Reshoring and FDI (foreign direct investment) surged in 2017 with 171,000 manufacturing jobs announced, up 50 percent from 2016 and 2,800 percent from 2010. The administration’s pro-business platform of lower taxes, reduced regulatory costs and the approximately nine percent decline in the USD from January 2017 to January 2018 have encouraged many companies to reevaluate their offshoring decisions.

Reshoring and FDI (foreign direct investment) surged in 2017 with 171,000 manufacturing jobs announced, up 50 percent from 2016 and 2,800 percent from 2010. The administration’s pro-business platform of lower taxes, reduced regulatory costs and the approximately nine percent decline in the USD from January 2017 to January 2018 have encouraged many companies to reevaluate their offshoring decisions.

After a strong 2016 finish, the U.S. rate of FDI, by foreign companies, and reshoring, by U.S. companies, announcements increased with an all-time high of reported jobs per month in the first quarter of 2017. The rate of job announcements was maintained throughout the year. Since 2010, rising Chinese wages, low U.S. energy costs, intellectual property concerns and advancements in technology and automation have been influencing more companies to consider U.S. manufacturing. Since November 2016, the prospect of national tax and regulatory reductions and import tariffs has accelerated the trend.

For example, Exxon Mobil announced plans in January of this year to spend $50 billion to expand its domestic operations and create thousands of jobs, citing the tax cut measure. Toyota Motor Corporation and Mazda Motor Corporation plan to establish a joint venture and invest $1.6 billion in an auto plant in Huntsville, Alabama, creating 4,000 jobs. An $850 million incentive package secured the much sought-after plant for Alabama. Apple plans, over five years, $30 billion in U.S. capital spending that is expected to create more than 20,000 jobs. The investment includes a new campus, $10 billion toward nationwide data centers and an expansion from $1 billion to $5 billion of funding for investment in advanced U.S. manufacturing.

Factors Cited for Reshoring and FDI

Understanding the reasons other companies have given for reshoring helps companies to determine whether those reasons apply to them also. The factors that influence reshoring and FDI are similar, with the following exceptions. Reshoring places a higher emphasis on Made in USA image, automation and re-design of the product.

FDI places more emphasis on government incentives and skilled workforce. Since reshoring is almost all from low-wage countries, the companies have to minimize labor cost here to enable reshoring and can provide more perceived increase in value by offering Made in USA branding. Since most FDI is primarily from other developed countries, Made in USA is a less powerful sales argument. Foreign companies that often have larger projects tend to receive the largest government incentives.

Reshoring Initiative data, collected from about 3,000 companies across the U.S. from 2007 to 2017, finds quality/rework/warranty to be the No. 1 area of dissatisfaction with offshore, about two thirds higher than No. 2, freight cost. The No. 3 area of discontent was total costs (an aggregation of all relevant costs and risks), which is consistent with previous conclusions from the Reshoring Initiative Library and TCO user databases. Companies offshored primarily to reduce their product cost, making decisions based on wage rates or ex-works price. A combination of accumulated negative offshore experiences and offshore costs rising relative to domestic costs has driven companies to reevaluate their offshoring decisions.

Most of the negative issues reported are related to distance: freight, delivery, inventory, etc. Others are country specific: rising wages, IP risk, political instability, etc. IP risk was No. 10 but still mentioned by 10 percent of the companies that reshored. Other high-ranked factors were supply chain interruption, communication and loss of control.

Reshoring BOP

BOP (Back Office Processing), e.g., HR, IT and accounting, has also been heavily offshored and is starting to trend back. The Reshoring Initiative is looking for a company to test the feasibility of such reshoring using RPA (Robotic Process Automation). Email if interested, info@reshorenow.org.

Competitiveness

Continued success of reshoring and FDI will depend on sustained government actions that increase the price competitiveness of U.S. manufacturing and on corporations implementing more rapid automation and skilled workforce training and greater use of TCO (Total Cost of Ownership) for sourcing and siting decisions.

New Technology

New technologies, including automation, robotics, advanced manufacturing and the Internet of Things, are changing the perspective of global manufacturing. Labor now represents a smaller share of total costs. As “smart factories” reduce the relative importance of wages, companies can effectively compete using automation and advanced manufacturing technologies to improve the economics of localized production. The more efficient processes, coupled with close proximity to the U.S. market, positively impact innovation, flexibility and responsiveness. Consumer demand for customization and shorter cycles is satisfied while producing higher quality products in smaller batches with reduced inventories.

Workforce Training

Workforce Training

Companies are beginning to make more investments in training. Some are partnering with organizations such as the Society of Manufacturing Engineers (SME), a nonprofit that develops specific educational programs to fit the needs of manufacturers. For example, SME’s Partnership Response in Manufacturing (PRIME) program forms a collaboration between local school districts, the manufacturer and SME to identify skill set needs and translate them into educational programs. Companies are recognizing that incorporating continuous learning into their business plans for the ongoing development of skills training and knowledge enables them to keep up with and employ technological advancements.

One way to judge skilled workforce availability is to obtain data on the local rate of credentialing by organizations such as NIMS (National Institute for Metalworking Skills), MSSC (Manufacturing Skill Standards Council) and AWS (American Welding Society).

Economic Logic

The economic logic of TCO is built around the savings achieved by producing or sourcing locally. The shrinking savings from low, but rising, offshore wages and purchase prices are increasingly offset by dozens of hidden costs. To help quantify those costs, the Reshoring Initiative website provides tools to help companies decide objectively whether or not their overhead will come down more than their manufacturing cost goes up when sourcing locally. The Total Cost of Ownership Estimator® helps companies more accurately assess the total company impact of offshoring or reshoring decisions. Recommended reading includes “Getting A Company Started with TCO” to plan TCO analysis.

Comparing Locations for Reshoring

It is essential for a company to evaluate and define its operation when launching a location search. This includes the size, requirements and location factors that are key to the success of the project. First, operational needs need to be identified. Second, the list of potential location options needs to be narrowed down to those that can meet those operational needs. Then, incentive programs at the state and local levels should be pursued.

“We get lots of inquiries, especially from foreign companies, asking where they can get the most incentives,” said Michelle Comerford, project director at Biggins Lacy Shapiro & Company, a professional site selection and incentives consulting firm. “And, it is important that we educate them to first understand location-driven cost variables and operating conditions that may impact their businesses, and evaluate those before looking into state and local incentives that might be applicable.”

For many FDI or reshoring operations, one of the most important location drivers is availability of workforce with desired skillsets to operate, maintain and repair the automated equipment that will power these new production processes.

“All the incentives in the world won’t make up for a location that doesn’t have the right type of workforce that a business needs to survive,” said Comerford. “For most of our clients today – both office and industrial operations – workforce is the most important location driver. We are employing lots of new tools and techniques to conduct very detailed analysis of labor markets to help our clients find the right pool of workers for them at startup, as well as a pipeline for the future.”

“All the incentives in the world won’t make up for a location that doesn’t have the right type of workforce that a business needs to survive,” said Comerford. “For most of our clients today – both office and industrial operations – workforce is the most important location driver. We are employing lots of new tools and techniques to conduct very detailed analysis of labor markets to help our clients find the right pool of workers for them at startup, as well as a pipeline for the future.”

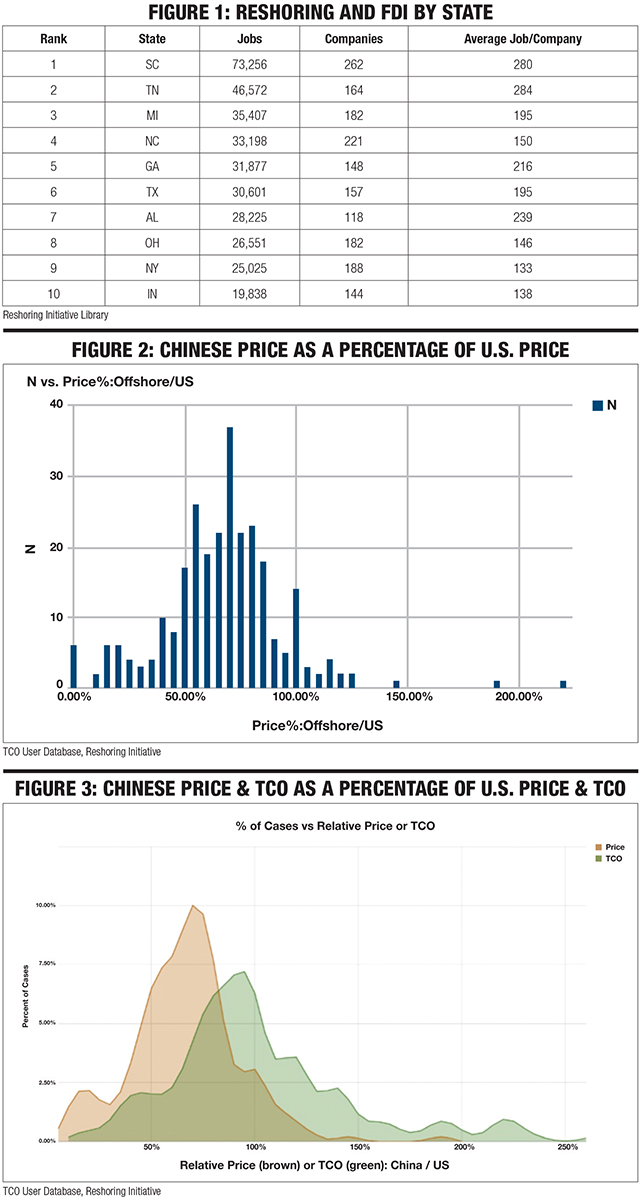

One strategy that some companies are pursuing is to consider the states that have gotten the most reshoring activity in recent years as a starting point of potential states in which to locate. [Figure 1 is a list of the top 10 states for reshoring and FDI based on data from the Reshoring Initiative Data Report.] Of course, there are many local communities within each of these states with variable labor skill availability, cost structures and business climates that will necessitate detailed analysis against a company’s operating requirements.

Offshore vs. Domestic Production

Reshoring Initiative user data shows that, under current conditions, if companies use the TCO Estimator instead of price to make their decisions, they can reshore more than 25 percent of what they have offshored and improve their profitability. The TCO Estimator typically closes a 15 to 20 percent price gap, but some companies find that the analysis is worthwhile even if the gap is as much as 50 percent.

Figures 2 and 3 compare price vs. TCO. Figure 2 shows the distribution of Chinese ex-works price as a percentage of U.S. ex-works price for a broad range of products. The mode or center for the normal distribution is about 72 percent, demonstrating that often not a lot is going to be won based on price alone. However, roughly half of the product imported from China is within 25-30 percent of the U.S. ex-works price.

Figure 3, the brown (left) curve, is based on the same data as the curve shown in Figure 2. The green curve is based on TCO, which averages about 95% of the U.S. TCO. Therefore, the U.S. goes from almost never winning on price vs. Chinese sources to winning about 40 percent of the time with TCO.

Other Tools Available

The Reshoring Initiative’s free tools and data can help companies make better sourcing decisions and sell against imports. Please visit www.reshorenow.org to:

• Calculate TCO with the free online Total Cost of Ownership Estimator®. Use for your sourcing decisions and as a sales tool against imports.

• Compete in the Second National Reshoring Award competition for parts made via metalforming, fabricating or machining.

• Submit your own reshoring case for free publicity and get a Manufacturing is Cool t-shirt , Made in U.S.A.

• Search the Reshoring Initiative Library to see which companies are reshoring. Find which of your competitors have reshored and their issues and successes. Find sales prospects committed to domestic production.

• Visit the Reshoring Initiative website and check out the e-Newsletter for important links to its current initiatives.

• Visit the BLS & Company website for free resources for reshoring companies: www.BLSstrategies.com/MadeInUSA.

• Email or call the Reshoring Initiative for advice. Info@reshorenow.org or 847-726-2975. T&ID