Automation! Robotics! Driverless vehicles! Drones! When it comes to warehousing, distribution and supply chains, those are the most often heard buzzwords in the mainstream media and across industry conference agendas.

Automation! Robotics! Driverless vehicles! Drones! When it comes to warehousing, distribution and supply chains, those are the most often heard buzzwords in the mainstream media and across industry conference agendas.

With companies facing fierce competition for warehouse workers, plus rising wages in major metropolitan areas, it would seem reasonable to assume that the industry would be keeping up with—and investing in—the latest technologies and digital tools that drive greater process efficiency with fewer staffers.

To understand where the industry is headed, we started with a look back. Ten years ago, in the Warehousing Education and Research Council’s (WERC) fifth DC Measures study and report, we took an in-depth look into which technologies were most frequently implemented within operations. This year, in the 15th edition of our annual benchmarking study of key warehousing and distribution performance metrics, we revisited the topic of technology implementations, interested to see if our aforementioned assumptions proved true. Interestingly, what we found is that our field is not adopting as many digital technologies with either the speed or urgency we anticipated. More on that in a bit.

First, though, a quick overview of the findings in the 2018 DC Measures, the contents of which are intended to help warehousing managers, directors and supervisors—and their C-level bosses—compare their operations against others in the field to improve their own performance. The 2018 study received 549 individual responses, with the largest group of individual respondents reporting their title as “manager” (47.9 percent).

Among overall respondent groups, manufacturers were the largest at 28.5 percent, followed by retailers at 25.4 percent and third-party warehouse operators at 22.7 percent. (This is a shift over 2017’s report, which saw more responses from retailers and 3PLs than from manufacturers.) Of 2018’s manufacturing respondents, the largest two sub-segments make consumer products (12.7 percent) or are in general manufacturing (6.5 percent). Finally, as to what’s being picked, 66 percent report cases as opposed to pallets, and 55 percent say their customers are either end consumers or retailers.

Notably, the research team—Georgia College & State University’s Karl Manrodt, PhD, professor of Logistics and director of the Master of Logistics and Supply Chain Management Online Program, and Donnie Williams, PhD, assistant professor of Logistics/Supply Chain Management, as well as WERC Lead Researcher Joseph Tillman, founder of T-Squared Logistics—discovered that five of the Top 12 most popular metrics used focus on employees. It’s a new trend, and one that echoes the challenges warehousing operations continue to face in attracting and retaining qualified workers. The five include:

• Contract Employees to Total Workforce

• Overtime Hours to Total Hours

• Part-Time Workforce to Total Workforce

• Cross-Trained Percentage

• Annual Workforce Turnover (its first appearance in the Top 12 in six years)

People vs. Technology: Which is Key to Operational Success?

People vs. Technology: Which is Key to Operational Success?

In recent years, the DC Measures study observed a disconnect between companies stating that employees were critical, but not necessarily using employee-related metrics in their management. No longer. In 2017, 66 percent of respondents ranked people over process and technology as being of primary importance; in 2018, that number rose to 71 percent. Perhaps that’s because, as our researchers discovered, although warehousing technology continues to advance rapidly, its implementation lags behind.

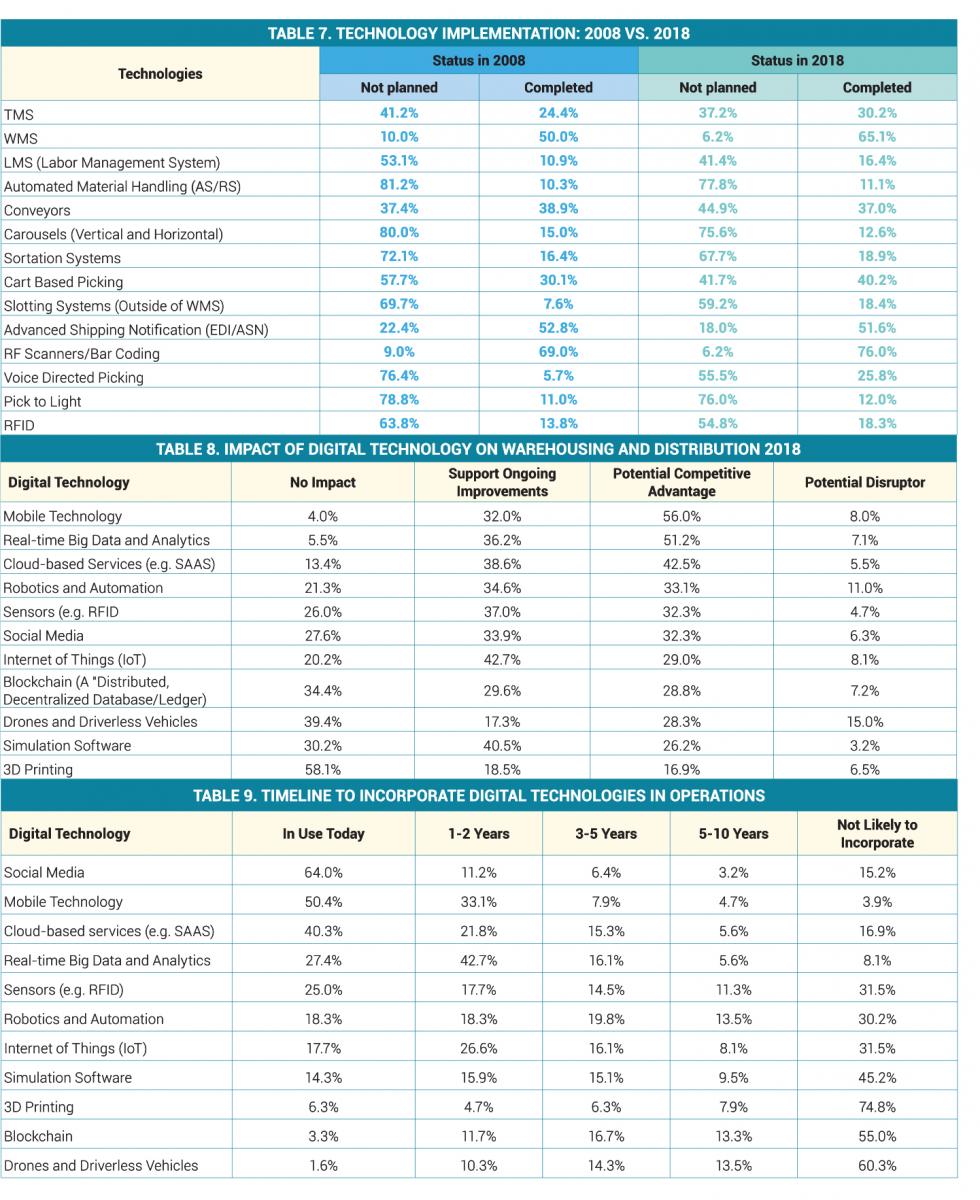

So where does our industry stand with warehouse technology implementations, in comparison to 2008?

Interestingly, among technology implementations in 2018 vs. those in 2008, the leading solution (76 percent) is radio-frequency (RF) scanners and bar-coding—two pre-digital technologies unveiled in the 1970s. Voice-directed picking has experienced the largest increase in implementations over the past decade, with usage up 353 percent. Finally, although 30 percent more facilities have implemented a warehouse management system (WMS) since 2008, about 35 percent still manage their operations manually via Excel spreadsheets or disconnected, equipment-specific inventory-management modules.

What’s notable about these findings is that although the most implemented technologies improve accuracy and efficiency, the digital supply-chain technologies making the mainstream headlines (Automation! Robotics! Driverless vehicles! Drones!) are also the ones rated highest by respondents as having potential for industry disruption. Yet, when asked about their implementation plans for these technologies, 60.3 percent say they are unlikely to incorporate driverless vehicles and drones into their operations and 30.2 percent are not planning to add robotics and automation.

Maybe that is due to companies’ continued prioritization of people as the critical link that keeps supply chains running—outweighing technology and process excellence. While facilities report sustained operational improvements, they’re clearly obtaining it through their focus on their people. A full 89 percent of respondents rank the connection between people and processes as being of primary importance to their firms over the past two years.

Further, the report finds that every operational improvement made can be attributed to efforts in improving people through better hiring and training practices, or through better processes—as companies utilize their resources more efficiently (this harkens back to the top three metrics used in 2018: Average Warehouse Capacity Used; Order Picking Accuracy; and Peak Warehouse Capacity Used).

It may even be a sign of the workforce “buyer’s market” that warehousing employees don’t report feeling threatened by the advent of digital technologies. Notably, the report cites Amazon and Radial employees interviewed by NPR who not only think automation or robots will not take their jobs, but also deny that robots can even complete the tasks they perform.

Using Mobile Technology, Social Media and the Cloud

So where does that leave warehousing and distribution in terms of adopting digital supply-chain technologies over the next 10 years? Looking ahead, the majority of respondents (50.4 percent) report using mobile technologies today. In the next 24 months, 33.1 percent say they plan to incorporate these solutions (tablets, smartphones, headsets, mobile data capture devices and augmented reality), and 56 percent say they have significant potential to provide a competitive advantage (only 3.9 percent don’t plan to incorporate mobile devices).

Also at the top of the “in use today” category of digital technologies is social media. Not even considered viable for business back in 2008, 64 percent of respondents report utilizing it to support supply-chain initiatives. And 20 percent will implement it within the next decade as a competitive advantage. How? Companies are learning how to align their supply-chain networks with the collaborative communications that social media platforms facilitate. Our researchers believe that social networking will enable companies to innovatively and efficiently establish stronger, one-to-one connections with their trading partners.

Likewise, cloud-based services (40.3 percent) and real-time big data and analytics (27.4 percent) are being used more frequently in today’s warehousing operations; in the next five years, 37.1 percent and 58.8 percent of respondents plan to implement these digital technologies, respectively. Surprisingly, 55 percent of respondents do not anticipate adding enterprise-ready blockchain digital ledgers for better visibility and security within their supply chains. Yet, with Walmart and other major corporations beginning to mandate its use, they’ll likely need to revisit that assertion.

Overall, in spite of finding a significant increase in performance among respondents across most of the measured metrics in the past decade, technology adoption has been slow while the focus on people has been strong. After 15 years of study, however, DC Measures has noted that in order to remain competitive, it is critical to integrate and improve across all three elements of success: people, process and technology.

We invite you to learn more from our research as you formulate your own best practices around warehousing operations by visiting WERC.org. T&ID