The recent 2025 USA Reshoring Survey, a collaboration between the Reshoring Initiative and Regions Recruiting, confirms that the skilled labor shortage is a significant barrier to foreign direct investment (FDI) and reshoring efforts in the United States. This feedback is consistent with reports that factory startup and expansion projects in the United States have experienced delays because of difficulties in finding skilled workers.

The survey revealed game-changing priorities for America’s reindustrialization: unleash a workforce powerhouse, level the cost playing field, increase use of total cost of ownership (TCO) and prepare for geopolitical risk. The survey results will help corporate executives decide whether to reshore and help them pick the site that best addresses their priorities for successful reshoring. Corporate real estate professionals and site consultants will find useful insights for supporting reshoring opportunities.

The Annual Report and the Reshoring Survey Report

The Reshoring Initiative’s 2024 Annual Report shows detailed patterns of what companies have done under actual conditions. Survey data adds insight into motivation and potential impact under various scenarios. In this article, we will examine insights from both reports.

What the Data Tell Us

Reindustrializing America is impossible without reshoring and FDI, which require strong, effective industrial policy. The Reshoring Initiative 2024 Annual Report shows tremendous progress, but the United States must address workforce shortages and manufacturing cost disadvantages to maintain and increase this momentum.

U.S. manufacturing reshoring and FDI topped 244,000 jobs in 2024. In 2024, U.S. manufacturing reshoring and FDI remained strong, driven by companies seeking to shorten supply chains, reduce exposure to geopolitical risks and avoid costs associated with impending tariffs. In 2025, global supply chains are grappling with uncertainty. Data from the Reshoring Initiative Report and the Reshoring Survey offer timely insight into how companies are responding to the changing environment.

More than two million jobs have been announced since 2010, highlighting a long-term trend toward domestic production. The initial million jobs took 10 years to come back and were driven by a gradual recognition that numerous costs and assorted risks often outweighed the substantial differences in manufacturing costs and free on board (FOB) prices.

The accelerated rate of one million in the last four years was primarily due to the added impact of massive government funding, such as the Inflation Reduction Act of 2022 (IRA), the CHIPS and Science Act of 2022 and corporate recognition of the dramatically increasing levels of geopolitical risk in the global supply chain.

Q1 2025 job announcements are trending lower. In the first quarter of 2025, data projected a potential drop to 174,000 announced jobs for the year. As the tariffs started to firm and the economy stayed steady in the second quarter of 2025, the projection jumped to 223,000. That figure could climb rapidly if firms gain full confidence in the permanence of new tariff and industrial policies. Many large and substantial tentative announcements are contingent on clearer signals from the administration.

Workforce Development is Crucial

While manufacturing apprenticeships have increased by 83 percent over the past decade, the growing demand for skilled labor remains a major constraint to scaling reindustrialization efforts. More automation, immigration of skilled workers, recruitment and training of high school graduates will be necessary to increase output, improve competitiveness and fill the current skills gap.

Findings from the National Reshoring Survey

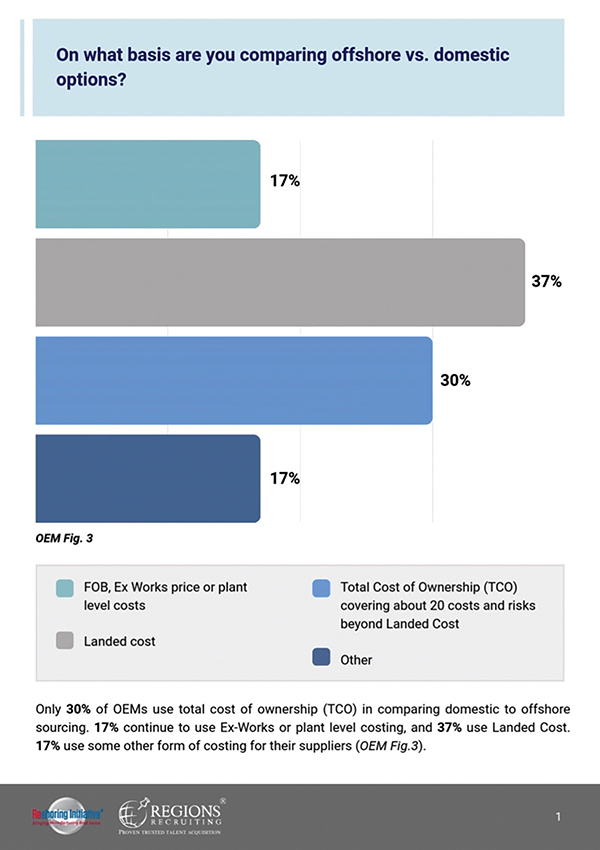

Comparing cost: shifting OEMs to TCO would reshore billions of dollars of annual production. Only 30 percent of original equipment manufacturers (OEMs) use total cost of ownership (TCO) in comparing domestic to offshore sourcing. The largest segment of OEMs use landed cost, which ignores about 15 percent of additional offshoring costs and risks as compared to TCO. Others use ex-works price, which ignores about 25 percent.

Ninety one percent of contract manufacturers (CMs) said the principal reason they lost orders to imports was price. This is consistent with OEMs’ top reason for offshoring: 69 percent said cost was their top priority.

The Reshoring Initiative’s Total Cost of Ownership (TCO) Estimator is a free online tool that helps companies account for all relevant factors, including overhead, balance sheet, risks, corporate strategy and other external and internal business considerations, to determine the true total cost of ownership.

The TCO user data shows that shifting virtually all OEMs to a robust TCO system could reshore $200 billion of manufacturing with no government subsidies, no supply chain shock, no retaliation and no impact on inflation after factoring in all global risks and costs.

CMs can use TCO to make a case with customers when competing with offshore competitors. For example, Morey Corp, an Illinois based electronics contract manufacturer, reported that TCO was the key to winning a $60 million order when competing against a lower-cost Chinese competitor.

Workforce Development

OEMs place a much higher priority on a skilled workforce than on tariffs, currency, tax rates or regulations. Given the desired workforce, OEMs would reshore 30 percent of their products currently offshored.

If 15 percent tariffs were applied to all imports from all countries, OEMs said they would bring back 23 percent of what they currently offshore. This was followed by a 15 percent reduction of the USD (21 percent), corporate tax rate cuts from 21 percent to 15 percent (18 percent) and U.S. regulations set to match those offshore (17 percent).

Thirty one percent of OEMs and 26 percent of contract manufacturers (CMs) said that deporting illegal immigrants would have a negative impact on their business, emphasizing the criticality of a robust labor force at all skill levels.

Manufacturers must also take a proactive approach by engaging with workforce development resources. Contacting their state’s department of labor can inform manufacturers of available programs and make the state aware of specific industry needs. Establishing direct communication with local school districts is essential to align educational curricula with manufacturing requirements.

Competitiveness

Forty three percent of OEMs were willing to pay 10 to 20 percent more for components if they could arrive five weeks earlier. This premium for shorter lead times points to a great opportunity for CMs.

Typical delivery time by surface freight from inland China/Asia to the Midwest is about six weeks. Presumably, the benefit comes from much smaller inventories and better availability.

OEMs place considerably more emphasis on engineering’s proximity to manufacturing (45 percent) versus CMs (22 percent). This differential suggests an opportunity for CMs: improving and promoting technical responsiveness.

Trade and Geopolitical Risks

On the possibility of China invading Taiwan, 77 percent of OEMs claim to be concerned, yet only 38 percent have worked with CMs to identify products to reshore as insurance. OEMs claim to be concerned about the issue, yet their actions with CMs do not reflect a consistent effort to find alternatives.

The best way to promote more reshoring and protect the United States from increasing geopolitical risks is to implement an effective national industrial policy. Such a policy should focus broadly on leveling the cost playing field and providing the needed quantity and quality of workforce, reducing regulations and the (now passed) retention of immediate expensing of capital investments such as automation.

Automation makes U.S. manufacturing more cost competitive, enabling more reshoring and requiring still more automation, creating a virtuous cycle.

Addressing Root Cause Problems

To achieve long-term success, the United States must confront two core challenges: a shortage of skilled labor and uncompetitive manufacturing costs.

Skilled Workforce

The United States needs a much larger workforce – approximately five million more workers — to achieve balanced trade. The workforce must be much better trained to improve quality, delivery, cost and automation.

The highest priority should be to increase recruitment and improve training of skilled trades workers: toolmakers, welders, etc., as well as engineers. Partially due to demographics, manufacturing is competing with universities and many non-manufacturing fields for recruits.

To achieve reindustrialization, manufacturing must get more and higher quality high school graduates. The Reshoring Initiative has suggested replacing the typical “college for everyone” rhetoric on government websites with “a good career for everyone” mindset.

High Payback Solutions

- Share with students that the average income for apprentice graduates is roughly equal to Bachelor’s degree graduates.

- Make student loans more available for fields with shortages such as engineering.

- Develop an apprenticeship loan program.

- Enable the Small Business Administration to guarantee $250,000 loans to finance automation for each apprentice a company hires. The idea makes it more appealing for a company to take a business risk to automate and train to become competitive, the worker gets a good career and the national workforce is improved.

Manufacturing Cost Competitiveness

The driving force of offshoring has been the reality that U.S. manufacturing costs are 10 to 50 percent higher than in almost all competitor countries. To address this, a targeted revaluation of the U.S. dollar would improve cost competitiveness and drive both reshoring and more exports.

If tariffs are used, they must be comprehensive: applied to all countries to avoid loopholes like transshipment for tariff avoidance. The Reshoring Initiative would prefer to see a more modest 10 to 15 percent tariff instituted on a long-term basis such as 10 years so that companies feel more confident making investments.

A better plan would incorporate a Value-Added Tax (VAT) and encourage the use of the total cost of ownership (TCO) metrics, mitigating the need for tariffs altogether and supporting smarter decision-making.

Investing in automation is a critical element in any reshoring strategy but not a panacea. U.S. productivity growth has stalled at zero percent for 15 years, compared to China’s six percent annual improvement.

Are You Thinking About Reshoring?

The Reshoring Initiative encourages companies to implement the top priorities for reindustrialization revealed by the survey — build a strong talent pipeline, use total cost of ownership and prepare for geopolitical risk. T&ID