The U.S. renewable energy debate between legislators reminds me of hamsters on an exercise wheel. They go round and round incessantly but ultimately go nowhere – but then, hamsters are not very smart. Therefore, let’s examine the renewable energy market in the United States. By its very definition, renewable means “that which is inexhaustible or replaceable by new growth.” In contrast, fossil fuels (oil, coal, natural gas) are finite. Finite, of course, means it is limited and will end at some point in time. So think about this: inexhaustible versus finite – seems like a pretty simple argument to me. Granted, it may be 100, 200 or even 300 years before one of the fuel sources runs out, but it is only a matter of time before one does. Of course, nuclear energy can (and should) be part of the solution, but then a Chernobyl or Fukushima event occurs and grounds us with the reality of this technology. The popular notion that some new energy technology will be developed before we run out of fossil fuels without some cataclysmic event as a catalyst is contrary to historical events since mankind has been on this planet. What person would argue that a lack of a cohesive renewable energy policy will have no effect on the security of our country? There will always be a conflict over energy resources not to mention the debate over global warming, and it will not be settled by diplomacy. Apparently, many in Washington as well as over 1/3 of the states, either do not agree or the obvious simply escapes them. So, without any more political pontificating, let’s start with something that makes sense to everyone. Renewable energy means jobs and investment.

The U.S. renewable energy debate between legislators reminds me of hamsters on an exercise wheel. They go round and round incessantly but ultimately go nowhere – but then, hamsters are not very smart. Therefore, let’s examine the renewable energy market in the United States. By its very definition, renewable means “that which is inexhaustible or replaceable by new growth.” In contrast, fossil fuels (oil, coal, natural gas) are finite. Finite, of course, means it is limited and will end at some point in time. So think about this: inexhaustible versus finite – seems like a pretty simple argument to me. Granted, it may be 100, 200 or even 300 years before one of the fuel sources runs out, but it is only a matter of time before one does. Of course, nuclear energy can (and should) be part of the solution, but then a Chernobyl or Fukushima event occurs and grounds us with the reality of this technology. The popular notion that some new energy technology will be developed before we run out of fossil fuels without some cataclysmic event as a catalyst is contrary to historical events since mankind has been on this planet. What person would argue that a lack of a cohesive renewable energy policy will have no effect on the security of our country? There will always be a conflict over energy resources not to mention the debate over global warming, and it will not be settled by diplomacy. Apparently, many in Washington as well as over 1/3 of the states, either do not agree or the obvious simply escapes them. So, without any more political pontificating, let’s start with something that makes sense to everyone. Renewable energy means jobs and investment.

The Economics Make Sense

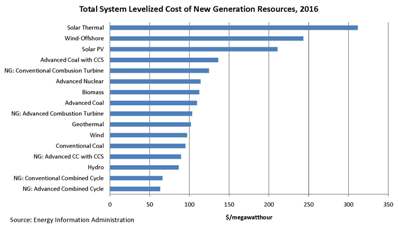

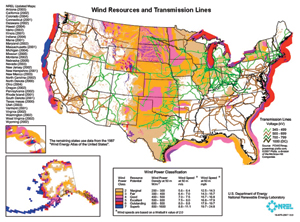

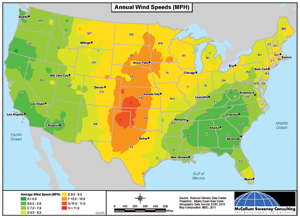

The first argument is always that renewable energy does not make economic sense. Unless the Department of Energy, the National Renewable Energy Lab, the Energy Information Institute, and many other agencies are all plotting together under some grand conspiracy scheme, this simply is not true. Granted, some forms of renewable energy are more expensive than others, and some (such as hydro  where sunk costs have already been absorbed) are much cheaper, the total system leveled cost to bring on new generation by 2016 is surprisingly competitive for certain technologies. Examination of the chart should dispel the myth that renewable energy is not affordable, especially as it relates to Onshore Wind and Geothermal. However, one of the problems with this chart is that it does not take into account the cost of building additional transmission lines to bring the power from the generation source to the market. As you can see from the map, this is an issue for wind, since the most productive wind generation regions are located where the least amount of transmission is available. Of course, if this were a valid argument, then Southern California, Florida and the Plains States would all have had to finance and build the interstate system because they use interstate highways to bring produce to the market – which is, of course, absurd. The U.S. has many priorities at present and energy independence (or at least less reliance on foreign oil) is as important to our nation’s prosperity as was the construction of the interstate system.

where sunk costs have already been absorbed) are much cheaper, the total system leveled cost to bring on new generation by 2016 is surprisingly competitive for certain technologies. Examination of the chart should dispel the myth that renewable energy is not affordable, especially as it relates to Onshore Wind and Geothermal. However, one of the problems with this chart is that it does not take into account the cost of building additional transmission lines to bring the power from the generation source to the market. As you can see from the map, this is an issue for wind, since the most productive wind generation regions are located where the least amount of transmission is available. Of course, if this were a valid argument, then Southern California, Florida and the Plains States would all have had to finance and build the interstate system because they use interstate highways to bring produce to the market – which is, of course, absurd. The U.S. has many priorities at present and energy independence (or at least less reliance on foreign oil) is as important to our nation’s prosperity as was the construction of the interstate system.

Corporations Buy Green Energy

Corporations Buy Green Energy

An increasing number of corporations have started to use renewable energy resources for their electricity and thermal energy needs. The reasons vary by company and are not simply the philosophical pursuit of “green energy” as a feel-good policy. Instead, there are sound economics behind this action, and a good example is IBM. In 2001, IBM signed a five-year fixed-price contract with its utility to provide wind generated electricity at their operations in Austin, Texas. The green electricity was slightly more expensive than the utility’s conventional power initially, but because the utility periodically adjusts its conventional power prices to reflect changes in primary fuel wholesale costs (a common practice by utilities), this action was considered to be a hedge against possible price increases of fossil fuel–generated power. This practice helped to stabilize the IBM facility’s costs variations over time. The result was less volatile earnings quarter after quarter which pleased the stock market analysts who hate surprises.

Using renewable energy has also been employed by companies to reduce their emissions of greenhouse gases and other airborne pollutants that pose regulatory and financial risks to firms. This is particularly important to firms in non-attainment regions where offsets can be used to lower the existing pollution footprint. Many companies are anticipating that mandatory controls on greenhouse gases are just around the corner in the United States. As a result, these companies are setting certain targets internally so that they can still operate efficiently and effectively if and when a carbon-constrained world becomes a reality – sort of a hedge against future regulations.

In some cases, renewable energy is the source of lower energy costs. Both BMW and General Motors either own or purchase landfill gas  to replace natural gas at a substantial savings. Georgia-Pacific and other companies in the forest products industry use wood wastes to generate heat and electricity at their processing plants. Using biomass residues as fuel reduces their energy costs compared to buying natural gas. In addition, since the residues are a by-product of the manufacturing process, a “tipping” fee is avoided if dumped in a landfill which is an additional source of savings for both the fee and the costs associated with transportation.

to replace natural gas at a substantial savings. Georgia-Pacific and other companies in the forest products industry use wood wastes to generate heat and electricity at their processing plants. Using biomass residues as fuel reduces their energy costs compared to buying natural gas. In addition, since the residues are a by-product of the manufacturing process, a “tipping” fee is avoided if dumped in a landfill which is an additional source of savings for both the fee and the costs associated with transportation.

Finally, many corporations utilize “green energy” to differentiate their product brand in the marketplace. BMW plans to produce an electric car that utilizes carbon fiber which will reduce weight and thus put less strain on the battery. One of their key suppliers, SGL Carbon, which McCallum Sweeney represented, stated that one of their most important site selection criteria was cheap, affordable and green energy. There were several places in North America capable of providing cheap power, but only a few could provide both cheap and green power.

Name a major corporation and odds are that nine out of ten are in support of “green power” in some fashion.

Jobs, Jobs, Jobs It is estimated, according to the U.S. Department of Labor’s statistics released in May, that the national unemployment rate is 9.1 percent which does not take into account the underemployed or those who are frustrated and have simply given up looking. Instead, the 9.1 percent only represents those people who reported looking for work in the past four weeks. When the underemployed and the discouraged are added to the numbers, the unemployment rate rises to 16.6 percent. The Bureau of Labor Statistics (BLS), a unit of the Labor Department, began tracking this alternative measure - known as the U-6 for its department classification - in 1995 after economists lobbied for a method comparable to the way Japan, Canada and Western Europe count their unemployed. Either way you count it, the numbers are very grim.

It is estimated, according to the U.S. Department of Labor’s statistics released in May, that the national unemployment rate is 9.1 percent which does not take into account the underemployed or those who are frustrated and have simply given up looking. Instead, the 9.1 percent only represents those people who reported looking for work in the past four weeks. When the underemployed and the discouraged are added to the numbers, the unemployment rate rises to 16.6 percent. The Bureau of Labor Statistics (BLS), a unit of the Labor Department, began tracking this alternative measure - known as the U-6 for its department classification - in 1995 after economists lobbied for a method comparable to the way Japan, Canada and Western Europe count their unemployed. Either way you count it, the numbers are very grim.

The fact is that lots of jobs have been created in the renewable energy industry and there is potential for many more. For instance, the solar power industry doubled the number of people working in the sector from approximately 50,000 in 2009 to 100,000 in 2010. According to the Solar Energy Industries Association (SEIA), it is expected that 2011 will show a 26 percent increase. The geothermal energy market is showing promise as well. According to the Geothermal Energy Association (GEA), each geothermal project involves up to 1,000 people per project, and the U.S. Department of Energy has awarded $47.4 million to 22 geothermal projects in California to develop new technology. Just in California alone, the most productive geothermal region in the U.S., this represents 22,000 jobs coming online in the next few years. According to the Biotechnology Industry Organization (BIO), the bio-refinery industry accounted for close to 40,000 jobs in the U.S. as of June 2010. Second and third generation commercialization of fuels is expected to create 190,000 direct new jobs by 2022, with an additional 610,000 indirect jobs. The wind industry experienced a slowdown in 2010 for the first time in several years and is considered stalled. At its peak in 2008, the industry employed approximately 85,000 people, representing only a fraction of the potential in this sector. Let’s not forget hydro power. This sector accounts for anywhere from 200,000 to 300,000 jobs, depending on the math to calculate the number of people necessary to operate, maintain and monitor operations per megawatt of power. According to a study performed by Navigant Consulting, there is approximately 40 GW of untapped hydro power which could be responsible for around 500,000 direct jobs by 2025 – not counting the almost 1.0 million indirect and induced jobs.

The jobs created in this industry are not only much needed in many regions of the country, but the jobs involved in this sector span the gamut of skill levels and include just about every craft and professional job description imaginable. The pursuit of renewable energy policies will help us avoid what we know for certain is around the corner as well.

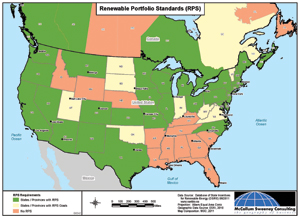

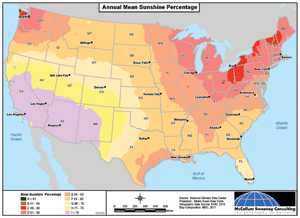

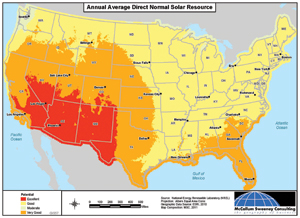

It’s Not Just in Kansas, Dorothy

I suspect that few would argue that jobs have indeed been created in the renewable energy sector. The opinion of some states regarding the controversy regarding the recruitment of this industry (enter the hamsters again) goes something like this, “That industry does not affect my state since we do not have 350 days of sunshine, continuous wind, or hot springs. This is part of the American Reinvestment and Recovery Act (ARRA), and something we do not support.” If this were true, then Alabama, Mississippi, Tennessee and South Carolina would not have pursued the automotive sector as aggressively as they did in the past since only a small number of cars are sold collectively in these states compared to the rest of the country. Examination of the maps that follow demonstrate that most of the land-based wind energy potential is situated on either the West Coast, Southwest or Central Plains states; yet, the manufacturing and supply chain for wind energy is dispersed throughout the country. Having been involved in several site searches for renewable energy companies, wind in particular, the question always arises about the finalist state’s position regarding Renewable Portfolio Standards (RPS) or the voting record of the federal house and senate representatives regarding Production Tax Credits (PTC). Many times it makes a difference between winning and losing the project.

Similar to the diversity in the craft skills and professional ranks that are needed to support the renewable industry, the same can be said of the range and types of suppliers – particularly with regard to manufacturing. A little know fact is that almost 60 percent of the components for a wind turbine are still imported by General Electric, a U.S.-based mega corporation, which happens to build nacelle units in both Florida and South Carolina, a considerable distance away from the epicenter of the wind energy corridor. If I were an economic developer or a legislator, this factoid would sure trigger a response in my brain regarding fertile hunting grounds for job recruitment.

Renewable Energy is Here to Stay

In summary, renewable energy provides an enormous opportunity for jobs and investment if the facts were only scrutinized objectively and strategically. The nation’s unemployment rate is hovering around 10 percent (even higher according to alternate measures). Renewable energy jobs typically are accompanied by high wages and excellent benefits with stable international companies. The opportunity has been seized by states such as Iowa, Texas and Arkansas, and ignored by almost the entire Southeast (typically a leader in economic development). Are we faced with another Civilian Conservation Corps situation similar to the New Deal program of the 1930s depression created to provide jobs? I do not think so. Instead, it seems more like the interstate program of the early 1950s where the autobahn concept was imported to the U.S. with a significant and impactful effect on our country’s economy. In the mean time, the clock is ticking.