Headquarters (HQ) is the term used to denote the managerial and administrative center of an organization. It is the nucleus, the central core of a corporate entity. There are many underlying considerations a CEO and team have to wrestle with and be certain about before dealing with the challenging complexities of potential headquarters relocation and they will be brought to light here to help make the process smoother.

Where does the team start the process of HQ relocation? It won’t be simple, quick, unencumbered or handled in a hollow framework. All aspects of the process must be thorough, well researched, thought provoked, realistic, mindful and demonstrate understanding of the true risks and rewards of any concrete decision.

The first order of business and the question needing an answer is WHY? What is (are) the primary driver(s) behind the HQ relocation? Once that is determined, it must be mixed with multiple other layers of variable consequence, e.g., the company’s financial status, current/emerging competitive landscape, stakeholder appreciation for strategic initiatives, major internal change on the horizon, employee morale, company culture/values, etc., all of which have an impact on any decision. No, it is not simple. Yet the right decision can markedly enhance attainment of key strategic objectives.

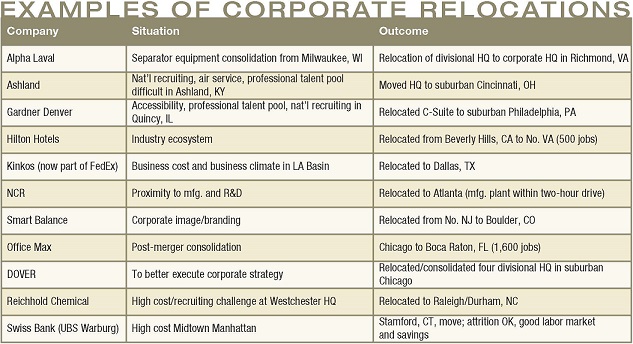

It is clearly the “Why” that ultimately drives the feasibility of “Yes or No” to “Go/No Go” and always comes before the “Where.” Some “Why” reasons could include:

It is clearly the “Why” that ultimately drives the feasibility of “Yes or No” to “Go/No Go” and always comes before the “Where.” Some “Why” reasons could include:

1. Is there an imperative to consolidate redundant operations, such as the aftermath of a merger/acquisition?

2. Has the company outgrown its hometown roots?

3. Can the company find and keep best-of-class talent from the local labor market?

4. Does the location reinforce a new branding/image campaign?

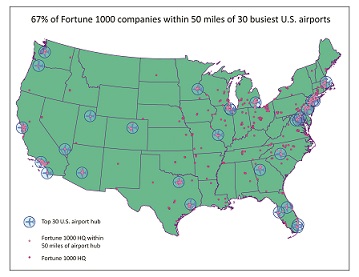

5. Is there a need to gain better access to customers via air both domestically and globally?

6. To ensure the ability to effectively implement corporate strategy, would a new location help improve national recruiting and the ability to rotate field personnel through HQ?

7. Can this location house a showcase facility for new products and hands-on training?

8. Does this location offer technological possibilities for how and where people work?

8. Does this location offer technological possibilities for how and where people work?

9. Is ‘sustainability’ in the corporate vernacular? Will the location avail the workforce to utilize mass transit/walking/biking – all options to reduce driving time?

10. Does the workforce embrace corporate values?

11. Does the corporate culture require an overhaul?

12. Is the current workspace conducive to the new way of working: ergonomic, bright, airy, natural light without a major overhaul to internal space?

13. Would there be material benefits for colocating HQ with R&D and/or manufacturing?

14. Would the company benefit from having HQ located in an area where there is a significant industry presence (ecosystem)?

15. By virtue of HQ location, do competitors enjoy any operational advantages?

16. Is the area’s quality-of-life portfolio conducive to relocate professional talent with experience and recent college graduates?

The cost of corporate HQ relocation can be in more than dollars (although financial consequences can be substantial) to the company: disruption to the organization, management distraction from running the business day to day, employees less productive, sour grapes sentiment from those employees left behind, subterfuge by alienated employees, etc.

Also, when a large company relocates out of a smaller community, it is felt more personally and needs to be handled with extra sensitivity and consideration. This should entail assistance to the community for embarking on initiatives to replace lost jobs. Foundational giving or retaining a satellite office are other ways in which to soften the blow and help to leave a positive presence and uphold the company’s reputation, both out of gratitude and for public relations purposes.

Unless a head office is situated in a high real estate cost market (e.g., New York or San Francisco), rarely will a HQ move result in any cost savings. Rather, the bulk of headquarters moves are done for strategic business reasons. Relocation costs will likely be substantial. Ideally, they should be recorded with other restructuring charges to absorb a strategic financial hit and move on to making the company stronger in every respect.

1. One-time costs associated with HR relocation embrace:

1. One-time costs associated with HR relocation embrace:

- Separation

- Relocation

- Replacement

- Temporary dual staffing

2. Real estate one-time costs include:

- Current space disposition

- Capital cost for a new building

- Office content moves (which might include a data center)

- New furniture/fixtures/equipment

- Temporary dual occupancy

3. Transition management

- Incremental staffing

- Outside advisors

- Travel

4. Miscellaneous (e.g., change of address, stationery, financial assistance to the departing community).

Key recurring costs should be contrasted against the base case (remain at the existing site). They would include: payroll (e.g., relocating employees and new/replacements), occupancy, travel, taxes and incentives (cost offset). Regarding incentives, these could be meaningful (e.g., payroll tax rebates, sales tax exemption and/or deal closing grants). However, incentives usually will not either change the financial efficacy of relocation or significantly reduce upfront (or one-time) costs.

In addition to cost, understanding relocation’s potential impact on the existing employee population will be instrumental in determining if a HQ move is even viable. Attrition should be estimated for various employee groupings such as critical personnel (move induced attrition must be negligible), executive, professional/managerial, clerical, department, etc. Assumptions on dimensions of policies to apply for a group move (e.g., home sale) need to be made prior to forecasting employee retention/attrition. Outcome of these analyses will also influence the cost equation.

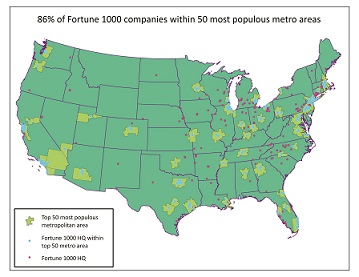

If the management decision is a “Go” with Board approval obtained, then the challenge of determining the “Where” phase begins. After desktop research and systematically eliminating areas not meeting the most critical criteria, and outreach to economic development agencies, a shortlist of three to five areas will emerge as the most promising locations. Then comes due diligence in the targeted finalist locations.

Areas will be contrasted on myriad factors and ranked on how each location best satisfies key operational criteria. Among factors that should be addressed are:

1. Labor market

- Competitive demand (by skillset)

-

Availability (by skillset)

- Industry specific

- Generic

-

Retention/turnover

Retention/turnover -

Keys to ‘Employer-of-Choice’

- Company reputation/brand

- Compensation (salary usually well above market and pay for performance)

- Benefits

- HR practices

- Recruiting sources/methods

- Worksite characteristics/amenities

- Worksite access

- Internal work environment

- Carbon footprint/green initiatives

- Civic involvement

- Corporate giving

2. National recruiting

- Experienced talent

- College fresh-outs

3. Quality-of-life (impact on national recruiting)

- Housing

- Education

- Crime

- Arts/culture

- Outdoor recreation

- Climate

- Cost-of-living

4. Best sub-labor markets

5. Available/sites/buildings

5. Available/sites/buildings

- Physical characteristics (e.g., size, contiguous floors, common space)

- Acres

- Appearance/image

- Amenities

- Compatibility with other tenants/neighbors

- Parking

- Utility infrastructure

- Lease terms/rates/or purchase cost/build-to-suit option

6. Air service

- Domestic

- Global

- Time

- Cost

7. Higher education

8. Natural disaster risk

9. Area image (supporting company brand/image)

10. Tax practices/rates/exemptions

11. Useable incentives, e.g.,

- Grants

- Tax rebates

- Tax abatements

- Tax credits

12. Comparative business costs

13. Qualitative/cost rankings.

It must be remembered that a plan needs to be in place to blend the old (relocation) and new (replacement) employees in a manner that fosters the kind of culture envisioned by top management.

HQ relocation is a rare and seldom occurring event in the lifecycle of a corporation. Therefore, a well-crafted tactical plan to be certain that a move would achieve desired results is essential. At the outset, prioritize the reasons relocation is under consideration. In addition, dynamics such as the following should at least be discussed:

1. Centralizing/vs. decentralizing selected functions

2. Future definition of what constitutes a HQ

3. Outsourcing selected functions

4. Technology issues

5. Security issues (including disaster recovery)

6. Global footprint.

Once the drivers and exogenous forces are addressed, then a logical approach wherein risks/rewards are defined will lead to a “Go/No Go” decision.

In conclusion, a wise and shrewd management team that integrates all important variables into the decision-making process amid warp-speed technology advances, security vulnerabilities, global competition, social media influences, financial ups and downs, new and ever-changing regulations on business, managing a dynamic enterprise yet keeping stakeholders and workforce concerns at the top of the list of considerations should be congratulated. No, getting to a decision is not simple.

However, what ultimately tips the scales for a decision of “Yes or No” to “Go/No Go” is whether or not the objectives of “Why” were met.