After a challenging few years, biotechnology is back. While much of the life sciences field proved relatively insulated from the broader macroeconomic climate in recent years (with employment and profits continuing to increase during both good times and bad), the biotechnology industry experienced significantly more volatility. The collapse of the capital markets during the economic downturn forced smaller companies to significantly reduce expenses. Large pharmaceutical conglomerates, on the other hand, struggled to devise new products to replace the sales of blockbuster drugs with expiring patent protection. Between 2007 and 2009, biotechnology employment declined in all but two states.

After a challenging few years, biotechnology is back. While much of the life sciences field proved relatively insulated from the broader macroeconomic climate in recent years (with employment and profits continuing to increase during both good times and bad), the biotechnology industry experienced significantly more volatility. The collapse of the capital markets during the economic downturn forced smaller companies to significantly reduce expenses. Large pharmaceutical conglomerates, on the other hand, struggled to devise new products to replace the sales of blockbuster drugs with expiring patent protection. Between 2007 and 2009, biotechnology employment declined in all but two states.

Since the depths of the recession, however, the biotechnology industry has rebounded strongly. During the past two years, every state in the U.S. has experienced an increase in biotechnology employment. In addition to employment gains and an overall increase in financial health, the biotechnology industry has once again become a Wall Street darling. With dozens of successful initial public offerings of biotechnology firms, by the end of 2013 it looked like it was poised to be the best year for biotech IPOs in at least a decade. The return of investor confidence in biotechnology has not only provided much needed capital, but also highlights the increasingly buoyant long-term prospects of all aspects of the industry.

Defining the Biotechnology Industry

Popular definitions of biotechnology vary, often due to a blending of health-related industries with pure biotechnology industries. While biotechnology is increasingly integrated with other disciplines, the industry has four primary applications, as follows.

Agriculture and Chemicals: Biotechnology is widely used in agricultural commodities to produce genetic changes that increase crop yields, heighten resistance to disease and improve nutritional qualities. Biotechnology can also be used to create enzymes that transform organic matter into chemicals and fuels for industrial uses.

Agriculture and Chemicals: Biotechnology is widely used in agricultural commodities to produce genetic changes that increase crop yields, heighten resistance to disease and improve nutritional qualities. Biotechnology can also be used to create enzymes that transform organic matter into chemicals and fuels for industrial uses.

Biomedical Drugs: Includes traditional pharmaceuticals composed of chemical compounds and biomedical drugs derived from living organisms (such as human cells and antibodies).

Medical Devices: Biotechnology is the basis for a wide array of sophisticated medical devices and equipment.

Research and Testing: Biotechnology is extraordinarily complex and the development of a new drug or device often takes several years (or even decades) of research. Due to government regulations and liability issues, testing can add several additional years to the product development cycle.

Site Selection Factors

Despite the differences between individual biotech subsectors, site selection considerations continue to revolve around two ingredients critical to sustained success — capital and talent. The presence of supporting innovation infrastructure and financial incentives also play important roles in biotechnology site selection considerations.

Capital

Biotechnology is one of the most research and development intensive industries in the U.S. The development of a new biomedical drug or device can take many years and cost millions (or even billions) of dollars. As a result, nascent biotechnology firms must often operate for a significant time before generating revenue. The availability of financing, including early-stage venture capital funding, is crucial in sustaining operations.

Within the U.S., venture capital funding is overwhelmingly concentrated in just a handful of regions. In 2012, for example, California and Massachusetts firms received more than 60 percent of all biotechnology venture capital funding in the U.S. Other leading states for venture capital funding include New York and Washington.

For biotechnology companies located outside of traditional venture capital hubs such as San Francisco and Boston, the presence of a major research university can often provide critical funding. Such schools often have close ties to aligned government agencies that can provide research. Academic research and development expenditures are not only more geographically disbursed than is venture capital funding, but federal funding for research and development is significant. In 2012, life sciences research expenditures at U.S. universities exceeded $37 billion.

Talent

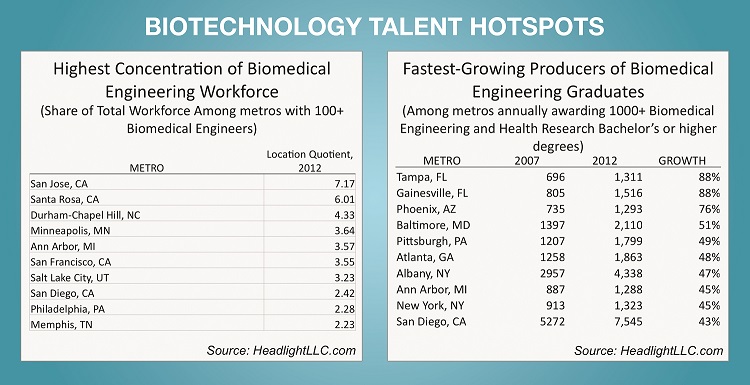

Biotechnology is among the most complex and innovative industries in the U.S. In addition to ample funding, the sector also requires a deep pool of specialized talent. Workers in positions such as biological scientists and biomedical engineers are critical to advancing scientific discovery, the lifeblood of the biotech industry. Acquiring the skills necessary to fill such positions can be extremely time-intensive and talent is often difficult to procure, especially for the most technically sophisticated occupations. Each year, for example, the U.S. awards fewer than 16,000 biological and biomedical sciences degrees at the doctoral level (in comparison, the U.S. produces approximately 40,000 legal graduates each year).

Given the relative scarcity of talent, biotechnology firms typically locate in regions that either possess an existing workforce or that offer the quality of place amenities that can readily attract skilled workers to the community. Outside of established biotechnology leaders such as Boston and San Francisco, college towns can often provide prospective firms with the ability to attract outside talent while also cultivating a skilled local workforce.

Innovation Infrastructure

Innovation Infrastructure

Compared to more traditional industries such as manufacturing and logistics, biotech firms typically require little in the way of hard infrastructure investments such as roads and large industrial sites with multimodal access. Instead, biotechnology firms require research labs, technology incubators and other innovation infrastructure assets.

Communities with major universities and/or research hospitals often excel at providing the necessary innovation infrastructure to support the biotechnology industry. The Sid Martin Biotechnology incubator at the University of Florida in Gainesville, for example, has helped spur significant biotechnology investment within the region. Since its inception in 1990, companies located in the Sid Martin Incubator have attracted more than a billion dollars in investments, contracts and grants.

Established companies may also seek public-private partnerships with universities in an effort to reduce the financial risk of expanding operations. In March 2013, for example, GlaxoSmithKline and Texas A&M University partnered together on a $91 million flu vaccination manufacturing facility that will provide the federal government with supplies in the event of a biological pandemic or attack. The new plant will be the cornerstone of the Texas A&M Center for Innovation in Advanced Development and Manufacturing, which is expected to generate $40 billion in investment over the next 25 years.

Incentives

Many states and municipalities throughout the U.S. maintain aggressive incentive policies to spur the development of innovation clusters, including the biotech sector. As a result, most significant expansions or relocations involve some form of public investment.

State research and development tax credits are especially attractive incentives for biotech firms. Although they are typically available to companies regardless of industry, they are particularly valuable to biotech firms due to the industry’s disproportionally high levels of research and development expenses. Since Minnesota adopted the first research and development tax program in 1982, the policy has become increasingly popular. Today, the majority of states offer some level of tax relief for research and development expenditures.

In addition to generic research and development incentives, a handful of states have developed specific inventive programs tailored to the biotechnology industry. Maryland’s Biotechnology Investor Incentive Tax Credit provides investors in biotech firms with a 50 percent income tax credit. North Carolina’s Biotechnology Center provides bridge loans to early-stage biotech companies. In New Jersey, job creation incentives for biotech companies are available at a lower threshold to than companies in other industries.

Texas and California have gone beyond traditional incentive policies to establish massive research and development funds for companies in aligned life science industries, including biotechnology. The California Stem Cell Research and Cures Act, passed in 2004, provided $3 billion to support stem cell research. Three years later, Texas voters approved the creation the Cancer Prevention and Research Institute of Texas (also backed by $3 billion in funding). While the organization has created new opportunities throughout the Lone Star State, Greater Houston has been a particularly notable beneficiary. Buoyed by the Texas Medical Center, one of the largest concentrations of medical facilities in the world, Greater Houston firms and researchers have thus far received $250 million in funding.

Looking Ahead

Looking Ahead

In 2014, the biotechnology industry will face several potential obstacles, as well as significant opportunities. Companies that can successfully navigate these complex issues will be well positioned to thrive in the years ahead.

A Biotech Bubble? — In recent months, a growing chorus of observers has warned about the potential emergence of a bubble in biotech stocks. Although such skeptics remain in the minority, the spectacular performance of biotechnology stocks is undeniable. During the past year, the NASDAQ Biotechnology Index has soared 60 percent, nearly double the gains in the broader market. While concerns of a biotech bubble may be premature, sustaining such extraordinary growth will be a formidable challenge for the industry.

Demographically Driven Demand – The continued aging of the Baby Boomer generation will invariably increase the demand for medications and devices. Biotech companies that can deliver products and services that either extend life or improve the quality of one’s later years will enjoy an immediate and growing customer base.

Legislative Environment – Although the American Affordable Care Act is the law of the land, the legislation’s ultimate impact on the biotech sector remains unclear. Increased access to healthcare and prescription drug coverage promises to spur additional demand for biotechnology products. On the other hand, an emphasis on evidence-based medicine may increase pressure on biotech firms to demonstrate that their products are not only safe and effective, but also offer comparative advantages over existing treatments.

Continued Globalization – The U.S. is the world’s undisputed epicenter of biotechnology. Globalization will create opportunity for domestic companies to enter new markets. At the same time, the growth of foreign biotechnology clusters in places such as India, Israel and Singapore also suggests that American firms will face increased competition.

(Another) Imminent Patent Cliff – During the next two years, patents will expire on drugs that currently have combined sales of $100 billion. Although the loss of patent protection on blockbuster drugs may dampen the cash flow of big pharmaceutical companies, it may also lead to increased acquisition of smaller biotech firms as larger companies look to shore up their product pipeline.

Ultimately, the future of the biotechnology is extremely favorable (especially compared to the difficult environment that characterized the industry in recent years). The improved fortunes of the biotech sector will help support increased site selection activity, as companies expand operations to meet growth and pursue new innovations.