In the fabricated metals industry, while there are several major players in the U.S. and around the world, small to mid-size companies tend to dominate the sector. Fabricated metals companies transform metals into intermediate or end products. Production processes involve forging, stamping, bending, forming, welding or assembly, or a combination of these processes.

In the fabricated metals industry, while there are several major players in the U.S. and around the world, small to mid-size companies tend to dominate the sector. Fabricated metals companies transform metals into intermediate or end products. Production processes involve forging, stamping, bending, forming, welding or assembly, or a combination of these processes.

In the U.S. there are an estimated 51,000 metal fabricators. Examples of the many small to mid-size companies in this field include Mayville Engineering (tube/pipe fabricating in Mayville, Wis.), TMCO (structured steel in Lincoln, Neb.), AOC Metal Works (Chester, Va.), Special Products and Manufacturing (sheet metal in Rockwall, Texas) and Farris Fab & Machine (plate in Cherryville, N.C.).

Among the major players are Alleghany Industries, Precision Cast Parts, Valmont Industries, Flowserve, Mueller, Ball Corp., Schaeffler (Germany), Toyo (Japan), Canam Group (Canada) and China Synergy Group (China). The NAICS classification for this manufacturing sector is 332.

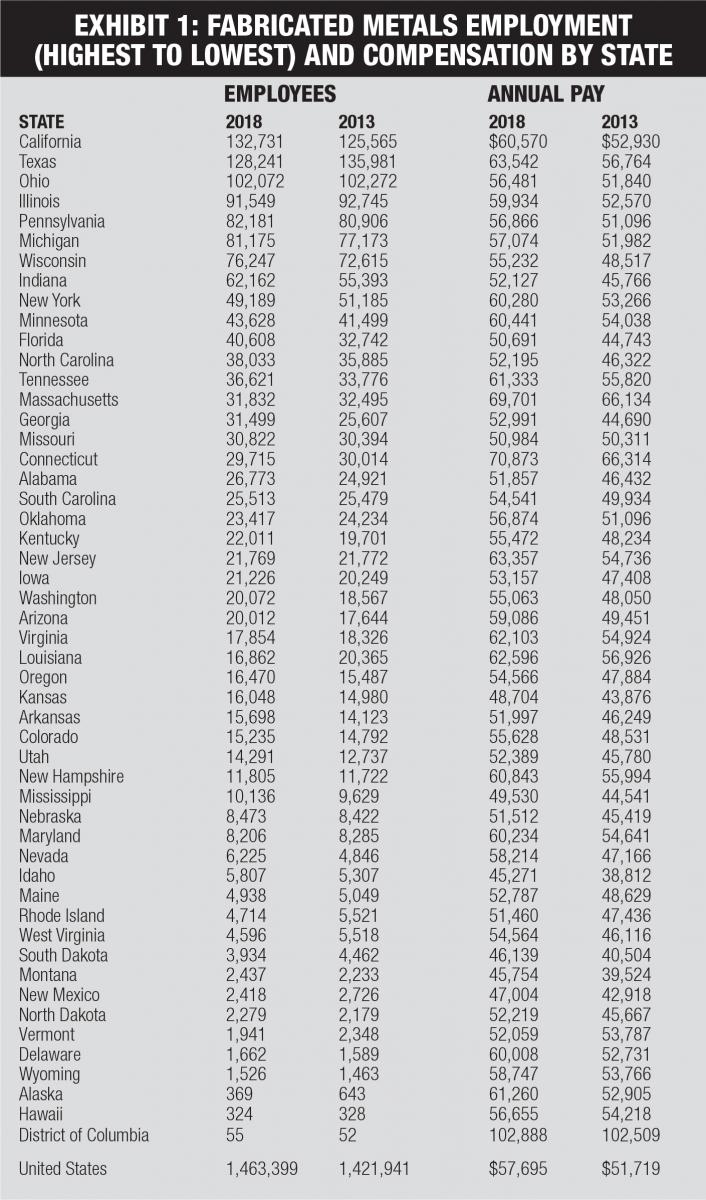

The industry employs almost 1.5 million people in the U.S. Despite significant automation, this represents a five-year increase of more than 3 percent. Average compensation for industry workers is approximately $58,000. This is up by 11 percent over the preceding five years. Non-supervisory production workers earn an average of $44,700 ($21.48/hour) exclusive of overtime, shift premium or pay for performance. On balance, this is a well-paying manufacturing industry.

Major economic sectors that consume fabricated metal products include energy, transportation equipment, agriculture, non-residential construction, health care and infrastructure.

Industry Trends

Industry Trends

Sales closely track GDP and capital spending. Hence, the fabricated metals industry has been on a solid upward revenue trajectory over the past 10 years. Annual sales volume increases have been averaging over 3 percent. Last year, the global market for fabricated metals was approximately $21.5 billion. It is forecast to reach $24 billion by the end of 2024.

Metal fabricators have been expanding despite headwinds, including trade/tariff wars, fluctuating steel/aluminum prices, lower rate of growth in China, downsizing by some auto companies and severe labor shortages. The recent trade accord signed by the U.S. and China will be a welcomed relief. This will improve both the import and export situations for fabricated metals producers.

A healthy U.S. economy and strong demand from emerging economies (especially Asia and Africa) are also positives. Reshoring manufacturing also has and will continue to play a modest role in shoring up demand.

A mega trend within the industry is the embracing of automation. Companies have heavily invested in technology for several reasons, such as increased efficiency and productivity, better quality and less reliance on direct (and indirect) labor.

Technological advances prevalent in the metal fab industry have embraced robotics, artificial intelligence, 3-D manufacturing and the Internet of Things (IOT). An example is Noble Industries, located in Noblesville, Ind., which utilizes the latest technology to make custom metal parts and has achieved ISO 9001 certification.

Automation has reduced the number of unskilled positions required on the factory floor. But it has also necessitated an upskilling for both existing workers and new hires. Nearly all positions need to be filled by workers with strong foundational skills including math, data interpretation, software familiarity (e.g., enterprise planning) and collaboration.

Critical positions within the metalworking/fabricating industry include:

• CNC Machine Programmer

• CNC Machine Operations

• Machine Maintenance

• Welding

• Data Scientist

• Mechanical Engineering

• Manufacturing Engineer

• Process Engineers

• Quality Control

• Business Process Management

• Manufacturing Execution System (MES)

• Engineering Lithium Experts

• Network Technicians

These skills will be difficult to find irrespective of location. But, there are indeed differences among locations. Whether expanding at an existing site or choosing a location for new facilities, there are several tactical measures metal fab companies need to consider for enhancing recruitment/retention of top-flight talent. Among these are:

• Market competitive compensation

• Starting salary

• Wage progression

• Pay for performance

• Steady as opposed to rotating shifts

• Voluntary as opposed to mandatory overtime

• Significant investment in training

• Market competitive fringe benefits (especially offsetting a high percentage of premium and requiring only a

modest deductible)

• Partnerships with local technical schools and community colleges

• Participation in programs promoting manufacturing as a career

• Social media branding and recruiting

• Civic involvement/corporate giving (part of brand recognition)

• Flexible time off policies

• Full tuition reimbursement

• Career advancement tracks

• Strong supervisory development program (technical and soft skills)

• Greater reliance on women and veterans

• Formal apprenticeship and internship programs (start at the High School level)

• Possibly retention bonuses for new hires (6 and 12 months)

• For certain skills, subsidizing moving expenses to relocate skilled workers

• Signing bonuses for critical positions

• Attractive internal work environment

In other words, successful staffing requires a holistic approach toward human resources. This goes well beyond compensation.

Geographic Concentration

As many fabricated metals companies have a significant proportion of customers within reasonable proximity (often one- or two-day delivery by truck), it is not surprising to find that states with the greatest industry presence tend to be in these regions. The top 10 producing states are:

1. California

2. Texas

3. Ohio

4. Illinois

5. Pennsylvania

6. Michigan

7. Wisconsin

8. Indiana

9. New York

10. Minnesota

States with moderate but relatively fast-growing employment bases include Florida, Georgia, Kentucky, Arizona and Utah. All these states are well-positioned relative to growing regional customer clusters in one or more of the consuming industry sectors.

Keys to Successful Site Selection

A structured, metric-driven approach should be followed to ensure that a new location will maximize success of the subject business. The process unfolds in several phases.

Phase 1: The Building Blocks

In this phase, sometimes referred to as discovery, the study’s foundation and framework are defined. It’s important to outline what is driving the need for a new (or expanded) operation and what business objectives will be realized from establishing the proposed entity. The analysis and result must be in total alignment with drivers/objectives.

For instance, let’s say that finding labor to support expansion of the physical footprint represents a cornerstone objective. Your team has stated that an available building is a must, and your study identifies a community that meets all the key requirements—except for an available building. But you discover that an attractive property is on the market 20 miles away. However, that would place the operation in a different labor market (the 30-minute commute shed for hourly workers could be significantly different 20 miles from the optimal location). Competitive demand could be greater and supply of requisite skills much thinner.

Consequently, long-range success is jeopardized by opting for a faster and less costly solution to launch new production. In the end, the business will likely pay a price far greater than the savings from a more expeditious real estate solution.

In this hypothetical case, fast-track construction and creative financing could likely lessen the gap between available building and build-to-suit. Moreover, build-to-suit would ensure maximum production efficiency.

After drivers/objectives, the next challenge is to delineate start-up and future operating requirements. These entail:

• Headcount

• Number by skill level

• Percentage that can be qualified entry level vs. experienced

• Characteristics of the ideal hire

• Off-shift staffing

• Maximum acceptable turnover

• Budgeted compensation

• Start and mature rates, by position

• Reliance on incentive compensation

• Shift premiums

• Site/building

• Size

• Characteristics

• Machinery and equipment investment

• Utilities

• Power

• Gas

• Water

• Sewer

• Redundancy

• Green energy

• Raw materials

• Sources

• Shipment mode

• Transportation

• Motor carrier

• TL

• LTL

• Rail

• Air

• Passenger

• Cargo

• Seaport

• Small package

• Environmental

• Air

• Water

• Noise

• Vibration

• Hazardous waste

• Storage

• Disposal

• Scrap disposal/purchase

• Vendor support

The project team then needs to place relative weights on various criteria. First, delineate the boundaries of factor categories such as labor market, customer proximity and site/building. Then, place individual factors (e.g., skilled labor availability, percentage of customers that must be served by next-day delivery and site dimensions) into the major groupings. Assign relative weights to each grouping and individual factor.

Additional fundamentals that need to be agreed upon involve:

• Ideal and latest start date for the new operation

• Geographic search region (e.g., entire U.S. or selected states?)

• Desirability of being located near competitors

• Permits that could be challenging for approval

• Tolerance for natural disaster risk

• Time zone preference

• Inter-plant shipments

A milestone timeline should be created with key dates and responsibilities. Checkpoints should also be injected into the timeline. Once this baseline information has been agreed to, the location analysis is activated.

Phase 2: Location Screening/Create a Short List

Initially, develop a multi-round template for rejecting/retaining areas until a long list of promising areas (seven to 10) emerges. Each round would embrace statistical thresholds such as minimum population size, distance from a seaport, size of the manufacturing workforce and resident skills base (e.g., desktop research, screen locations (typically at a metro or county level), round by round.

This is a metric-driven process. For instance, if the new facility will require 25 machine operators, the screening threshold might be 625 (25:1 ratio per new hire for this skillset).

Desktop research will yield the long list. Now reach out to the lead economic development agency in each area to elicit intel (beyond stats). Issue an RFI that would seek input on considerations such as:

• Major employers, including metals manufacturing

• New/expanding employers

• Downsizing employers

• Profiles of available sites/buildings

• Electric power reliability/cost

• Water/sewer capacity

• Environmental conditions

• Market wage survey

• Technical school and community college annual grads (e.g., manufacturing technology)

• Four-year college graduates (e.g., engineering, computer science, business)

• Training programs

• Preliminary incentives

Review RFI responses (combine them with desktop results). Create a scorecard to rank the seven to 10 long-listed areas. Be sure to pay special attention to labor pool size/composition and competitive demand. The best locations will be lowest cost and highest on operational dynamics such as labor market.

This process will produce a short list of finalist locations. Typically, the short list is composed of two to four areas.

Phase 3: Location Evaluation/Boots on the Ground

Here is when the team visits each finalist location. Field investigation will enable the team to determine which location, on balance, best supports attainment of important criteria and enhances potential success from a business strategy perspective.

While in each area the team undertakes the following:

• Interviews with comparable employers. Significant emphasis should be placed on what it takes to recruit/retain requisite skillsets in sufficient numbers. The new location cannot be constrained by an existing or projected labor shortage. Also, inquire about other dynamics such as electric power reliability, truck backhaul opportunities, environmental permitting, etc.

• Interviews with other pertinent groups (e.g., utilities, site/building owners, educators, environment agencies, etc.)

• Discussions with economic development and government officials (e.g., taxation, incentives, permitting, etc.)

• Tours of available sites/buildings

• Be sure to ascertain which sub-labor market is optimal and then see if suitable properties are available in that commute shed

Post fieldwork, the team convenes to discuss the merits and drawbacks of each area. Then scorecards are refreshed and the short-list areas re-ranked. Don’t over-emphasize the value of possible incentives. The new location must be A-rated on operating conditions, especially labor. If two or more locations are similar, then incentives can help swing the ultimate decision.

Once executive management has approved the final location recommendation, due diligence needs to be undertaken. Focus on the chosen location, keeping the best alternative in the mix in case a major impediment surfaces in the top-rated area.

Phase 4: Final Due Diligence

The project team is often expanded at this point. Before committing to an area, the following need to be satisfactorily resolved.

• Final incentives negotiations

• Short list site/building negotiations

• Fast-track construction/permitting

• Utility service

• Unionization risk

• Best recruiting sources/methods

• HR practices

• Taxation

• Legal

• Environmental

• Transportation commitments

• Other considerations as appropriate

Once final due diligence is completed, a formal announcement can be made. The announcement should convey to stakeholders how the new facility supports the overall business strategy. In addition, the acceptance of incentives needs to be properly positioned. Lastly, an internal project manager will need to be appointed to coordinate all tasks necessary to get into business in the new location.

Conclusion

The fabricated metals industry is in a strong position to capitalize on growth opportunities as we head into the new decade. Barring an economic downturn, sales should continue to moderately rise both abroad and in the U.S.

The recent tariff reductions will certainly bolster growth prospects. Capacity utilization hovers around 80 percent. As that rate increases and existing sites are constrained by labor shortages, the pace of new fabricated metals plants will increase.

Of course, there will be a pause when the next economic downturn appears. When it does, companies cannot be complacent on human resources. A recession will temporarily free up available labor. But given long-term demographic trends and the ever-increasing need for highly skilled talent, labor will continue to exert substantial influence over a company’s ability to thrive in this new decade.

While there are many important factors that must be in sync (i.e., location attributes vs. operating requirements), labor will trump all considerations.

Any potential new location should be characterized by:

• Extensive pool of requisite talent in the primary commute zone (30 minutes)

• Low to moderate competitive demand (from existing and new employers)

• Demographic trends auguring well for future labor supply

• Robust education/training programs for manufacturing at area schools

• Reasonable salary levels and low probability for future wage escalation

• Low turnover

• Nonunion

Lastly, examine your company’s Human Resources policies and programs. See what the best employers are offering in the new location, and determine what it would take to earn and maintain employer-of-choice status. Then adjust your HR tactics as appropriate. T&ID

St. Mary Parish, La.:

Shaping Business in Metal Fabrication

When it comes to metal fabrication, St. Mary Parish, La., is a leader in the field. Local machine shops service and support several large industrial segments, including shipyards, oil fields and processing plants.

Shipyards in the area produce vessels of all sizes for domestic and foreign entities, including patrol ships, passenger taxis and cargo haulers, along with deep-water platform equipment and services. Large fabricators of oil field equipment include Cameron/Schlumberger (underwater fuel-gathering systems), Oceaneering (remote operating vehicles) and Intermoor (platform stabilizing systems). The process industries include carbon black producers, sugar cane processing and salt mining—all of which have needs for specialized parts manufacturing and replication.

The result has been the growth and evolution of machine shops with a high diversity of customers within the parish, nationally and internationally. As different as their clients are, so is the equipment they work, while enabling St. Mary Parish to be recognized as a leader in metal fabrication and in machining in particular. The parish has more than a dozen machine shops, from larger integrated machining, such as Cameron/Schlumberger, to many independently owned machine shops.

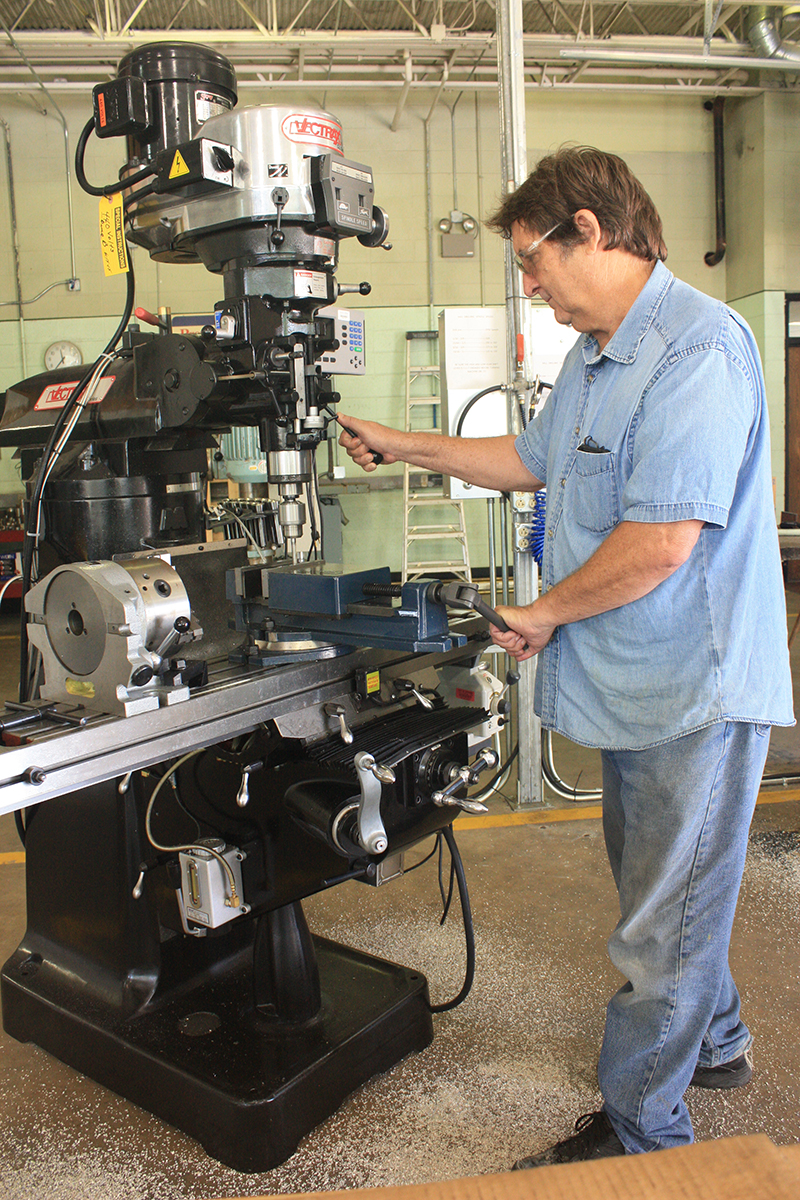

How does St. Mary Parish keep a flow of machinists entering the workforce? South Louisiana Community College in Morgan City, in conjunction with local machine shops, has developed a fundamentals of machining course. The Machine Tool Technology Program is a 12-week, 400-clock-hour program that provides a supply of workers with the basics of machining on Mechanical and CNC machines. Prospective machinists receive instructions on hand tools, measuring tools and instruments, understanding blueprints, math and construction, lathes, milling, CNC equipment and most importantly, safety. The comprehensive machining program was developed by local machinists for new workers entering the labor force. Shop equipment is also provided by the St. Mary Parish Local Machine Shops.

St. Mary Parish is driven by its manufacturing base, and a trained labor force is critical to business success.