Every energy generation, transmission and distribution utility is already being influenced by the challenges of a changing climate. However, it is not too late for companies and utilities to recognize these challenges as opportunities to cost-effectively adapt, build market resilience and grow advantage.

Having worked on the leading edge of applied climate adaptation for over 10 years, the focus on business adaptation has definitely accelerated in recent years. Government was an early leader but now the utility and private sector are seeing the impacts hitting their bottom line from extreme climatic events.

The United Nations International Strategy for Disaster Reduction (UNISDR) highlights that natural disasters since 2000 have caused over USD$1.3 trillion in damages, affected 2.7 billion people and killed 1.1 million people. These disasters have a significant impact on energy utility businesses around the world through direct damages, loss of productivity and supply chain failure.

"Dealing with climate change is now a cost of doing business," said Tom Carnac, president of the Carbon Disclosure Project in North America. "Making investments in climate-change-related resilience planning both in their own operations and in the supply chain has become crucial for all corporations to manage this increasing risk."

The 2014 Carbon Disclosure Report included 60 companies that described the current and potential future climate risks and their associated costs. Highlights from the utility companies’ disclosures to their investors between 2011 and 2013 include:

-

Sempra Energy disclosed costs exceeding its $1.1 billion of liability insurance coverage due to wildfires in San Diego;

-

Consolidated Edison, Inc. disclosed costs related to Superstorm Sandy at over $431 million1.

Understanding a utility company’s priority climatic risks is critical for cost-effective improvements to resilience and is meriting executive management and board attention. For example, several utilities in USA, Canada and Australia have developed regulatory submissions for integrating climatic risks into energy pricing, capital and operational expenditure planning plans. These companies have argued that hardening critical energy infrastructure now will save significant tax payer costs and disruption when extreme weather events occur.

In the case of the Australian electricity transmission and distribution companies, more than half the businesses submitted a case for incorporating climatic change into their regulatory pricing review and five-year plan. Initially the Australian Energy Regulator was unsure how to respond, having never considered how to incorporate climatic risk into regulatory management of the industry.

The regulator allowed some concessions, but then began a process of extensive engagement across the industry and developed consistent guidance for how to incorporate climatic risk into future regulatory submissions. The regulator also wanted energy utilities to demonstrate that they are taking this threat seriously and are already implementing climatic risk mitigation that is within the current operational control and budget. For example, solutions that are low cost and easy to implement such as adjusting procurement specifications for substation components to better handle prolonged higher ambient temperatures.

To successfully engage with the regulator, energy utilities need to understand and clearly communicate the current and future risks as well as the range of potential risk mitigation solutions. For those solutions that require additional public funding to reduce significant risks, the business case needs to be transparent that these funds were to be used directly to address these risks. Example include the undergrounding of critical transmission lines in high wildfire danger zones or relocating a power substation that is in a storm surge exposed area.

Reducing greenhouse gases is necessary to minimize the magnitude of change to our climate, but can only go so far. Despite current efforts, the impacts of climate change will be severe and no energy utility company should consider itself immune to its consequences, even in the short term. So what can you do now?

Assess Risk

The number of extreme climatic events is increasing at a global scale, forcing multi-site energy companies in particular to respond or at least to have a considered position for increasing the climate resilience of asset and operational portfolios. All site acquisition, planning, expansion and development should factor in changing climatic conditions.

AECOM has completed more than 180 climate risk/vulnerability/adaptation assessments globally with at least 20 projects for the electric utility and energy sector and it is clear that there is not a single pathway to correctly use the climate science and support decision makers to prioritize action. The approach to recognize the climate vulnerability of a region usually applied by government is not an efficient way for electricity and gas utilities to assess the risks and opportunities, especially where utilities have been privatized.

In AECOM's experience, it has been best for energy utility clients to integrate climatic risk into existing frameworks for anticipating productivity, operational risks and opportunities for growth. This is best done at an organizational executive level first, followed by focusing in on specific sites, operations and technologies with significant risks or opportunities. Sites are usually selected for detailed analysis when they are business critical, potentially vulnerable and are assets the company expects to keep for longer than 10 years and or if expansion is planned.

Some of AECOM's utility clients have coal mine power station sites that are already being regularly impacted by flooding over the past decade but did not proceed with detailed analysis because they are already planning to divest these assets. One Managing Director for Strategy and Development for a power company AECOM was helping told the company, “These have become costly and annoying sites. These (climatic) interruptions take a toll on everybody, not just the bottom line. You can’t put a stress factor into your cost benefit analysis, but maybe you should.”

Don’t just consider short-term acute events like storms, but also understand longer-term chronic events like increases in drought frequency. One AECOM client was experiencing an unusually long and severe drought and had not joined the dots between increased distribution pole fires and drought frequency. The lack of rain meant the usual rain washing of insulators was not occurring and the dust build up was causing arcing faults and generating fires. A change in the insulator maintenance regime took a 10-fold increase in pole fires back down to an average occurrence of faults and pole fires. This was particularly important in reducing the potential for the utility network starting wildfires.

Implement the Right Solution

Implement the Right Solution

Every business is different but they all profit from making informed decisions. While you may have identified a potential risk or market opportunity, is it really worth doing anything about it right now? Understanding the cost of not adapting versus the cost of adapting is vital. It is critical to bring these decisions back to what it means to level of service requirements, productivity, regulatory compliance, license to operate, health and safety and, if applicable, profit/shareholder value.

For a global energy company, AECOM did a detailed assessment of climatic risk for three power station and transmission sites, each in a different country. Only two of these sites were identified with high to very high risks to assets, operations and business objectives. The risk to business objectives such as financial performance and environment, health and safety ended up being the strongest determinate of risk. The assessments considered current and future watershed flooding, drought, hurricanes/typhoons, dust storms, wildfire, coastal inundation, storm surge, vector borne disease and erosion.

AECOM also developed practical operational improvements (adjust maintenance regimes) and options for increased drainage, protection and technology investments. Specific buildings, storage facilities, structures and services with critical functions that needed additional protection/elevation were fed into the site master plans for asset renewal/expansion phases.

For new assets, incorporating climatic risks into their designs was the lowest cost solution. It also meant the solution to adapt could be to allow space or functionality to provide additional protection later when the engineering thresholds of design are likely to be significantly challenged.

All the solutions were evaluated against a multi-criteria analysis to highlight risk mitigations that were most effective in reducing risks, provided broader financial, social or environment benefits and the cost to implement was low to insignificant. The majority of solutions that met these criteria were implemented. The solutions with a highest potential to reduce the highest risks but were likely to have significant costs to implement were analyzed in detail using a financial cost-benefit analysis. Several solutions were identified as having an attractive return on investment while protecting site productivity.

The financial analysis of solutions has supported executive investment decisions and helped to embed climatic resilience as another tool in the executive toolbox. A changing climate is rarely the dominant factor in decision making, but it is valuable information for big investment decisions. It should be used to arm utility companies with updated continuity plans containing smart actions to prepare for and reduce damage and loss when an extreme weather event does occur.

Business Continuity Planning

Businesses continuity plans are vital to increase resilience. They need to be renewed with a strong emphasis on emerging climatic risks to sites and supply chain. Some continuity plans have gone as far as to consider implications of changing climate to electricity customer demand and preferences. For example, a power station operator in India was designed to protect the site from flooding, but a significant proportion of its customer base had damaged properties and electricity distribution assets from the flood. While not the responsibility for the power station to respond to private property being damaged, nonetheless, the company had significant profit losses from reduced demand for several months while repairs and recovery took place.

Anticipating potential impacts to customers and having contingency plans in place reduces losses. In some cases, it could also maintain or increase profits. For example, the emergence of ‘Resilience Plans and Strategies’ for cities and the essential services they depend on, like energy, is a great opportunity for utility companies to work with other public and private sector companies to reduce losses during natural disasters to the local economy and community.

To quote Ban Ki-Moon, the secretary general of the United Nations, “Economic losses from disasters are out of control and can only be reduced with collaboration with the private sector.” The market challenges ahead are well illustrated in the Maplecroft Risk Atlas that forecasts 31 percent of global economic output is to face ‘high’ or ‘extreme’ climate change risks by 20252.

To quote Ban Ki-Moon, the secretary general of the United Nations, “Economic losses from disasters are out of control and can only be reduced with collaboration with the private sector.” The market challenges ahead are well illustrated in the Maplecroft Risk Atlas that forecasts 31 percent of global economic output is to face ‘high’ or ‘extreme’ climate change risks by 20252.

Cities and national governments are rapidly realizing they need new mechanisms and partnerships to increase resilience. For example, the UN International Strategy for Disaster Reduction has a ‘Making Cities Resilient Campaign’ with over 1,700 cities signed up and actively pursuing increased resilience to natural disasters. IBM and AECOM developed a city resilience scorecard to help these and other cities quantify their progress toward resilience. For example, the scorecard evaluates the electricity, gas and fuel supply resilience for a city3.

The energy utility sector is critical to managing the extent of damage that occurs in an extreme weather event. If the energy system fails then serious cascading consequences can occur resulting in community outrage and economic losses. Every energy utility should have a plan to manage within an increasing volatile climate system.

Self-Assessment

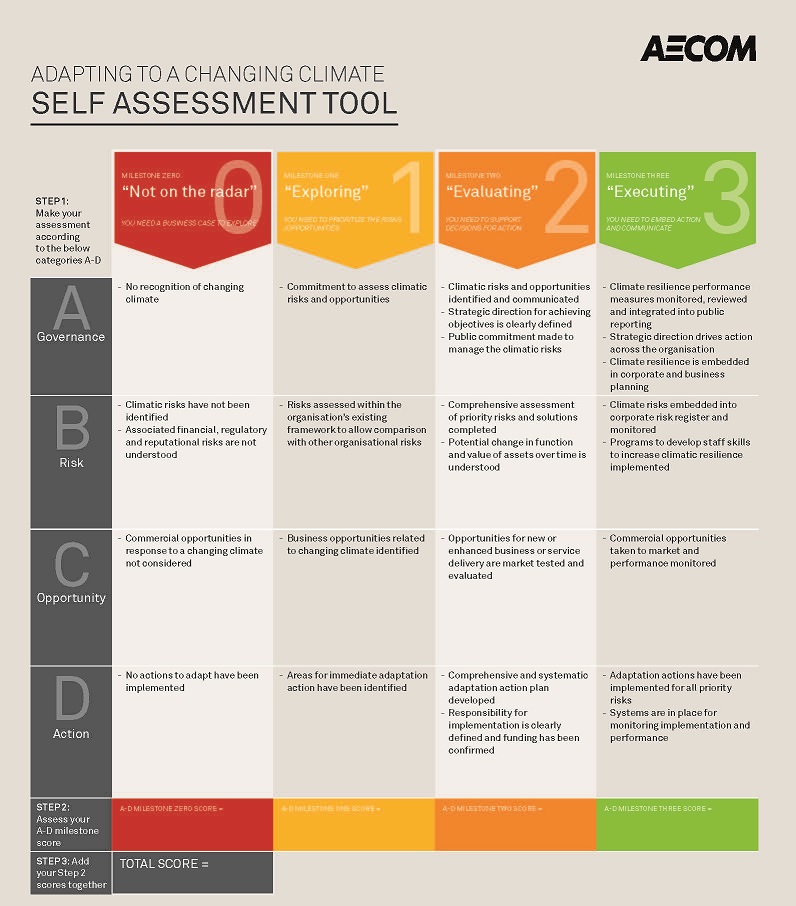

Adapting to a changing climate – how you are performing? What climate resilience performance do you want to tell investors, regulators and customers in the future? Use this Climate Resilience Self-Assessment and consider where you are now and where you want to be in the next three to five years as relevant to your own planning cycles.

_______________________________

References

1 Utility companies’ disclosures to their investors between 2011 and 2013 Cited 23/7/2014, https://www.cdp.net/CDPResults/review-2011-2013-USA-disclosures.pdf

2 Maplecroft Risk Atlas cited 23/7/2014, http://maplecroft.com/portfolio/new-analysis/2013/10/30/31-global-economic-output-forecast-face-high-or-extreme-climate-change-risks-2025-maplecroft-risk-atlas/

3 UNISDR City Disaster Resilience Scorecard, www.unisdr.org/campaign/resilientcities/about

Climate Resilience Self-Assessment ©AECOM 2014