Every day, we move through a world that’s become more connected, well beyond just our computers and electronic devices. That technological movement – a.k.a. the Internet of Things - has also moved onto the factory floor. While digitization in manufacturing lagged behind other industries at first, manufacturers of all sizes are now embracing the concept of connected and seamless operations to drive productivity and efficiency while also increasing the possibilities for innovation.

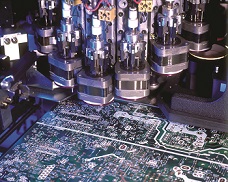

Connected hardware is making a huge impact on today’s shop floor. A new world of human-robot collaboration is bringing robots out of their cages and giving them the ability to “learn,” and work side-by-side with people. Factory automation is not only increasing productivity, but bringing with it the latest sensor technology that allows access to even more data

This isn’t just a passing industry fad, but a critical need to increase global competitiveness. Cisco estimates there are now 13 billion connected “things” that make up this Industrial Internet. Manufacturers are looking to deploy interoperable systems that can better connect workers to machines and machines to each other. Just as Big Data passes into common business lexicon, manufacturing might be seen as Even Bigger Data, as it is far and away the top industry in terms of data production. According to analysis from IDC and the McKinsey Global Institute, manufacturing stored 1,812 petabytes of data in 2010, almost double the 911 petabytes that were stored by government in the same year.

Clearly, there are benefits to manufacturers getting in on this high-tech revolution. Access to this amount of data from every facet of company operations certainly creates a wealth of opportunities, but analyzing that amount of data and finding a way to use it can be a challenge.

For many companies, especially small and medium-size businesses, moving to a more connected factory may mean a significant investment. In the economy’s current state, those smaller companies are holding back on that kind of spending, hoping for a more stable business environment.

Recovery from the Great Recession has been lengthy and at times halting for the broader economy. While manufacturing was quick to make a comeback sooner than other economic sectors, this year the industry is faced with some challenges. Low prices for oil and gas have cut both ways. On one hand, the energy industry has curbed its investment in capital manufacturing equipment due to its reduced profits. On the other, manufacturers in other industries are starting to see measureable cost savings from lower energy bills, which could encourage new equipment purchases as those savings begin to accumulate.

A stronger dollar has also meant that U.S.-made manufacturing equipment is more expensive to purchase overseas, creating a drain on exports. There has also been a noticeable reluctance from smaller manufacturers in recent months to invest in new capital equipment, perhaps a result of a continued sense of economic uncertainty.

Recent events in Greece could also have an indirect effect on the fortunes of the manufacturing economy. Long-term outcomes are still an unknown as Greece and the European Central Bank work through the details of a possible third bailout for the economically troubled country.

While these complications are problematic, there is positive news to report as well. The auto industry is turning in a strong performance, with 17 million U.S. vehicle sales predicted for 2015. The United States continues to benefit from foreign direct investment originating from overseas automakers as those companies push to make products closer to the consumer. The aerospace industry is also working its way through a large volume of aircraft orders that will keep factories humming through this year and next.

All of this means that growth in manufacturing investment will likely take a pause through the summer in part because of seasonality and in part to let the turmoil settle before companies move ahead with expansion plans. In the end, 2015 is likely to see modest growth in the manufacturing technology market, which has been forecasted since fall 2014.

Progress on Trade, Slow Going on Tax Reform

What happens or does not happen in Washington could also have an impact on investment decisions and slow down the pace of plant modernization and innovation. It was a frustrating six months for manufacturers hopeful that the new 114th Congress, led by a stronger GOP majority, would break the logjam that defined the last two Congresses.

There are a few highlights, but only a few. Most notable is the recent renewal of Trade Promotion Authority (TPA). Congress finally sent the measure to the White House after months of debate and weeks of intense negotiations. This TPA renewal is considered crucial to finalizing the trade agreements currently being negotiated with the Asia Pacific and the European Union. Its passage was a major victory for U.S. manufacturers

None of the action above brings us closer to the comprehensive tax reform package that manufacturers hoped for at the beginning of the year, but the groundwork is being laid. The Senate Finance Committee, led by Chairman Orrin Hatch (R-UT) and Ranking Member Ron Wyden (D-OR), has established working groups and heard hours of testimony. Two other Senators, Mike Lee (R-UT) and presidential candidate Marco Rubio (R-FL,) have introduced a comprehensive package that integrates the corporate and non-corporate (or pass-through) business tax system; eliminates double-taxation; and allows full expensing of capital purchases. The discussions will continue through this Congress, but any real action tax reform most likely won’t occur until after a new President and the next Congress are sworn in.

Much of the credit for the progress that has been made this year in Washington goes to manufacturers that have been vocal in the face of a frustrating legislative process in support of their industry. Their continued engagement is critical to moving the ball forward.

Author’s Note:

I’ve been a lifelong manufacturing professional, and the one message I’d like to give above all is this: In spite of the economic and policy challenges, this is one of the most exciting times I’ve seen to be involved in manufacturing. Technological innovation is happening at a rate like never before. Manufacturing is moving to a more flexible, agile and localized style of doing business that is revolutionizing the industry. While our challenges are real, our possibilities are limitless. The time we’re in now points to an impressive future ahead.