The global market for the medical device and equipment manufacturing industry, also known as Medtech, is estimated to reach $409.5 billion by 2023. Currently, the U.S. is the world’s largest medical device market, representing 40 percent of the global industry, with exports surpassing $41 billion, according to numbers from SelectUSA.

The global market for the medical device and equipment manufacturing industry, also known as Medtech, is estimated to reach $409.5 billion by 2023. Currently, the U.S. is the world’s largest medical device market, representing 40 percent of the global industry, with exports surpassing $41 billion, according to numbers from SelectUSA.

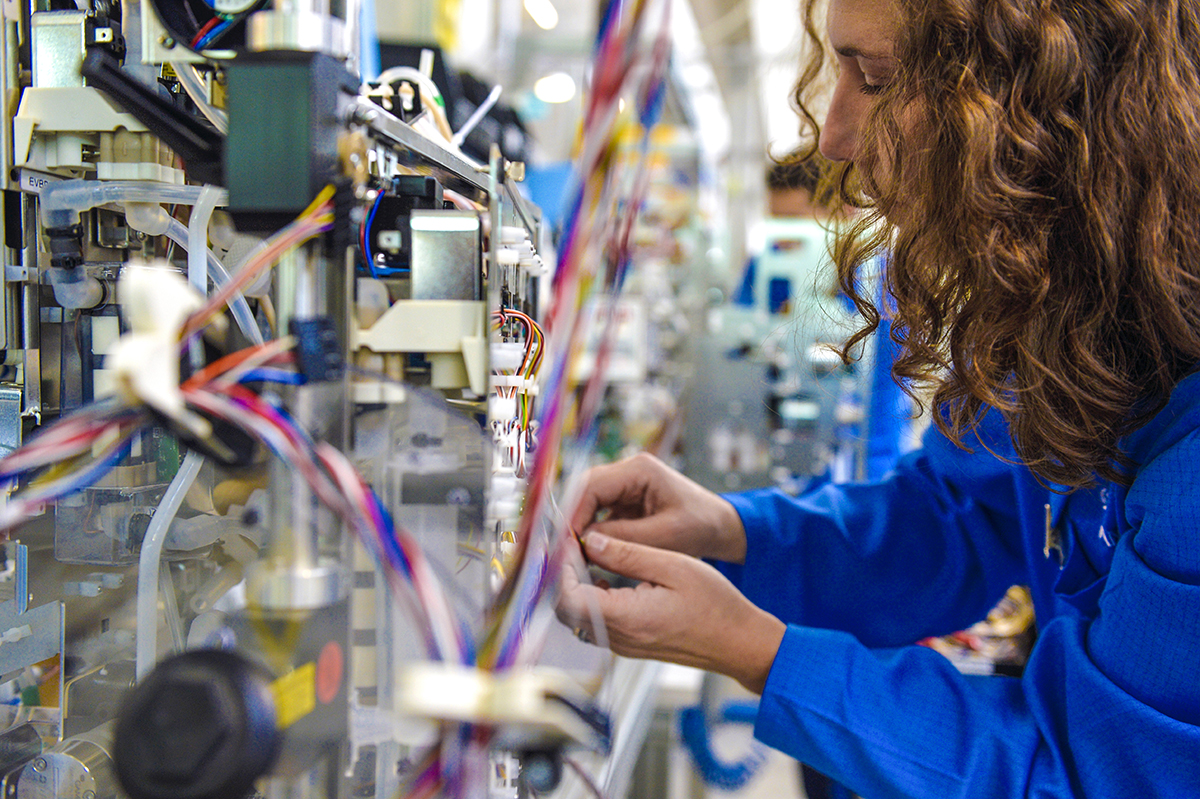

The industry consists of the designing and manufacturing of a large range of medical products that are used to diagnose, treat and monitor medical conditions and diseases. Products include medical software and in-home testing kits, and range in value from inexpensive bandages to multimillion-dollar robot surgical machines.

The medical manufacturing industry faces continual change due to tax policies, regulatory environment and technological advancements. On top of these factors, the medical products industry has faced a number of headwinds, such as healthcare reform, increased regulations and the medical device tax in the U.S. The medical device tax was originally included in the Affordable Care Act to help pay for the law’s health insurance subsidies. Fortunately for medical device companies, in January 2018, President Trump signed a deal to delay the 2.3 percent tax until Jan. 1, 2020. The Medical Device Manufacturers Association is urging Congress to pass a permanent repeal of the tax this year.

Despite the challenges, the industry is expected to see continued growth due to an aging population, a culture of innovation in the industry and continued technological advancement. With these evolutions and expansions, location changes are expected to be part of the strategic choices facing corporate decision makers.

Projected Growth Accelerates Site Selection Decisions

Projected Growth Accelerates Site Selection Decisions

When site selection becomes a viable option for a medical manufacturing leadership team to evaluate, the following factors are typically the most heavily weighted variables at the end of the process. They include talent, higher educational institutions, real estate, suppliers, utilities, tax and regulatory environment, and incentives.

• Talent: Talent is often a major factor for site selection in the medical manufacturing industry. The evaluation of talent usually focuses on the quality, cost, availability and sustainability of the workforce in a geographic area. Quality is typically measured by educational attainment and concentration of labor in a marketplace. Cost is focused on the price point of specific job categories essential to a company’s operations. Availability is evaluated by examining the number of people who are currently working in an industry and the number of underemployed people in specific positions. Sustainability is measured by looking at demographical data, such as population growth, migration into the area, K-12 enrollment, industry-specific certifications issued and the number of degrees being awarded by higher educational institutions on an annual basis.

• Real Estate: Real estate is also vital to corporate decisions related to medical manufacturing facilities. Often, life sciences manufacturing and distribution facilities require unique facility design, security and operational layout to meet product quality and regulatory requirements. In addition, real estate construction and occupancy costs directly impact project and operating expenses for the healthcare industry. Many life sciences projects require new construction or significant renovations to existing buildings in order to adhere to regulations and meet their needs.

• Suppliers: The medical manufacturing supplier industry in the U.S. is typically comprised of small and medium-sized operations. The availability of a strong network of suppliers to support life sciences businesses is critical. Major players in this industry sector include Zimmer-Biomet, Roche, Eli Lilly, Johnson & Johnson, General Electric, Medtronic, Stryker and Bristol-Myers Squibb. These industry leaders rely upon suppliers from the microelectronics, telecommunications, instrumentation, biotechnology and software development sectors, among others. Collaboration and innovation by both suppliers and customers is important to ensuring mutual success.

• Tax & Regulatory Environment: Understanding the tax and regulatory environment of each site under consideration for a project is extremely important. Tax and regulatory environment issues impact operating costs for companies on a daily basis. Corporate income tax, sales and use tax, medical device tax, worker’s compensation, unemployment compensation and property taxes are all areas that must be thoroughly evaluated. In addition, the costs and timelines associated with local, state and federal regulations are also very impactful to life sciences companies. Delays in the regulatory approval process increase project and operating costs for medical manufacturing companies.

• Incentives: At the end of the site selection process when a company has narrowed their choices down to a few final locations, economic development incentives become more important. Typically, when corporate decision-makers are considering two or three final communities for a project, the quantitative and qualitative data look very similar on paper. Incentives that can lower both project and operating costs can tip the scales in favor of a particular location. Site selectors and corporate decision makers place the highest value on cash equivalent incentives. In addition, flexibility and creativity in terms of the structure of incentives for a project are rewarded in the final analysis.

Site Selection Factors in a Real-World Situation

Site Selection Factors in a Real-World Situation

To help bring the factors involved into a real-world situation, let’s consider a recent site selection project that our firm led for a client. A $14 billion merger took place when Zimmer acquired Biomet and positioned the new entity, Zimmer-Biomet, as the undisputed global leader in the musculoskeletal healthcare market. When large mergers happen, there are always redundancies that must be analyzed. Key issues such as workforce, real estate assets, suppliers and transportation costs must undergo a meticulous evaluation in order to make strategic decisions for the business. Here is what the Zimmer-Biomet team had to consider:

• Zimmer-Biomet faced several challenges and opportunities associated with the integration of the businesses.

o Merging two business cultures together to ensure a smooth transition.

o Evaluating the business climate and talent at duplicative sites.

o Communication with customers to provide them with essential information regarding how they would be supported in a going-forward basis.

o Implementing decisions in an efficient manner.

• Key considerations for the company.

o The ability to retain and attract top talent.

o Local, state and federal tax & regulatory environment.

o Implications of existing incentive agreements and the ability to secure new incentives to support capital investment and/or job creation at sites.

o Current and future value of real estate assets.

After the merger, Zimmer-Biomet announced the consolidation of operations at its facility in Palm Beach, Fla. The company created 178 new jobs, in addition to retaining 473 positions, and made a significant capital investment of $1.89 million.

Site-Selection Tips for Medical Manufacturers

Top issues such as talent, real estate, utilities, tax & regulatory environment, suppliers, higher educational institutions, and economic development incentives significantly impact where a company decides to invest capital and create jobs. It is vital for corporate decision makers to have intensive information to incorporate into the decision-making process.

Corporate decision makers regularly engage the experience of site selectors when facing a site-selection evaluation. They provide the site selectors with a set of assumptions to evaluate factors and provide guidance. Site selectors then conduct extensive research and analysis for their clients in order to recommend the best locations to grow their businesses. This is a hefty responsibility that site selectors bear.

It is also important for companies to build the right team of experts to support the project with their knowledge. This team includes both internal and external members who can address a multitude of issues, such as real estate, tax, finance, human resources and incentives that impact project and operating costs. The best location for an expansion or new facility is usually not the least expensive location. In today’s world, quality usually trumps costs, but costs cannot be so high that it is not sustainable over a 10- or 20-year period.

Exceptional communication and collaboration between internal and external team members is crucial to ensure the key project objectives are met. When life sciences companies make site location decisions, they are with long-term goals in mind due to capital investment requirements. As a result, engaging with an experienced site selector, who truly understands the importance of completing detailed analyses prior to making recommendations is in the best interest of their clients and the communities involved. T&ID

Top Seven States for Medical Manufacturers

Knowing that the U.S. is home to the world’s largest medical device market, you might be wondering which states have become leaders in catering to this industry. Here are the top seven you should get to know:

• California is known as a center of innovation in technology and medical product manufacturing. With major hubs in the Orange County, Silicon Valley, San Diego and San Francisco areas, California is unrivaled when it comes to the size of its medical manufacturing industry. California also possess world-renowned educational institutions, large venture capital funds and a plethora of life sciences companies. In addition, the state boasts some of the top talent in the world.

• New York is well positioned in terms of medical products and innovation. A couple of years ago, Gov. Andrew Cuomo announced a $650 million initiative to fuel the growth of New York’s life science cluster. The state is known for having great higher educational institutions and access to capital. New York also has had a long history of attracting highly educated people to the state.

• Pennsylvania has a strong life sciences industry sector. According to the 2017 Pennsylvania Life Sciences Economic Impact Report, the life sciences industry directly employed over 112,000 individuals in Pennsylvania and supported over 230,000 indirect jobs in the Commonwealth. The industry also generated a total of $88.5 billion for Pennsylvania’s economy. Pennsylvania is also heralded for its life sciences start-ups and higher educational institutions. The state has a long history of attracting talent to the Philadelphia region.

• Indiana is also a global leader in the medical device and diagnostics industry sector. The city of Warsaw is known as “the orthopedic capital of the world” and the Indianapolis metropolitan area is a leader in medical diagnostics and pharmaceuticals. According to BioCrossroads, in 2018 Indiana’s life sciences industry was responsible for $78 billion in “economic impact.” Indiana also benefits from the proximity to top research institutions in the Midwest.

• Massachusetts has one of the strongest medical device and diagnostics clusters in the world. The state has invested about $1 billion into the life sciences industry sector during the past decade and is home to the largest biotechnology cluster in the U.S. The Boston area is one of the most innovative areas in the country, with top educational institutions such has MIT and Harvard.

• Minnesota has long been a leader in the life sciences industry sector. Nicknamed “Medical Alley,” the state boasts many large healthcare businesses and start-ups. The Mayo Clinic and University of Minnesota have been the major drivers of the growth of the medical manufacturing industry in the state. Minnesota has also had great success in attracting top talent to the Minneapolis-St. Paul and Rochester areas.

• Florida has established itself as a true hub for the life sciences. The state is home to some of the nation’s most highly regarded research centers; more than 1,100 biotech, pharmaceutical and medical devices companies; and more than 46,000 healthcare establishments. According to Enterprise Florida, the state is ranked second among states for FDA-registered medical device manufacturing facilities. Also, more than $1 billion is invested in life-science related projects by the state’s universities each year.