The West Coast port slowdown highlights much cost, risk and strategic factors that must be assessed when considering business site selection, expansion and relocation. The objective of this article is to demonstrate for the site selector the use of Total Cost of Ownership (TCO) of offshore vs. domestic production and sourcing, to quantify or eliminate risks such as the ports dispute.

Applying Total Cost of Ownership (TCO) - The many inherent risks of importing can be minimized or eliminated by producing and sourcing more domestically and replacing imported goods with domestically produced goods.

Total Cost of Ownership analysis is the first step in determining true risk impact of offshored production and the feasibility of reshoring. TCO is defined as the total of all relevant costs associated with making or sourcing a product domestically or offshore. TCO quantifies and forecasts current period costs and best estimates of relevant future costs, risks and strategic impacts. TCO helps in two ways. First, it quantifies the risks of offshoring, e.g., the ports dispute. Second, it evaluates if the manufacturing cost gap is now small enough to be offset by other factors, making reshoring feasible, thus eliminating the risk of offshoring.

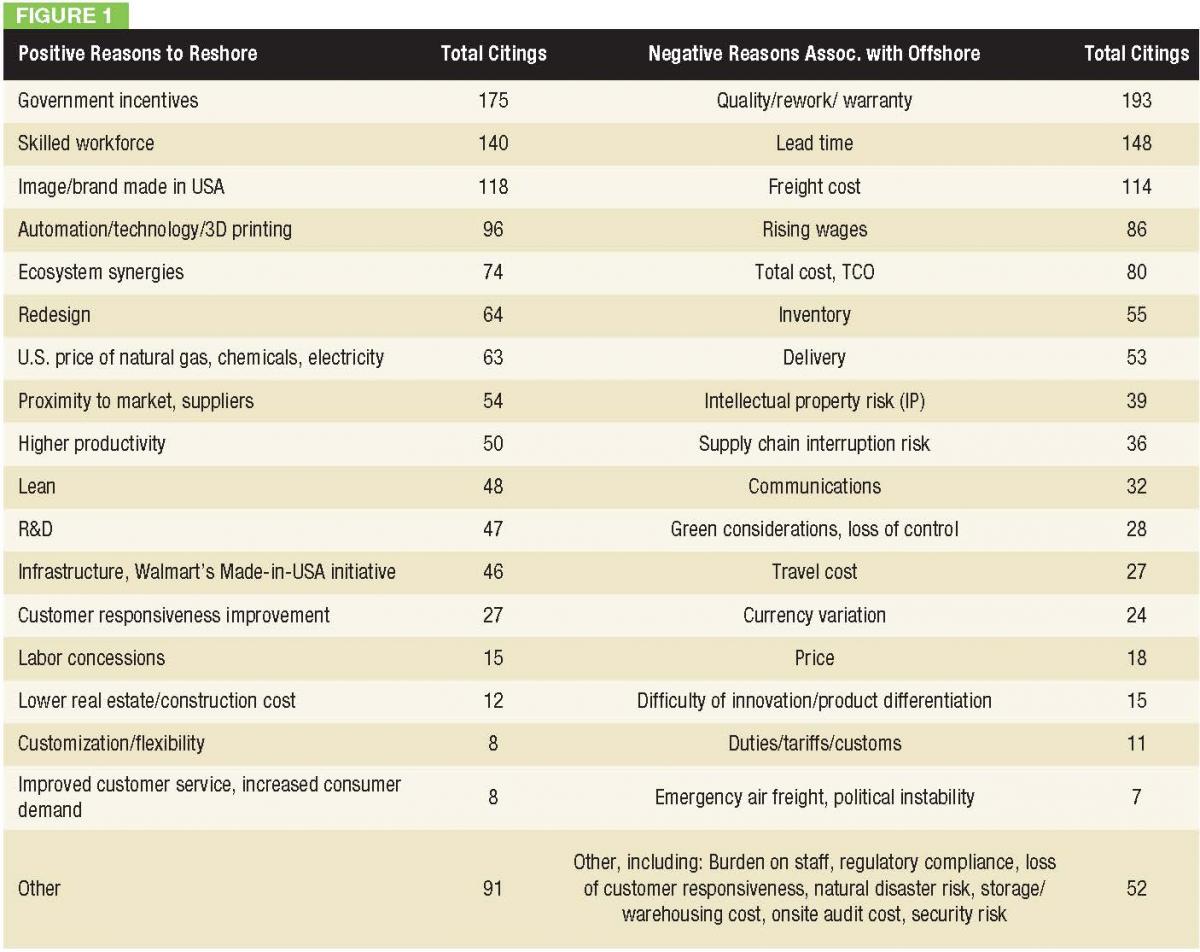

Most of the reasons cited in documented cases of reshoring are manifestations of lack of proximity. See Figure 1.

Reshoring Update - Available data show that OEMs, suppliers, distributors and retailers can increase profitability on 25 percent of what was offshored by bringing it back. The rate of recognition of reshoring opportunities is enhanced by companies starting to realize they offshored without accurately quantifying all of the hidden costs and risks associated with offshoring.

Increasingly, the labor cost gap is closing due to sharply rising wages overseas, especially in China. These changes are giving companies the opportunity to shed offshore risks while maintaining at least equal profitability by sourcing domestically.

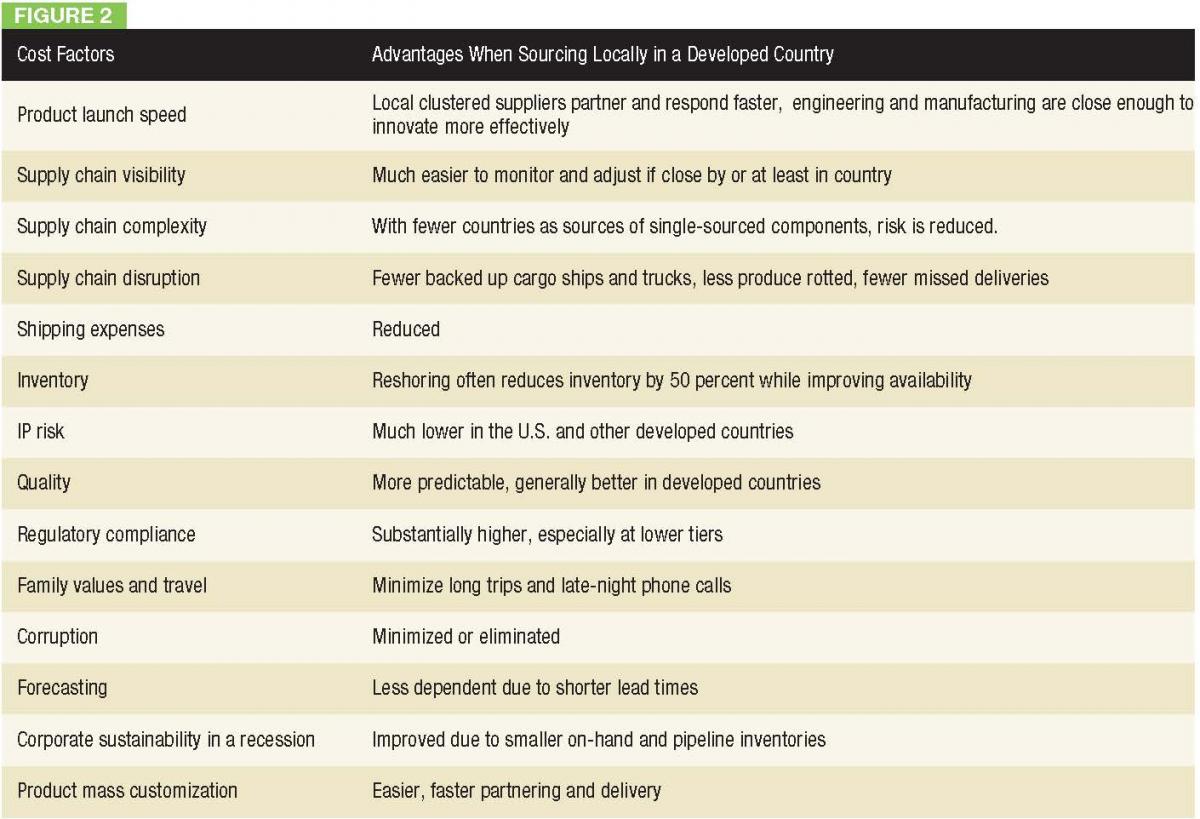

Manufacturing near customers improves innovation and responsiveness to customers’ changing needs while reducing a number of costs. Figure 2 shows import-related costs and how local sourcing in a developed country would mitigate each.

The advantages stated in Figure 2 can be used to reevaluate offshoring and see if the overhead, risk and strategic benefits of reshoring offset the typically higher domestic cost of goods sold. Once all direct TCO factors are accounted for, externalities, incentives and forecasts can be considered.

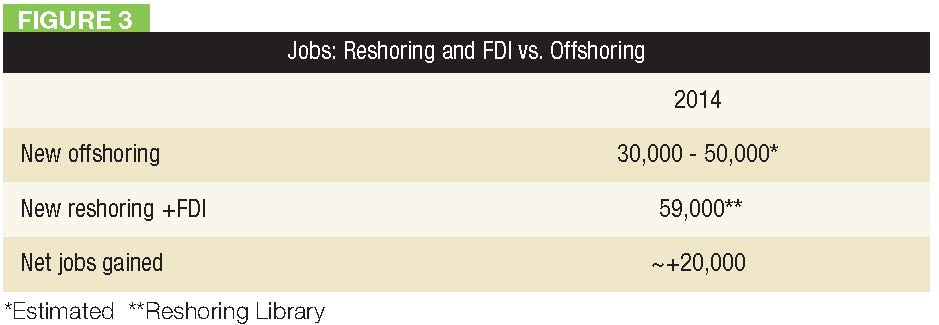

Manufacturing resurgence getting started - Prospects for U.S. industrial growth look good, with manufacturing employment above the regression line forecast based on the last 15 years, even if the years of recession are left out of the basis for the calculation. Reshoring, FDI (Foreign Direct Investment) and organic growth are now more than offsetting the negative employment impacts of offshoring and productivity. Figure 3 shows the impact of reshoring and FDI vs. offshoring.

Most commentators expect a trend toward more automation/advanced manufacturing, a higher mix of high-tech products and substantially fewer manufacturing employees, mostly “rocket scientists.” We agree with automation/advanced manufacturing, but are not convinced by the other two trends.

1. Automation: Clearly, most work that is in a huge, high-wage market must increasingly be automated or it will be lost either to low-wage countries or to high-skill, high-wage countries such as Germany.

2. High-tech products: The U.S. must balance its trade deficit. Most products are not high-tech. The rest of the world also wants to make high-tech. Conclusion: the majority of products we produce must be low to medium tech.

3. Fewer manufacturing employees: Balancing the trade deficit by reshoring and FDI will increase output by about 25 percent, which, combined with economic growth, should be enough to allow manufacturing employment growth despite automation.

4. Rocket scientist manufacturers: We do a poor job of recruiting and training them. We are getting better, but are still far below the German and Swiss best practice. We must employ many average workers or the economy collapses

5. Conclusion: The challenge will be to find a way to integrate flexible automation with average, but better-trained workers to make low/medium-tech products competitively. The Baxter robot is a good example of a solution.

Walmart - The feasibility and momentum of the reshoring trend is highlighted by Walmart’s initiative to supply its customers with $250 billion more made-in-USA goods over the 10 years ending with 2022. This particular reshoring commitment is the biggest opportunity one company has provided to U.S. manufacturing. In the 10th year of Walmart’s program, it will be buying $50 billion more U.S. products per year, generating, by our estimate, about 300,000 additional manufacturing jobs (by Boston Consulting Group’s estimate, 1,000,000 total jobs). Companies with Made-in-USA products to offer can get started at http://engage.walmart-jump.com/.

Get help reshoring and competing with imports - States are promoting reshoring. The Reshoring Initiative is working with Pennsylvania and Mississippi by organizing MEPs (Manufacturing Extension Partnerships) and others to help local companies understand they can economically manufacture or source more here. The programs promote an industry effort to identifying the companies from which suppliers lost orders for components, tooling, products, material or capital equipment because the company offshored production or sourcing. The teams will approach these companies and show them that if they use TCO for sourcing decisions, they can often eliminate their issues of quality, delivery, too much inventory, etc., and be more profitable by producing and sourcing locally. This kind of program is relatively easy to implement and should be adopted by communities and states nationwide. To participate, visit MS or PA reshoring.

Impact on freight transport - CFIRE - Site selection is heavily influenced by freight capabilities.Reshoring will impact freight patterns with fewer shipments from ports and more shipment from U.S. factories. The Reshoring Initiative is advising and assisting a Department of Transportation-funded project to forecast the impact of reshoring on freight infrastructure requirements. The project is managed by CFIRE at the University of Wisconsin-Madison.

Skilled workforce - Increasingly, availability of a skilled manufacturing workforce is the highest and toughest criterion in site selection, including the decision of whether or not to reshore. President Obama has been more supportive of the skilled workforce than have other recent presidents. He has promoted credentialing, apprenticeships and community college training. A good metric for skilled workforce availability is the number of certificates awarded per year in each state, for example those awarded by NIMS (National Institute for Metalworking Skills) and by MSSC (Manufacturing Skill Standards Council). The top states are, alphabetically: Florida, Illinois, Indiana, Pennsylvania and South Carolina.

Conclusion - Reshoring and FDI are growing from a solid base and now more than offset new offshoring. Companies are beginning to realize that the total cost of offshoring is often higher, including the impact of supply chain risk as we have seen with the West Coast ports dispute. Companies can find opportunities to mitigate risk and increase profitability by using TCO-based sourcing metrics.While the pain of the ports dispute is tangible, try TCO analysis to reduce your exposure to future supply chain disruption.

[1] http://www.npr.org/2015/02/26/389177391/west-coast-ports-dispute-caused-collateral-damage-labor-secretary-says