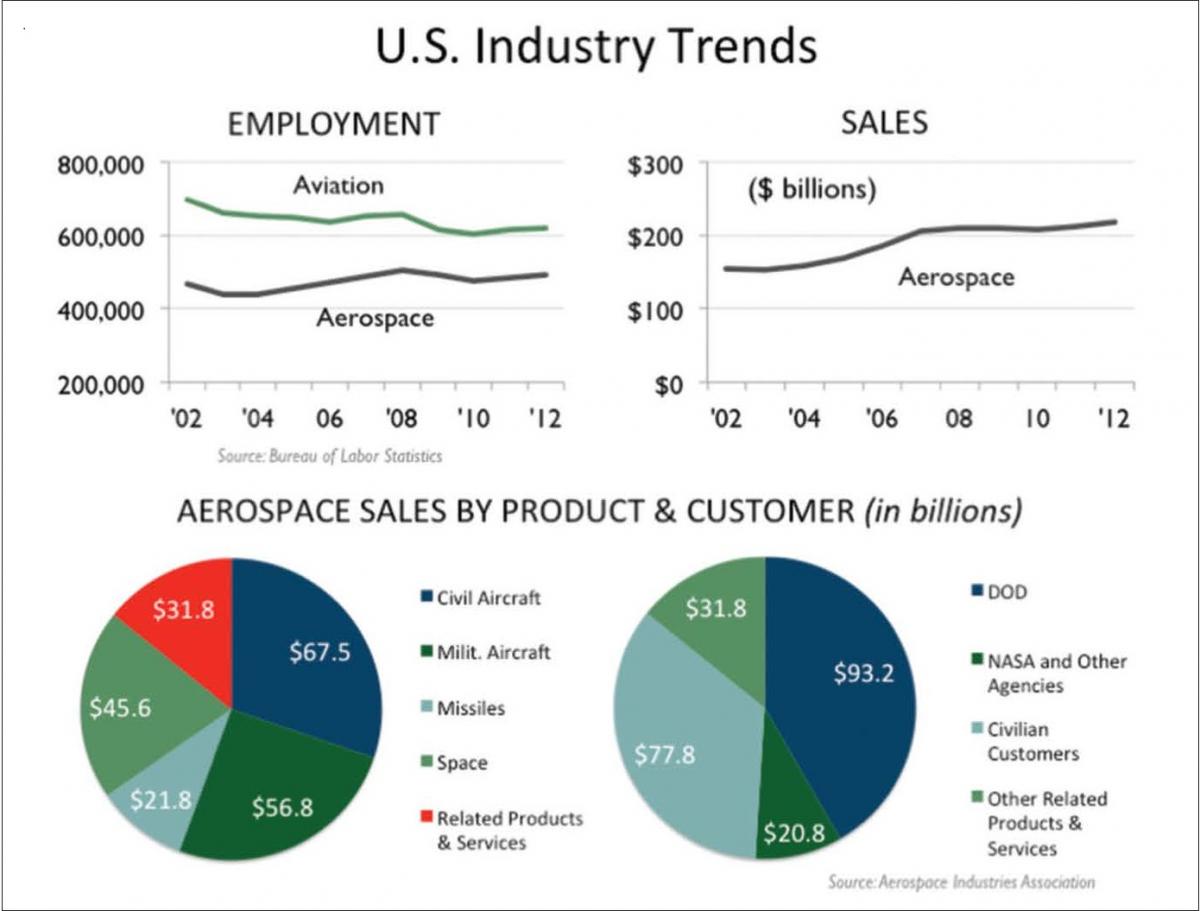

Aerospace and aviation are two distinct but related industries. Although the two sectors have followed different paths in recent years, they remain intertwined. Over the past 10 years, aerospace has been one of the more resilient sectors of the U.S. manufacturing industry. While the U.S. manufacturing employment declined 22 percent between 2002 and 2012, the aerospace sector grew seven percent over the same period. Today, nearly 500,000 workers are directly employed in aerospace manufacturing.

Aerospace and aviation are two distinct but related industries. Although the two sectors have followed different paths in recent years, they remain intertwined. Over the past 10 years, aerospace has been one of the more resilient sectors of the U.S. manufacturing industry. While the U.S. manufacturing employment declined 22 percent between 2002 and 2012, the aerospace sector grew seven percent over the same period. Today, nearly 500,000 workers are directly employed in aerospace manufacturing.

Despite these strong growth trends, the aerospace industry is facing one of its greatest challenges in history. Congress and the Administration are dealing with mounting national debt and the need to balance the federal budget. Considering the large multiplier effects of the aerospace manufacturing industry (estimates range from 2.2 to 2.6 additional jobs per industry job), over 1.5 million private-sector workers are supported by the aerospace industry, or one percent of total workers. The high value-add of the sector means that aerospace contributes three to five percent of the nation’s total Gross Domestic Product. Clearly, the outcome of the sequestration activities in the coming months will have a significant impact on this industry.

Today, aerospace encompasses a diverse range of activities, including the development and manufacture of aircraft, engines, parts, missiles and space vehicles. Aircraft manufacturing remains the largest and fastest-growing subsector of the industry. Slightly more than half of aircraft sales are for civilian uses, with military aircraft representing remaining sales. The fastest-growing subsector of the industry is now unmanned aerial vehicles (drones).

Despite employment fluctuations during the recession, the aerospace industry has experienced continued growth in sales and production over the past decade. Aerospace industry sales grew 41 percent from 2002 to 2012, driven largely by military and international sales. Sales to the Department of Defense (DOD) increased 56 percent over this period. Aerospace exports grew 68 percent, from 37 percent of all sales in 2002 to 44 percent in 2012.

Aviation employment fell dramatically over the past decade. With domestic air carrier bankruptcies and consolidation forcing significant cost-cutting measures, air transportation employment declined from nearly 615,000 in 2001 to 455,000 in 2011. Airport and other air transportation support operations have been the only source of employment growth in the aviation industry over the past decade. Support activities for air transportation grew 17 percent nationally from 2002 to 2012, creating over 23,000 new jobs.

The Future of Aerospace and Aviation

Looking ahead, the future fortunes of the aerospace and aviation industries are decidedly mixed. Over the past decade, U.S. military spending supported over 50 percent of industry sales, but with federal budget concerns and more conservative military deployment strategies, demand is likely to remain flat or decline in the years ahead.

Fiscal austerity in the U.S. has forced many aerospace companies to look abroad for growth. Direct commercial sales authorizations, which are granted by the U.S. State Department to companies seeking to sell military wares to foreign countries, have jumped dramatically over the past five years. Commercial sales authorizations grew from $67 billion in 2006 to $154 billion in 2010. Despite competition and barriers to entry, U.S. aerospace firms have little choice but to seek overseas military market opportunities in the years ahead.

Current forecasts for the civilian market are much brighter. Over the next 20 years, demand for new aircraft is expected to rise alongside rapidly expanding international air travel. According to projections from the Federal Aviation Authority (FAA), total passenger traffic between the U.S. and the rest of the world is expected to jump from 161.8 million in 2011 to 376.1 million by 2032. The growth of global air travel will require fleets of new planes; Boeing projects demand for nearly 32,000 new aircraft by 2031. To put this figure in perspective, there are currently fewer than 20,000 in service worldwide. Growth in passenger travel creates demand not only for new aerospace products, but also for aviation services, including airline personnel and airport operations.

In addition to traditional markets, emerging sub-markets such as unmanned aerial vehicles (UAVs) and commercial spacecraft also hold promise. UAVs, which represented a small segment of the aerospace industry 10 years ago, are expected to continue growing rapidly. According to the Teal Group, the UAV market is projected to nearly double from $6.6 billion to $11.4 billion over the next decade. This market could expand even more rapidly when regulatory changes come into effect in 2015 allowing the use of UAVs by civilian organizations in domestic airspace.

The current health of aerospace and aviation, especially in comparison to other manufacturing and aligned sectors, is uniquely dominated by massive increases in productivity. While aerospace employment increased only seven percent since 2002, sales increased 41 percent and after-tax profits 206 percent. Productivity gains suggests that rising sales and revenue may not necessarily produce equivalent job creation; U.S. aerospace and aviation employment is expected to remain relatively flat over the next decade, even as production grows and operations shift to more efficient locations within the U.S.

The current health of aerospace and aviation, especially in comparison to other manufacturing and aligned sectors, is uniquely dominated by massive increases in productivity. While aerospace employment increased only seven percent since 2002, sales increased 41 percent and after-tax profits 206 percent. Productivity gains suggests that rising sales and revenue may not necessarily produce equivalent job creation; U.S. aerospace and aviation employment is expected to remain relatively flat over the next decade, even as production grows and operations shift to more efficient locations within the U.S.

Geographic Distribution of Aerospace and Aviation

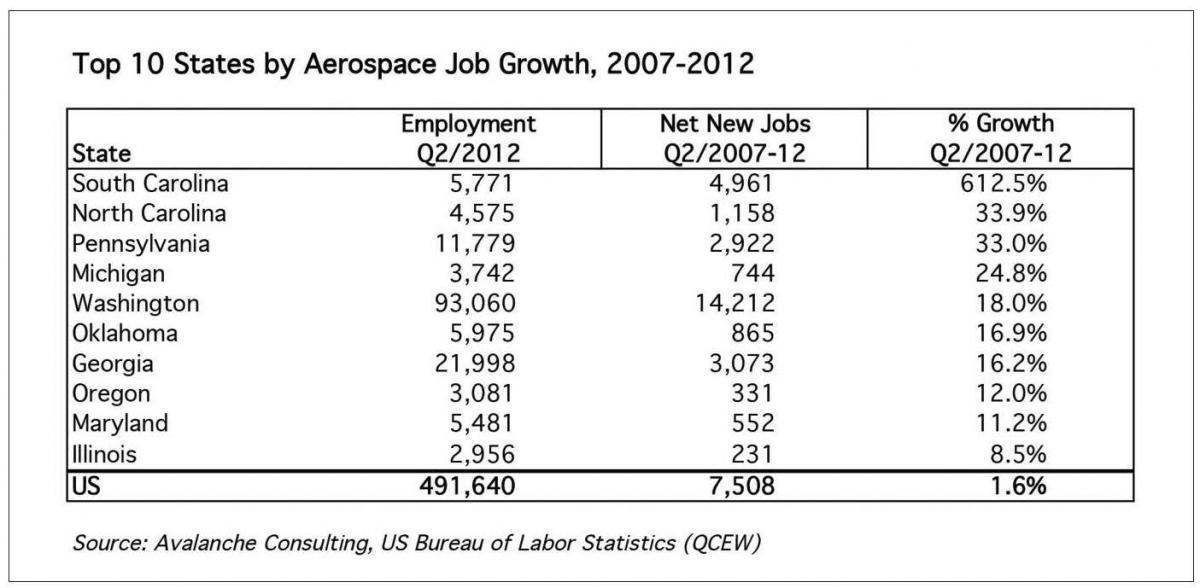

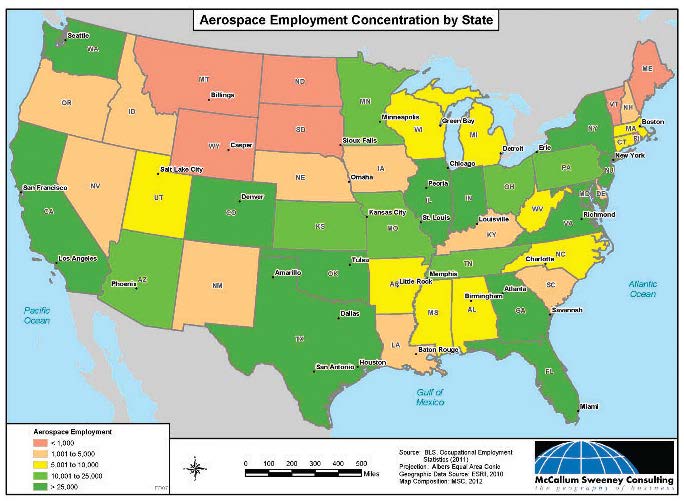

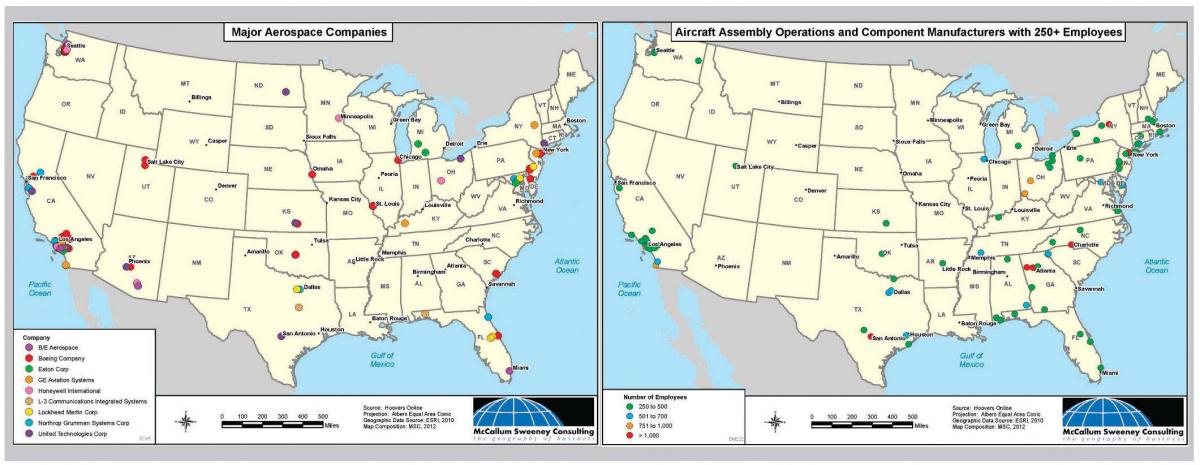

The aerospace manufacturing industry has traditionally been heavily concentrated in a few locales. In 2001, nearly 60 percent of all aerospace employment was located in five states—California, Connecticut, Kansas, Texas and Washington. These states benefited from large defense and other federal operations. Over the past 10 years, however, employment in many of these traditional aerospace powerhouses dropped sharply. In addition, the competitive nature of the industry has made all of the companies reconsider future expansion plans.

California, which once led the country in aerospace employment, has lost more than 8,000 aerospace jobs since 2002. California also lost major defense firms, including Lockheed Martin and SAIC, which relocated their headquarters to Washington, D.C. In Kansas, the recession deeply impacted the aerospace industry, which consists primarily of business jet manufacturing firms. Kansas lost more than 20 percent of its aerospace jobs over the past decade, as the recession dampened corporate jet purchases.

An era of unprecedented growth in emerging aerospace communities is now in effect, particularly for southeastern states. In Georgia, aerospace employment increased by nearly 12,000 over the past decade, more than any state in the U.S. In North Carolina, the number of workers employed in the aerospace industry doubled. And in South Carolina, the opening of Boeing’s new Dreamliner facility in Charleston transformed the region’s underutilized assets into a foundation of the aerospace industry and grew employment over 15-fold. The rise of the South Atlantic Aerospace Corridor provides valuable lessons for the future of the aerospace industry.

An era of unprecedented growth in emerging aerospace communities is now in effect, particularly for southeastern states. In Georgia, aerospace employment increased by nearly 12,000 over the past decade, more than any state in the U.S. In North Carolina, the number of workers employed in the aerospace industry doubled. And in South Carolina, the opening of Boeing’s new Dreamliner facility in Charleston transformed the region’s underutilized assets into a foundation of the aerospace industry and grew employment over 15-fold. The rise of the South Atlantic Aerospace Corridor provides valuable lessons for the future of the aerospace industry.

Aviation industry employment, in contrast, tends to locate according to population density and logistics. Air support employment is much more evenly spread across states, but Texas, Florida and California remain the clear leaders with 35 percent of employment. Almost all states lost air transportation employment over the past five years, but approximately half saw air support operations grow. Growth in air support operations, including airports, was led by West Virginia, North Dakota, Kentucky, Minnesota and Mississippi. Most states experiencing air support employment growth are either relatively economically successful, such as Texas and Virginia; locations for extraction industries, such as North Dakota and West Virginia; or freight distribution centers, such as Florida and New Jersey.

Site Location Factors for Aerospace Companies

What are the driving factors in aerospace companies’ site selection decisions?

1. Labor Availability – A qualified workforce is one of the most important assets to aerospace companies. At the engineering and management level, companies look for strong university engineering programs or federal facilities with aerospace talent. Not only are aerospace workers specialized and highly trained, but they are also older than the overall workforce. According to one estimate by the Aerospace Industries Association, among large aerospace companies, nearly 30 percent of workers will be eligible to retire in 2016. The presence of a strong local engineering program or relevant federal facility ensures that aerospace companies will continue to have access to a robust talent pipeline.

1. Labor Availability – A qualified workforce is one of the most important assets to aerospace companies. At the engineering and management level, companies look for strong university engineering programs or federal facilities with aerospace talent. Not only are aerospace workers specialized and highly trained, but they are also older than the overall workforce. According to one estimate by the Aerospace Industries Association, among large aerospace companies, nearly 30 percent of workers will be eligible to retire in 2016. The presence of a strong local engineering program or relevant federal facility ensures that aerospace companies will continue to have access to a robust talent pipeline.

2. Labor Regulations – During the past decade, right-to-work states like South Carolina and Georgia have generally been more successful at attracting new aerospace facilities than states with a strong union presence. The migration of aerospace employment into right-to-work states is fueled by the perception that they offer companies a more stable operating environment. When multi-billion-dollar aircraft deliveries are on the line, the prospect of a labor strike threatens reliability.

3. Infrastructure – Major aerospace manufacturing facilities have unique real estate requirements. Communities with decommissioned military bases or other underutilized assets can provide aerospace companies with the specialized infrastructure they require. Physical attributes of airports such as the length and weight capacity of runways and the availability of developable land with direct runway access are important to aerospace manufacturers.

4. Competitive Business Environment – Too often, communities mistake incentives for a competitive business environment. While large incentive packages are an absolute requirement when recruiting a new facility from one of the larger aerospace conglomerates, other financial considerations are also at play during the site selection process. In many ways, these factors are even more important, as they can benefit much smaller firms that might be unable to take advantage of incentives. Competitive property and sales tax rates, for example, help lower the cost of operating in a tremendously capital-intensive industry. Research and development tax credits can also provide support to an industry heavily dependent on innovation. And fast permitting can help businesses both small and large begin operations as soon as possible.

5. Political Diversification – A practice mastered by defense firms, locating manufacturing facilities in multiple states provides companies with greater political and economic clout. Traditionally, geographic diversification in site selection has ensured that any potential cut to a favored federal defense contract would be vigorously challenged by a host of congressmen, senators and other stakeholders. In recent years, however, geography has also been driven by logistical considerations. As the supply chain of companies becomes increasingly complex, geographic diversity helps ensure resiliency.

Future Considerations

Judging from the growth of the aerospace industry and changing emphasis on economic considerations, virtually every industry is taking a good hard look at themselves these days. On the commercial side of the equation, companies are making sure that they will no longer be at the unpredictable whim of unions. They are looking to create redundant operations as a hedge against chaos that results from strikes and conflict. On the military side of the equation, the impact of sequestration is, in fact, looming; however, at present, it is impossible to understand the outcome on employment, consolidation or organizational realignment. From both authors we think it is a safe assumption that the industry is going to change and will be a windfall for some locations and not-so-welcome news for others.