Reshoring Trend Overview

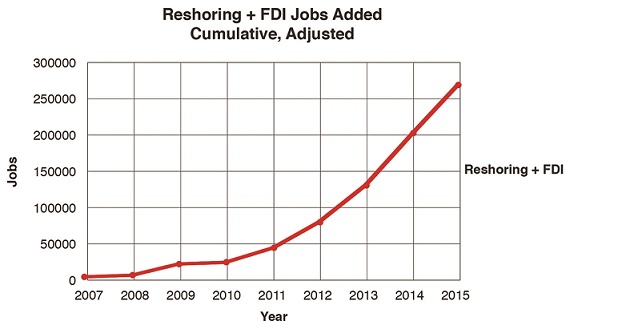

According to the Reshoring Initiative’s calculations, about 240,000 manufacturing jobs have been brought to the U.S. from offshore in the last six years. That job gain is the sum of both reshoring and FDI. The logic of local sourcing is the same for both: it achieves an average of 20-30 percent savings as a result of producing near the market versus offshore, often enough to more than balance higher labor costs, taxes, etc.

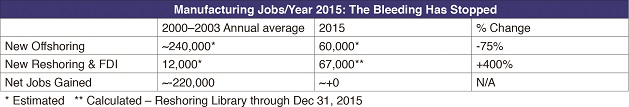

The Reshoring Initiative’s research shows the net inflow of jobs reached parity with the outflow in 2014 and 2015.

* Estimated ** Calculated – Reshoring Library through Dec 31, 2015

Most studies by Boston Consulting Group (BCG), Alix Partners and others agree that reshoring will continue to be strong in the coming years. One report by AT Kearney claimed that reshoring is subsiding. To substantiate this claim, AT Kearney primarily cited data on increased imports, which is an inaccurate measure of reshoring. Figure 2 shows the strong trend of companies choosing the U.S. over offshore production, as directly measured by reshoring and FDI data.

Challenges

Despite the progress, challenges do remain. Currently, the greatest barrier to reshoring is the strong dollar. Other obstacles include high corporate tax rate, lack of a VAT and shortages of skilled workers such as toolmakers and welders.

While these issues present challenges, they should be kept in perspective in the total cost model. In addition to quantifying the savings from producing in-market, companies can often find 10-15 percent cost improvement by investing in things like lean, automation or DFMA (Design For Manufacture and Assembly), which will often tip the scales back in favor of U.S. production.

Industry Trends

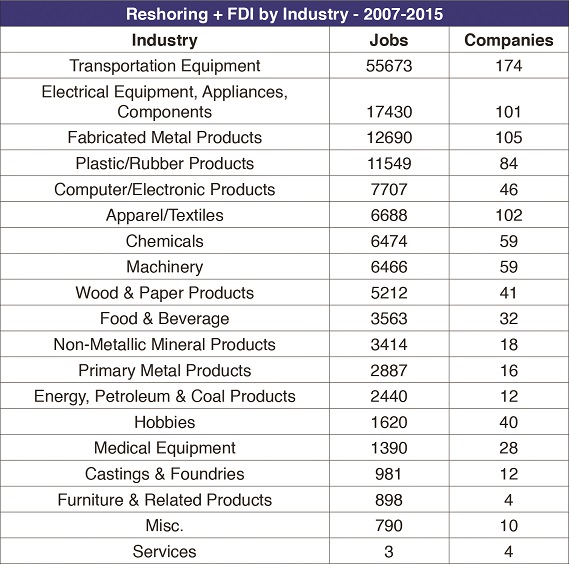

Transportation, which includes automotive, parts and aerospace, is the industry with the highest rate of combined reshoring and FDI. Figure 3 shows jobs and companies rates cases by industry.

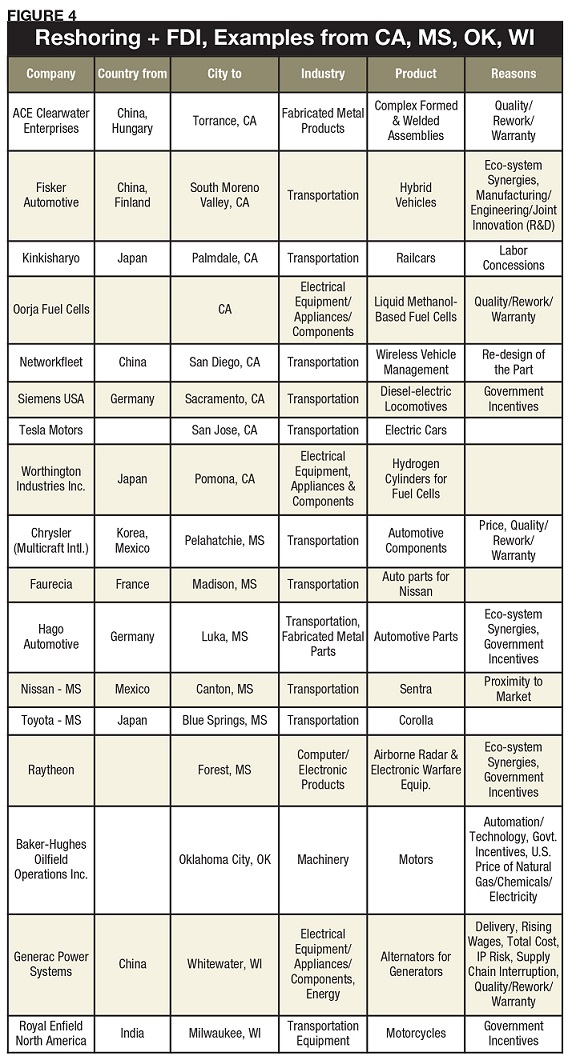

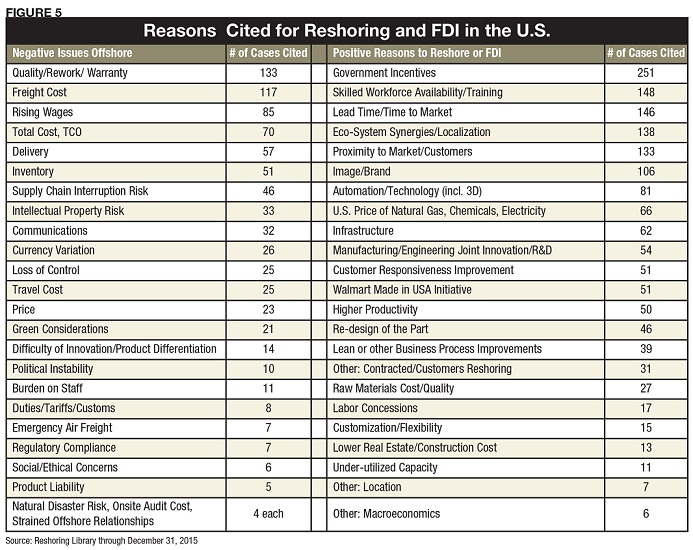

The main reasons driving U.S. reshoring and FDI are rising wages offshore and companies’ consideration of a broad range of costs, risks and strategic factors that were earlier ignored. To account for these costs, companies are using more sophisticated total cost of ownership (TCO) analysis. The list of reasons cited in actual cases of reshoring (Figure 5) identifies many of the factors included in TCO. More details can be learned about specific cases, industries or locations on the Advanced Search feature of the Reshoring Library.

It is only a matter of connecting the dots to see the potential draw of U.S. sourcing. BCG and others claim that more companies are considering U.S. production. Companies are tired of incidents like the west coast ports dispute, unstable foreign economies, political unrest and IP theft that are cutting into profits and damaging brand image. Consumers are tired of poor labor regulations, environmental abuses and unreliable quality behind their products.

Likewise, reasons in support of reshoring decisions are becoming clearer and are appealing to companies that wish to identify with social responsibility. It is reported that Millenials, who will soon hold a large portion of purchasing power, put a high value on corporate social responsibility. Even themes in the U.S. presidential primary indicate a shift to greater public intolerance of the corporate shortsightedness that often results in offshoring. Additionally, surveys indicate that consumers are willing to seek out and pay more for U.S.-made goods. The list goes on.

Ironically, it is the more qualitative factors that may become the most significant points in turning the tide to further local sourcing. The Reshoring Initiative is planning a Corporate Social Responsibility Estimator, which will measure the impact of companies’ sourcing decisions on the world environment and on the domestic economy. These two factors do not have an immediate impact on corporate costs, but result in potentially large impacts down the road. The primary point regarding the domestic economy is that businesses in the U.S. require a healthy, stable consumer market to turn a profit, and manufacturing itself is the cornerstone to such a market.

New MAPI research indicates the manufacturing jobs multiplier effect, previously believed to be an already high 1.4, is in fact closer to 3.6. Some companies, such as Walmart, recognize the dependence of a healthy middle class on manufacturing and are making front-end investments in their consumers. Walmart is the first of what will hopefully be many to follow. It has committed to sourcing an additional $250 billion of U.S.-made goods over the 10 years, ending in 2023.

The environmental benefits of local sourcing range from responsible brand image to reduced future carbon taxes to lower direct costs to, well, a clean, healthy environment.

Currently, with government incentives at the top of the reported reasons for production brought to the U.S., America is seeing strong regional support for manufacturers. As U.S. manufacturing continues to grow, the ecosystems around the companies will also be strengthened, creating a reciprocally, exponentially improved environment for existing and future investments. Supporting mechanisms like supply chains, R&D and skilled workforce will continue to improve with higher numbers of local manufacturers.

Still, if the U.S. is to see a manufacturing renaissance, corporations must take actions to support that goal. There are a number of resources available to help site selectors understand and act on trends in greater detail.

Some specific actions site selectors might take:

-

Use TCO to decide whether to site in the U.S., in North America or overseas. The Reshoring Initiative offers, free of charge, the Total Cost of Ownership Estimator®.

-

Use the Reshoring Library to locate customer companies that are bringing production to the U.S. Locate near them.

-

See where competitors are reshoring. Understand their logic.

-

Understand the impact of reshoring on the growth of the Chinese market. Chinese exports were down 20 percent in February year-on-year.

-

Anticipate reshoring’s impact on shipping: less ocean freight and coastal distribution centers, more local shipping of components and distribution from Midwestern and Southeastern factories.

-

Identify key customers or suppliers that might reshore or FDI and coordinate plans. Companies can go to:

a. Datamyne to see trends in imports

b. Local Manufacturing Extension Partnerships (MEPs) for help with competitiveness and reshoring

c. EDOs to find out about government programs and incentives.

Conclusion

When there is a choice to reshore or offshore, site selectors should look closely at all of the sector and reason trends within reshoring and use TCO analysis that captures all cost factors. The issues at hand are complex and highly interconnected. Making the right sourcing decisions requires that all players do their part and stay informed. Ultimately, the health of the domestic economy, the environment and individual corporate success will be impacted by such decisions. If corporations value a safe haven in which to function and a reliable market in which to sell, they should increase U.S. production whenever possible and seek opportunities to support a healthy consumer market that will in turn support long-term sustainability and profits.