The biotechnology industry has been front-of-mind as the public and private sectors had at first struggled, then rallied, in response to the many challenges posed by the COVID-19 pandemic. While this healthcare crisis may have fundamentally changed the way in which certain vaccines and other therapies are produced and distributed, the biopharma sector has for some time been undergoing a momentous realignment away from traditional chemical-based medicines and towards biologic, or cell-based drugs, and even newer cell and gene therapies.

These shifts have notably impacted the pipeline of new medicines, the revenues of big pharma companies and the valuations of the many nimble startups. They also have amplified the demand for the talent and the facilities that enable the manufacture of these exciting new drugs.

Why Should We Care About Biotech?

Although not without challenges, the biotechnology sector, and big pharma in particular, has generally endured the volatility that has roiled the financial markets since the beginning of 2022. Fortune reported that the 10 largest global pharma companies earned nearly $735 billion, and more than $130 million of profits, in 2021, driven largely by pandemic-inspired expansions of the manufacturing and distribution of vaccines. According to Fierce Pharma, 15 of the largest biopharma companies increased their revenues year-over-year, led by COVID-19 products: Pfizer (up 47 percent) AstraZenica (+32 percent) and Merck (+28 percent). The Wall Street Journal reported fears appear to be subsiding regarding the potential negative earnings impacts of the recently passed Inflation Reduction Act, and its Medicare drug price controls.

Looking forward, Evaluate has forecast the pharmaceutical drug industry’s total market cap will rise from almost $850 billion in 2017 to more than $1.4 trillion in 2026, based on the industry’s ability to drive innovation and improve patient outcomes. And although 2021 was one of the worst years on record for pharma mergers and acquisitions, Elevate noted signs of renewed activity in 2022 as Pfizer and others with COVID-19 cash to spend pursue acquisition targets.

The recent experience of smaller, less-capitalized drug companies has not been as favorable. Fierce Pharma reported that gloomy second quarter earnings are forcing some biotech startups to cut once-promising drug candidates or seek partnership deals with large companies. To compound the misery afflicting pre-clinical and clinical-stage drug companies, the level of biotech IPOs is the weakest it has been in more than five years.

Yet, despite some near-term pain, the outlook remains quite positive for the many innovative next-generation pharma companies bolstered by new technologies and poised to access an abundance of private capital. According to Elevate, 1,722 drug candidates were in pre-clinical phases last year: 1,673 were in early clinical trials and approximately 400 were in the late clinical trial stage. Among the discoveries now being commercialized are new MRNA technologies and vaccines such as the Pfizer/BioNtech and Moderna COVID vaccines, and new cell and gene therapies that promise cures (not just controls) for chronic medical conditions. These new cell and gene therapies, and other cutting-edge biologic-based medicines, are increasingly coming to market despite some significant biomanufacturing challenges.

What is Biomanufacturing?

Biopharmaceuticals can be broadly characterized as any therapeutic produced via living organisms, as opposed to the chemical syntheses employed in the manufacture of more traditional medicines. Contract Pharma magazine’s listing includes recombinant and non-recombinant cultured/fermented proteins and monoclonal antibodies; vaccines; blood-and plasma-derived products; cellular and gene therapies, among others.

Biomanufacturing facilities are unlike any other production operation. The process, which is based around growing and harvesting living cells, and then purifying, filling and finishing the product, occurs in a clean room environment that resembles a laboratory and not a conventional factory floor.. The utilities, which are vital to the biomanufacturing process, also are unique and include complex HVAC systems to control the purity, temperature and humidity within the clean room, purified water, clean steam, oxygen and emergency power.

All work is performed according to Good Manufacturing Practices (GMP), a set of standards designed to comply with FDA guidelines, that govern the many aspects of biomanufacturing, including the storage and handling of raw materials, production and filling/finishing. Biomanufacturing workers in a GMP environment must strictly adhere to Standard Operating Procedures (SOPs), written and approved step-by-step procedures regulated by the FDA, to accomplish their work.

Biomanufacturing in the U.S.

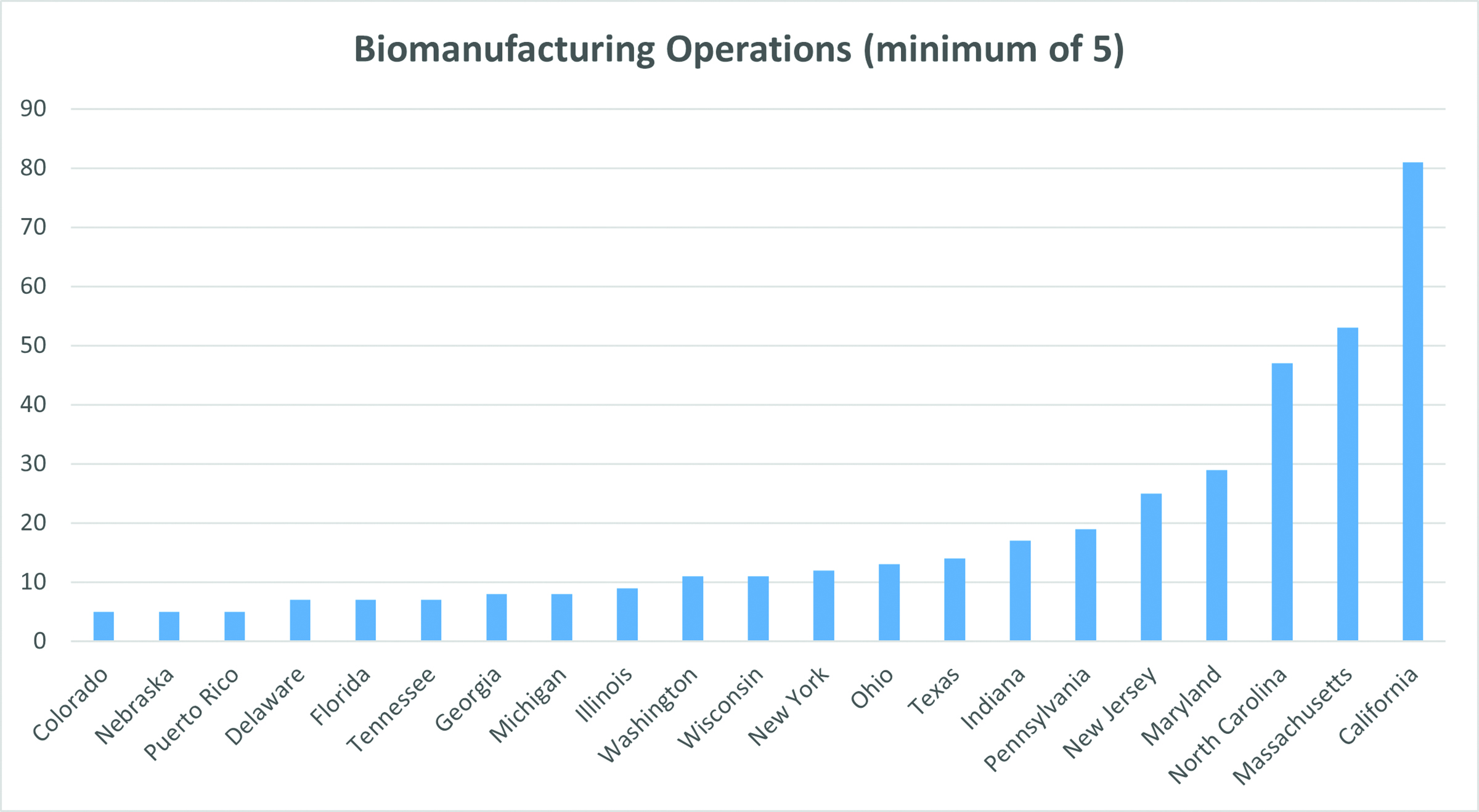

BLS & Co. continually tracks biomanufacturing project announcements. Research indicates that biologic drug production still tends to locate in the established clusters on both coasts, with California, Massachusetts and North Carolina the leading destinations. As the competition for talent and facilities heats up, more of this production is migrating to interior states such as Indiana, Ohio and Texas.

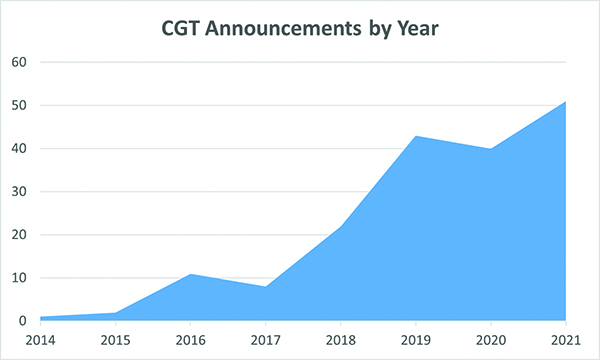

Cell and gene therapies (CGT), a subset of biologics treatments, are now front and center in the efforts to find cures for chronic diseases. There has been a surge in biomanufacturing announcements by companies seeking to produce batches of CGT drugs for clinical trials and, more recently, to generate drug product on a commercial scale. New CGT biomanufacturing facility announcements have soared from one or two in the middle of the last decade to 51 in 2021. 2022 promises to be strong, if not quite as robust as last year.

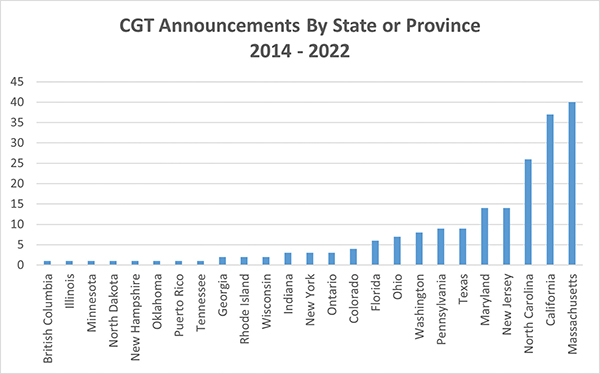

The destinations of these newly-announced CGT biomanufacturing facilities closely tracks those of the wider biologic drug industry, with concentrations in the well-known destinations on both coasts, and in emergingcenters in the Midwest, Southwest and Canada.

Critical Success Factors Influencing Biomanufacturing Location Decisions

In a relatively nascent industry such as biomanufacturing, there will likely be numerous variables influencing the site selection process. Many projects, particularly for pre-clinical and clinical trial stage companies, will be driven by the need to keep manufacturing close to their scientific and engineering centers, and it’s not uncommon for investors to insist that these operations remain within their line of sight. However, for other projects, the key variables would be familiar to any site selector: talent and real estate. Both are in short supply.

Reporting on biomanufacturing trends at the beginning of this year, DCAT Value Chain Insights observed, “The pandemic response is adding R&D and manufacturing to facilities that were already near capacity pre-pandemic.” Although supply chain issues have also been a culprit, this lack of capacity can largely be attributed to a nationwide shortage of workers experienced in GMP manufacturing, combined with a scarcity of good industrial buildings and sites in many markets.

Katrina Rogers, CEO of the Evergreen Bioscience Innovation, wrote on LinkedIn, “Companies engaged in current Good Manufacturing Practice (cGMP) manufacture of drugs, vaccines, biologics, and medical devices are experiencing an urgent need for employees. This need existed before the pandemic and has only intensified . . .”

Jared Loos, the CEO of life sciences A&E firm Ewing Cole, corroborated Roger’s perspective.

“I do have tangible evidence that a shortage of talent, and thus access to staff, seems to be the predominant factor in selecting new biomanufacturing locations. We recently met with a west coast biopharma company that told us that talent acquisition is one of their biggest challenges. Thus, they are now planning for an entirely new campus in a new region that could pay talent dividends. Access to talent was not only the driving factor in selecting the location – but also for the entire project in the first place.”

In response to talent constraints, biomanufacturers are increasingly writing job descriptions that do not require advanced degrees. When Scorpion Biological Services president David Halvorson announced his decision to locate a 500,000 square-foot biomanufacturing facility near Manhattan, Kansas, he asserted, “While we are a cutting-edge, automated, high-tech biomanufacturing company, that does not mean you need to have a master’s degree or a Ph.D. to work with Scorpion. Less than 15 percent of my workforce has to have a higher education.”

What Scorpion and others will be looking for is a strong work ethic and an aptitude for a job that is anything but ordinary. “Biomanufacturing is not a 9 to 5 job,” he said. “Cells get hungry and when cells get hungry, they are kind of like infants. They need to be fed and they need to be fed now. It’s not a job for the faint of heart.”

States and communities are responding to biomanufacturing talent shortages with accelerated training initiatives. North Carolina, which has long targeted biomanufacturing as a key industry, is perhaps the leader in such efforts. The North Carolina BioNetwork, operating out of the North Carolina State University Centennial Campus in Raleigh, and at community colleges across the state, delivers short courses, workshops and company-specific skill development in biomanufacturing as well as associate degree programs. The Centennial Campus is home to the Golden Leaf Biomanufacturing Training and Education Center’s (BTEC’s) 77,700-square-foot main facility featuring classrooms and laboratories with bench-scale and pilot-scale bioprocessing equipment and a 5,000-square-foot aseptic processing training facility. BioNetwork also offers a 136 hour “BioWork” certificate program designed to upskill workers who have had no prior bioprocessing experience.

North Carolina is not alone in taking the initiative to train new bioprocessing workers. Massachusetts has established a similar staff development infrastructure at the Middlesex Community College and at Worcester Polytechnic Institute, which has built a 10,000-square-foot Biomanufacturing Education and Training Center including a fully functional pilot-scale manufacturing plant. On the west coast, Solano College in the San Francisco Bay Area now offers a biomanufacturing bachelor of science degree and has formed the new California Biomanufacturing Center in collaboration with the City of Vacaville.

Finally, the Biden administration’s Build Back Better Regional Challenge recently awarded more than $1 billion to regional collaborations across the country to promote the onshore production of 50 to 100 “essential” medicines. Among the winners was an almost $53 million grant to Virginia’s Advanced Pharma Manufacturing and R&D Cluster to promote biomanufacturing in Central Virginia and create new job opportunities in the pharmaceutical industry for underrepresented populations.

The other significant constraint on the domestic biomanufacturing industry is the current shortage of suitable sites and facilities. This year, BLS & Co. tracked a flurry of new CGT biomanufacturing announcements including Intellia Therapeutics in Waltham, massachusetts (140,000 square feet); Vertex in Boston (344,000 sf); Vericell in Burlington, massachusetts (120,000 sf); Catalent in Princeton, New Jersey (30,000 sf) and Sonoma BioTherapeutics in Seattle, Washington (83,000 sf) and many others.

According to a recent report in Bisnow, “These expansions are especially important due to a biomanufacturing bottleneck across the nation. The expansion of cell and gene therapies, which have a greater need for marrying innovation and manufacturing processes earlier in the development cycle, means more startups are seeking more manufacturing capacity earlier in their life cycles, straining an existing shortage of such plants.”

New Space is Coming Online

MassBio reported that 1.7 million square feet of GMP manufacturing space is currently under construction across the state, and life sciences developers such as Alexandria Equities are said to be working on over one million square feet of manufacturing space in the San Diego region alone, with more slated in other markets. However, these projects are still several years away.

Given the scarcity of available biomanufacturing space, extended construction timelines, critical shortages of certain materials and construction labor and extraordinary inflation levels, facility designers and tenant representatives urge end users to get their contractors involved early in the facility planning process.

Bill Poole, Ewing Cole’s Fort Worth-based director, warned, “Many companies have unrealistic expectations regarding the facility construction process and timelines. ‘Design, bid, build’ had been the structure for years, but it’s not that way anymore. You now need to get construction involved early in design to avoid any unpleasant surprises later on.”

Tim Howland, of the life sciences project management firm Facility Logix, asked, “Can we say that we are now at the end of the pricing roller coaster? Some prices are falling back into line, but costs for supplies such as microchips and generators are still challenging, even growing.” Howland added that construction labor remains stubbornly difficult and expensive, “We are going to six trades and getting only one quote because everyone is so busy.”

What the Future Holds

If the pandemic has taught us anything it’s that public health and the delivery system including drugmakers, regulators, healthcare organizations, practitioners and insurance companies needs to be better prepared for the next emergency.

As the science advances and technologies and tools improve, the biopharma industry can be expected to respond with even shorter drug discovery, development and manufacturing timelines. It’s likely that ongoing shortages of labor, sites and facilities in many of the core domestic drug clusters may drive future biomanufacturing jobs and investment to newer, upcoming markets in Ohio, Indiana, Georgia, Texas, Colorado and Washington. States can enhance their competitiveness for these projects by proactively identifying sites and facilities that may be most suitable for GMP manufacturing operations; by building out the human development and training infrastructure necessary to load their pipelines with newly qualified workers; and by putting incentives in place to attract developers of biopharma facilities.

Finally, it’s also important to take into account the potential impact of state restrictions on abortion rights and how that might affect the location decisions by life sciences companies. Jay Biggins of BLS & Co., when recently interviewed on this topic by ROI-NJ.com, asserted that “It’s happening already,” and that, “For business decision-makers, this is a practical reality, not a political or social issue.” T&ID