New research by market intelligence specialist Interact Analysis has revealed that the manufacturing sector shows stagnant growth with little evidence of improvement since Q1. The findings have been released as part of a recent update to the company’s Manufacturing Industry Output Tracker (MIO Tracker).

Low levels of growth and a lack of investment is likely due to uncertainty about rapidly changing US trade policies. On the plus side, some commentators had suggested that the new tariffs would cause a bad recession and this clearly has not, so far, happened.

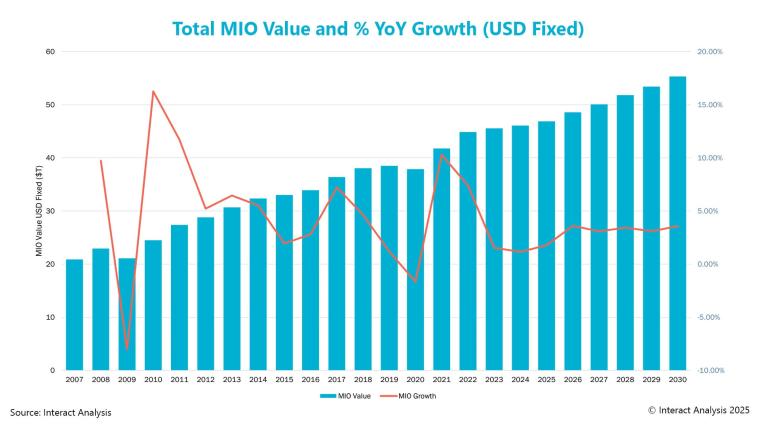

Looking forward to 2025, global manufacturing output is expected to grow by 2%. At a regional level, most of this growth will be in China and the United States, while Europe is facing a slight contraction.

Mixed picture for major manufacturing regions

Following encouraging signs at the start of the year, the overall manufacturing sector has been impacted by the uncertainty of tariffs imposed by the Trump administration in the US. While this has been a dominant factor in the potential growth of the manufacturing sector globally, each of the three major economic regions has performed differently. In Europe, the industrial powerhouses – Germany, France, the UK and Italy – face stagnation. However, smaller European manufacturing economies, including Poland, Spain and the Czech Republic, are on the rise and projected to gain market share through to the early 2030s.

Meanwhile, larger economies and well-established semiconductor hubs in the APAC regions are well positioned for robust growth underpinned by AI-driven investment and geopolitical diversification.

The outlook for the manufacturing sector in the Americas is directly linked to the health of the US economy, which at present remains uncertain. That being said, there’s a rise in nearshoring investments which could be a strong manufacturing growth opportunity.

Destocking and US tariffs impact the global machinery sector

Two key factors are currently weighing on the world’s machinery sector. Elevated interest rates in recent years have dampened machinery production, leading to excess inventory. This has led to a subsequent period of destocking, which is now coming to an end but has slowed down output. If destocking wasn’t an issue, recent interest rate falls might have supported a strong rebound of the machinery sector.

The most recent and obvious factor weighing on the machinery sector is the introduction of US President Trump’s tariffs, as they’ve put an abrupt stop to any potential recovery of the machinery sector. Anticipated capital expenditure has been paused for the time because of uncertainty around changing tariffs. There was a small spike in machinery orders due to machine buyers placing orders before tariff deadlines. However, it’s expected that after tariffs are implemented, there’s a high chance of new orders declining, pushing down production.

Commenting on the latest results, Jack Loughney, Lead Analyst for the MIO Tracker at Interact Analysis, said: “The economic uncertainty caused by tariffs has put a dampener on what could’ve been a good year for the global manufacturing. Despite this, we still expect 2.1% growth in 2025.”

There are no comments

Please login to post comments