Trade & Industry Development magazine approached CoreNet Global to gain a view of how the corporate real estate (CRE) industry is reacting to the recession. As of January 2009, the downturn entered its13th month in the

The commercial real estate markets will face another challenging year in 2009, yet there are some upsides. The current time frame also offers opportunities for strong companies to come out even further ahead once a recovery begins, and CRE is in a position to help – as seen in other downturns. Richard Kadzis, director of Special Projects inside CoreNet Global’s

Trade & Industry Development (T&ID): What are the most pressing economic issues for corporate and commercial real estate considering the current economic climate?

CoreNet Global (CNG): The consensus, industry-wide, is that the current cycle’s bottom for the commercial real estate markets will be in 2009.

CoreNet Global (CNG): The consensus, industry-wide, is that the current cycle’s bottom for the commercial real estate markets will be in 2009.

The sub-prime collapse and resulting credit and investment bank crises are hitting the corporate real estate sector as much as any other part of the business or general economy.

The number one problem and solution is availability of capital. Once capital frees up – and there’s plenty of it sitting on the sidelines waiting for conditions to improve – commercial real estate investments and transactions will make a comeback. But corporate spending, which has been frozen since late last year, will need to free up, too.

So the hot buttons for CRE will be red-hot in 2009.

T&ID: So there appears to be an upside.

CNG: One upside is that there was far less surplus space going into this recession than we saw following the Dot-Com crash and the resulting commercial real estate downturn of 2001 – 2005.

On the macro-economic side, record-low interest rates and the infusion of a trillion dollars or so into various bailout and recovery programs globally should help restore some vitality in 2009, and with it some confidence. Plus, we’re already more than a year into this recession, as it turns out.

Another plus could well end up being the increased levels of financial and market transparency that need to follow the demise last year of the commercially-backed mortgage securities model. It will be more regulated yet more transparent.

T&ID: What’s the longer-term picture hold for CRE, then?

T&ID: What’s the longer-term picture hold for CRE, then?

CNG: For the senior executives overseeing global real estate and workplace portfolios on a global scale for huge multinational companies - with the support of their outsourced strategic partners on the commercial real estate side of the industry - 2009 may very well turn out to be a case of “now, more than ever.”

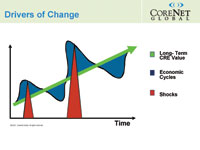

That’s because regardless of the economy, CRE’s twin charges never change. Cost cutting is a permanent state, like change itself. But so is the C-Suite and shareholder expectation that CRE delivers value, no matter if the global economy cycles up or down.

T&ID: There are drivers that surpass even the effects of recession, in a corporate strategic sense?

CNG: Yes, in other words, competitive advantage, innovation, speed to market and financial performance trump even an unprecedented global economic malaise. We’ve seen this before, and it’s likely to hold true again.

Simply put, short and long term, the ongoing CRE mandate will remain to deliver value to the corporate enterprise.

Still, the day-to-day survival mentality will color everything. While the cost-cutting pressure is constant, it’s more pronounced than ever right now. So is risk management.

T&ID: You mentioned hot buttons for CRE in 2009. What are they?

CNG:

More intense focus on risk management and business continuity

Efficiency with effectiveness - the tension grows in times like these

Cost management with value output - a paradox that keeps on going

What's left to cut? How to find hidden costs?

Emphasis on better capital planning vs. tight credit markets

Growing C-Suite mandate for CRE to govern all real estate activity

Another occupier or demand-side market

T&ID: Those hot buttons seem to reflect immediate and long-term priorities at the same time.

CNG: The dual shocks of the

T&ID: How so?

CNG: When the real estate recession of the 1990’s jolted everyone, CRE reacted by creating higher-level value for itself and the enterprise. It was during this period that ‘bleeding-edge’ adopters like Cisco Systems, Nortel and Sun Microsystems worked with CoreNet Global to launch Corporate Real Estate 2000.

It shifted the CRE industry paradigm by changing the nature of work and the workplace by saving on space and costs while creating value in the form of higher productivity, customer satisfaction and other indicators.

T&ID: Will the current jolt drive more and more CRE managers back toward the value protection mode, or will there be a focus on value creation?

CNG: Following this downturn, one outcome could be a transformation around the CRE delivery model, which involves more high-level outsourcing yet more intensive focus internally on strategic elements like planning, capital expenditures, governance, CRM, sustainability, talent and alternative workplace practices. But the financial model for commercial real estate, which is debt-oriented, might need to change, too.

T&ID: What are some of the factors that could drive this continuing evolution of CRE?

CNG: In a word, CRE is fast becoming a driver of the enterprise. For the past decade, Robert Osgood of Flad Architects has studied how companies and their CRE organizations are getting more aligned together, and how strategic drivers like innovation and speed to market are now enabled directly by CRE.

Osgood found that the underpinnings of the model are based on the application of a business framework to real estate, rather than a real estate solution imposed on a business. But the tendency for most companies is to reward short-term focus with a transactions-value, not strategic or long-term, emphasis. So if the reward and compensation model changes, including for service providers, another important change will happen.

Mike Joroff of MIT believes this transformation is already visible on the innovative edge of corporate practice even in the face of the global investment and credit crises. It will lead to some kind of a hybrid internal support model for companies that make the adjustment.

T&ID: How can you summarize all of this?

CNG: We’re in the middle of a time of unprecedented economic turbulence. The crisis has already slowed commercial market investment and transactions to a crawl. Tenant leasing is way down too. We think the downturn for our industry could end late in 2009, or early 2010.But on the other hand, it all adds more to the claim that more than ever, it’s always a good time for effective demand-side management.

Real estate plays the dual role of cost manager and value creator, and plays it well, in good times and in bad. The record shows it’s clear: Whether it’s the fast spike of trauma or the slow curve of a cycle, CRE continues to evolve on a straight line in upwardly mobile fashion.