moving the home office?

Subsequent questions would be “whether or not” and “where” to relocate. “Whether” measures relevant impacts and leads to a “go/no-go” decision. If the decision is to go, “where” would determine the new site for a relocated headquarters operation.

Headquarters Composition

A mini-trend has been occurring in corporate America, especially among industrial enterprises. That is, the leaner, smaller corporate head office. More and more companies with over a billion dollars in sales have been redefining what constitutes a headquarters office. In many cases, head office headcount size is under 100.

Today, many headquarters embody the C-suite and perhaps one or two direct-report levels. These executive-oriented functions typically include:

1. CEO

2. Finance

3. Legal

4. Human Resources

5. Technology

6. Sales/Marketing

7. R&D

8. Operations (usually includes heads of the major business groups).

A number of forces have led companies to “right-size” corporate headquarters. These include:

1. Concentrating the design and oversight of corporate strategy in one physical entity

2. Decentralizing the execution of corporate strategy into integrated business units, such as divisions or subsidiaries (which are often field-based)

3. Reducing corporate overhead and maximizing efficiency

4. Fostering location optimization for office segments

- Front

- Middle

- Back

5. Encouraging innovation and flexibility among business units, with headquarters providing a collaborative framework

6. In some cases, going offshore for tax reduction reasons.

We are witnessing an increase in the number of companies adopting the “lean” corporate headquarters model. Examples include:

1. AOL (media)

2. Aon (insurance)

3. Boeing (aerospace)

4. Cadillac (mfg.)

5. CKE Restaurants (food)

6. Dover (mfg.)

7. Exxon (energy)

8. Fiat Chrysler (mfg.)

9. Gardner Denver (mfg.)

10. Graftech (mfg.)

11. Hannaford (food)

12. Maybelline (cosmetics)

13. MoneyGram (finance)

14. Rain Cii (chemicals)

15. Tronox (chemicals)

16. Western Refining (energy).

As companies continue striving for efficiency, flexibility and nimbleness, the trend toward downscaling the flagship office is likely to continue. This does have implications for location of truly C-suite headquarters operations. They will typically gravitate to Tier One metros with global business resources.

Once the scale/composition of headquarters has been delineated, executive management should raise a basic question: Is the headquarters located in an area that maximizes attainment of key strategic business objectives? If there is any serious conjecture, a worthwhile exercise would be to explore the feasibility of relocation. Common drivers of the decision to relocate a headquarters include:

1. Customer access

2. Proximity to company operations (e.g., manufacturing plants, R&D centers, subsidiary headquarters, etc.)

3. Ease of travel

4. Talent pool depth

5. Ability to recruit nationally

6. Industry ecosystem

7. Infusion of fresh talent/internal change

8. Consolidation (especially post-merger or acquisition)

9. Divestiture

10. Cost reduction.

Scale and drivers materially impact whether or not and where to move corporate headquarters. Ascertaining whether or not to move is frequently referred to as a relocation feasibility analysis. Dimensions of a feasibility study entail the following:

1. Executive management decides on team members to perform the analysis

- Confidentiality is of utmost importance

- Protocols for communications, including a project code name, must be defined and followed

2. The team delineates the following:

- Base case for comparison purposes

- Confirmation of key drivers

-

Realistic scenarios to evaluate, e.g.:

- All business functions move locally (short-distance)

- All business functions move out-of-area (long-distance)

- Some functions remain locally while others relocate long-distance

- Front office moves to a Tier One metro and back office relocates to a smaller, low-cost metro (Tier Three or Four)

-

Human resources

- Retention

- Attrition

-

One-time costs

- HR related

- Real-estate-related

- Transition

- Miscellaneous

-

Annual costs (savings or penalties)

- Payroll

- Occupancy

- Travel

- Taxes

- Incentives (offset)

-

Additional considerations

- Customer proximity

- Air access

- Labor market

- National recruiting

- Capacity to facilitate culture-shift

4. Synopsis: risks/rewards

- Operational

- Cost

- Bottomline

5. The decision

- Which scenario

- Go/no-go

-

If no-go

- Identify steps to enhance success at current location

- Leave door open to future revisiting of issue

-

If “go”

- Determine optimal timing

- Post-move operating requirements

- Expansion of the project team

- Location study game plan (the where challenge).

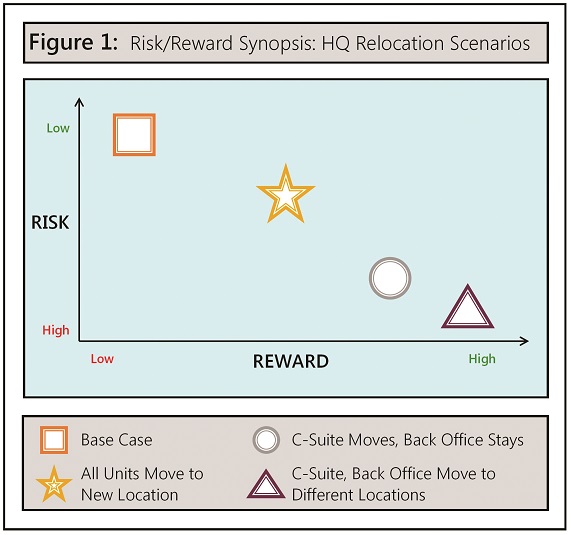

The just-noted items need to be assessed for each relocation scenario and the base case. Figure 1 illustrates how outcomes can be summarized for top management review.

The just-noted items need to be assessed for each relocation scenario and the base case. Figure 1 illustrates how outcomes can be summarized for top management review.

It should be emphasized that a notable proportion (approximately one-third) of companies that consider headquarters relocation opt to stay put. In such cases, the potential advantages are not viewed as being sufficiently compelling to offset the downside, which could include business disruption, diversion of management time, loss of critical personnel and cost. Regarding the latter, the preponderance of headquarters moves are not undertaken to achieve cost savings. Often annual costs will be higher (than current), and one-time outlays can be substantial, with no payback due to savings. Rather, headquarters tend to relocate for strategic business reasons such as talent attraction.

Despite this proviso, feasibility study results commonly lead executive management to pursue relocation. In such cases, upper management needs to understand the extent of resources (financial and people) that must be deployed to smoothly implement relocation within acceptable cost/disruption parameters.

Where to Relocate

As with relocation feasibility, scale and function will ultimately shape the location decision. Front office (C-suite and/or two rungs below) will gravitate toward “global metros.” These Tier One areas feature international air service, extensive domestic air service, substantial presence of Fortune 500/1000 headquarters, a large executive/managerial talent pool, diverse range of lifestyle opportunities and favorable national recruiting capabilities.

If a back office operation (e.g., financial transaction processing, customer service, help desk, etc.) is involved in the relocation, then labor market considerations will predominate. The objective will be to locate in an area (Tier Three or Four metros) with minimal competitive demand, abundance of direct skills, a big underemployed base and modest labor costs.

Should relocation encompass any middle office operations, then the project gravitates to a location in between the above. Middle office functions tend to be more professional skills oriented but still somewhat cost-sensitive. They can include fraud/compliance, technology, shareholder services, asset management, legal support, etc. Here, Tier Two or Three metros become likely targets.

As can be deduced from the above, composition and scale can decidedly affect the efficacy of a final location decision. If two or all three office segments are involved, tradeoffs (e.g., air access, clerical labor pool depth, national recruiting and labor costs) will invariably arise. In other words, the location solution will be less than optimal for one or more office segments.

The location selection process will be similar no matter which functions comprise headquarters. What changes is only the degree of emphasis placed on various factors. Determining where to relocate involves a two-phase analytical exercise.

1. Phase One: Location screening

- Composed of desktop research

- Series of statistical thresholds established (e.g., large hub airport, population size, industry/occupational employment)

- Metro areas screened and those failing to meet thresholds eliminated

- A longlist of eight to 10 areas generated

-

Longlisted locations further assessed

- Mainly by issuing a “Request for Information” (RFI) to each area’s lead economic development organization

-

RFIs designed to obtain input such as:

- Corporate headquarters roster

- Roster of new/expanding employers

- Roster of downsizing employers

- Availability/cost of Class A office space

- Planned air service improvements

- Tax practices/rates

- Potential incentives

- Utilizing an area ranking/scoring model, the longlisted locations are compared and contrasted relative to both cost and qualitative factors

- Typically three are shortlisted for final consideration

2. Phase Two: Field-based due diligence

2. Phase Two: Field-based due diligence

- In this phase, the study team spends time in each area to assess both short-term and long-range attractiveness for the new headquarters

-

While in the field, the team engages in the following:

- Interviews with other headquarters employers

-

Interviews with other groups, e.g.:

- Executive recruiter

- Staffing agency

- Workforce center

- Business associations

- State/local government

- Residential real estate

- Commercial real estate

- Education/training

- Qualified office space tours

- Quality-of-life tours

- Dialogue with state and local economic development organizations relative to an incentives package

-

Of major importance, the team needs to identify the best sub-markets from an HR perspective

- Talent pool

- Commute distances

-

Lifestyle opportunities

- For transferees

- For new hires nationally recruited

- Office space options should be confined to the best sub-labor markets

-

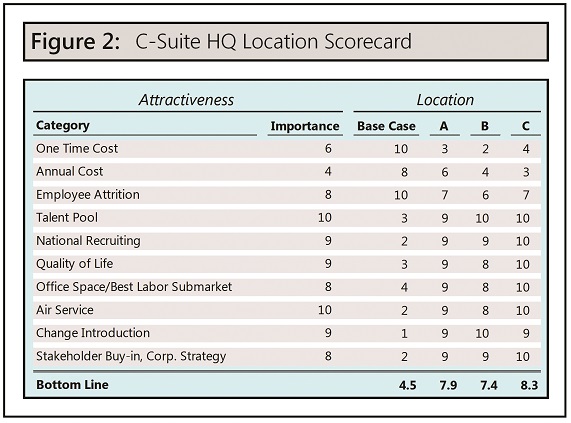

Each shortlisted location is assessed/ranked (see the sample scorecard in Figure 2) on key factors/criteria such as:

-

Talent pool breadth/depth

- Metro

- Best sub-market

- University resources

- Quality-of-life/cost-of-living

- Air service

- Office space

-

Business costs

- With incentives

- Without incentives

-

Talent pool breadth/depth

- The preferred location and best alternative are selected.

Now the team engages in final negotiations for office space and incentives in the two (or perhaps three) areas. Additionally, final due diligence is completed by finance, legal, technology, etc.

Before the ultimate decision is made, the following should also be addressed:

1. Expansion of the team to enter the transition phase

- Internal

- External

2. Milestone relocation timeline

3. Conceptual office space design/space standards for the new headquarters

- Collaborative environment

- Reflective of corporate values

- Sustainable features

4. HR policy design

- Separation

- Relocation

5. New hire recruiting plan

6. Changes, if any, to compensation and HR practices

7. Final determination on lease vs. own

8. Storyline/communications for announcing the decision

- Internal

- Government

- Other stakeholders

Conclusions

Headquarters relocation occurs infrequently for nearly any company. But when the challenge arises, relocation can be a game changer.

It is, therefore, paramount to get the “strategic” inputs right. These include composition, scale, rationale and relocation scenario (what functions to move and what is sought in a new metro area).

Beware of mixing diverse functions in relocation. Successful operation of each function could be compromised if they have distinctive operating requirements.

Before deciding on a “go” course of action, be sure the risks can be managed and the rewards are fully achievable. If a “go” scenario is selected, then let the end game decision be shaped by what is most critical for a successful headquarters operation. Adopting that guiding principle, follow a dual-phase process to arrive at an optimal relocation decision. And by all means, ensure any relocation study is conducted within the strictest rules of confidentiality.