1. Demographics

2. Increasing healthcare spending

3. Continuous innovation in product development and application

4. Consolidation, which is enhancing market penetration, revenue and cost-efficiencies

5. Collaboration among OEMs, CMOs (contract manufacturers) and suppliers

6. Rapid growth (double the industry average) of wearable medical devices (e.g., heart rhythm monitoring), which also strengthens the remote-patient monitoring market.

Global sales of medical devices are expected to have exceeded $400 billion in 2017. The U.S. accounts for about 40 percent of worldwide revenue. Projections call for per annum sales growth in the five percent range. The U.S. will continue to represent the largest market. The fastest international growth will occur in Asia, especially China and India.

Solid growth rates will translate into a robust level of new and expanded manufacturing facilities. The U.S. will continue to witness extensive capital investment in manufacturing capacity. Reflecting strength of the market, 15-18 percent of new investment will likely be foreign owned with leading countries to include England, Germany, Switzerland, The Netherlands and France.

Domestic U.S. companies will also continue adding capacity. American-owned medical device manufacturers will also strategically site offshore operations to serve growing markets, especially in Asia. But it should be noted that U.S. exports of medical devices represent about $45 billion. Consequently, U.S. medical device manufacturers have more latitude in deciding when, how and eventually where to establish offshore operations.

Domestic U.S. companies will also continue adding capacity. American-owned medical device manufacturers will also strategically site offshore operations to serve growing markets, especially in Asia. But it should be noted that U.S. exports of medical devices represent about $45 billion. Consequently, U.S. medical device manufacturers have more latitude in deciding when, how and eventually where to establish offshore operations.

Industry Typology

The FDA lists 1,700 different medical devices. For classification/regulatory purposes these have been divided into 17 specialty panels. Production facilities must be registered with the FDA, unless an exemption applies (would be mostly in Class I). The FDA, however, does have the authority to inspect regulated facilities to ensure compliance with “good manufacturing practice” regulations. This becomes a factor in design/build or purchase of an available building by medical device producers seeking to add new manufacturing capacity.

While there are many household name players in the medical device field, the industry is highly fragmented. In the U.S., there are some 7,000 production facilities operated by medical device companies. About four-fifths have fewer than 50 employees. Total industry employment has recently surpassed 400,000. Mean salary is some 15 percent greater than the U.S. manufacturing average.

Fragmentation has helped to spur innovation and niche market specialties. This also has been partly responsible for the industry’s consolidation trend. In the past 12 months, there have been over 150 mergers/acquisitions among medical device manufacturers. While consolidation will result in a degree of business unit realignment, including downsizing of selected facilities, the trend will also fortify competitive marketplace positioning, setting the stage for future expansion, including new manufacturing plants.

Geographic Concentration

Geographic Concentration

The industry tends to be clustered in the most populous states. These include California, New York, Pennsylvania, Florida, Texas and Illinois. Several mid-size states also have strong representation, in part because one or more major firms were founded and matured in these states. They include Minnesota, Washington and Virginia.

Nearly all states, however, have a notable industry presence. This is partly attributable to the astonishing growth of startup companies in the industry. These often tend to be launched by entrepreneurs associated with the health-related sector. Such areas could provide fertile ground for medical device companies seeking to establish new production operations within an established or emerging industry ecosystem.

Relative to siting new facilities, the industry is geographically diverse. For the higher volume, more labor-intensive manufacturing plants, medical device companies will often opt for smaller metros or counties. Drivers are supply of entry-level labor with strong basic skills, moderate operating costs, especially labor and availability of incentives (which may not be attainable in larger metros due to wage thresholds and other eligibility requirements). The majority of locationally active medical device companies have been deploying manufacturing operations to mid-size (Tiers II and III) metros featuring a balance of qualified talent at moderate cost.

The most advanced medical device plants often will seek out a location with an established industry presence (typically a larger metro region). Technical talent is the main driver. A medical school is also preferred both for collocation and talent pipeline pool breadth/depth. For these kinds of enterprises, industry ecosystem presence is a locational priority.

Location Criteria Human Resources

Location Criteria Human Resources

Paramount to medical device manufacturers is the ability to recruit/retain top-flight talent. Talent represents one of the most pressing challenges facing the industry. Identifying labor markets that can produce substantial applicant flows is a critical locational determinant.

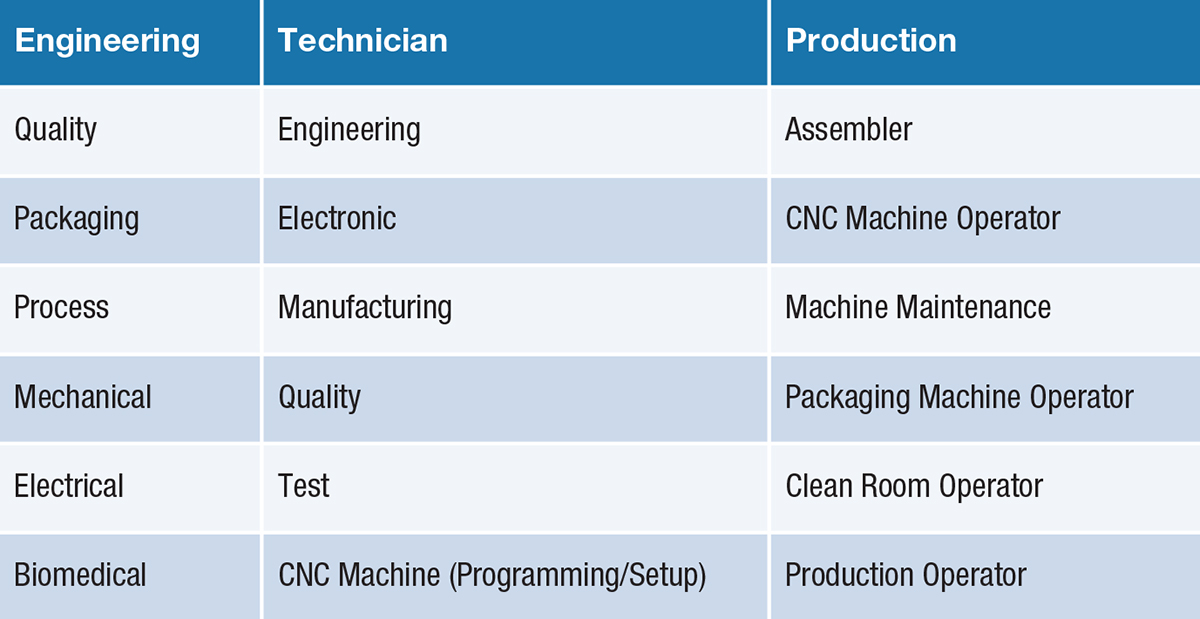

Depending on product mix, headcount requirements will vary. However, there are positions that tend to be common among manufacturers in this industry. They are found in the chart here.

It is important the selected location display a competitive demand/talent pool depth equation that will yield a surplus of requisite skillsets well into the foreseeable future. Furthermore, compensation level needs to be no higher than what was projected in the “business case” for creating the new manufacturing plant. In addition, the favorable dynamic of demand/supply/cost must be sustainable over the mid to long range. Choosing a problematic labor market constitutes one of the biggest risks for successful site selection in the medical devices industry. The following systematic approach for identifying and selecting the best location from a labor market perspective should be considered.

Projecting the scale and mix of skills both for year one and future years is a critical first step. This includes an estimate of the proportion of new hires requiring experience vs. qualified entry level. It is also important to clarify the ideal characteristics of new hires. These characteristics can determine potentially suitable (and unsuitable) labor markets.

Once this HR groundwork has been laid, the challenge is identifying a short list (usually two-four) of locations that appear to be well-qualified from a labor market vantage point. Relying on desktop research, a series of statistical thresholds should be established. Start with macro (e.g., population trends) and sequentially delve into micro (e.g., specific occupations or job families) thresholds. Establish a metric for each threshold, such as population size (250:1 for each new hire), medical devices industry employment (e.g., 10:1 for each new hire) and machine operator labor pool (e.g., 25:1 for each new hire). Eliminate areas that fail to pass the test on thresholds (metrics need to be set for each factor.

Then, send a request for information (RFI) to the lead economic development agency in semi-finalist or long-list locations. Typically, there will be seven to 10 long-list contenders. Via the RFI, gather intel on considerations such as:

1. Employer roster

2. New/expanding companies

3. Downsizing companies

4. Pertinent education/training programs

5. Unionized operations

6. Summary of industry ecosystem

7. Private sector local wage/benefit survey

8. State labor legislation

9. Talent attraction programs (efforts to recruit people to the area)

10. HR-related incentives (e.g., payroll tax rebates).

Combining desktop and RFI outcome, design a scorecard to rank/score long-listed areas on labor market criteria. Ideally, the best locations will score well on qualitative criteria such as excess supply and display a favorable labor cost structure. This exercise will lead to selection of finalist or short-list locations (often three to four).

At this juncture, the site selection team visits each short-listed area. The main objective is to gauge labor market viability, both in the immediate future and several years out. To gather these insights, field investigation should embrace:

1. Interviews with similar employers to ascertain recent and emerging labor market experiences

2. Applicant flow

3. Quality (e.g., basic skills, computer literacy, problem-solving team work)

4. Turnover

5. Absenteeism

6. Recruiting sources/methods

7. Commute sheds

8. Preferred sub labor market

9. Salary levels

10. Pay for performance

11. Future supply/cost pressure

12. Reliance on internships and apprenticeships

13. Education/training resources and programs

14. Collaboration among employers for post-secondary training

15. Benefits programs/flexibility

16. HR practices

17. Employer-of-choice keys

18. Interviews with other pertinent entities (who can shed light on labor market conditions)

19. Staffing agency

20. Executive recruiter

21. Workforce development/labor offices

22. Educational institutions

23. Business groups (e.g., plant and HR managers associations)

24. Economic development organizations

25. Residential realtor (quality of life and national recruiting)

26. Area tours

27. Available office space (or build-to-suit sites)

28. Location of competing employers

29. Residential concentrations of targeted labor resources

30. Highway access

31. Mass transit

32. Assessment of office space on characteristics important for recruiting/retaining talent

33. Amenities

34. Access

35. Attractiveness

36. Tenant compatibility

37. Environmental/green

38. Parking.

Discussions with economic development and government officials relative to incentives and other pertinent considerations (e.g., types of companies seriously looking at the area for new facilities, entrepreneurship/business startup in medical and health industries, downtown revitalization, etc.) are essential as well.

Subsequent to field study, supplemented research will be required. This could include data mining of job posting sites (from LinkedIn to Indeed) to quantify talent pool demand/depth in occupations not yet classified/reported by the government), GIS commute zone maps to support sub labor market selection and quantifying talent pool additions from colleges/universities both in the area and up to at least a 50-mile radius.

The team subsequently creates a schematic or series of placeholders to aggregate field findings (e.g., demand, supply, cost, stability, future cost pressures, sub labor market, etc.). Each area should be assigned two scores on respective factors: the first score reflects the current labor market picture and the second score encompasses the team’s opinion on the future labor market state of affairs. This process should result in a tiering of the short-listed locations. Two will often be selected for final due diligence (e.g., real estate negotiation, incentives negotiation, technology/infrastructure, finance, legal, etc.).

Additional Criteria

Picking the right location does involve a range of variables beyond human resources. A similar elimination/vetting process should be followed in assessing the potential fit of any candidate location. Among the more prominent siting criteria for medical devices locations include:

1. Utility cost

2. Electric power reliability

3. Medical school presence (a requirement for some companies)

4. Natural disaster risk

5. Small package pickup/delivery service

6. Environmental permitting: Air service to HQ, R&D sites and select gateway cities

7. Tax practices/rates (especially on machinery and equipment)

8. Incentives, in addition to HR-related.

The medical devices industry should continue on an expansionary path. Revenue/profit projections are solid for the next few years.

A healthy level of new plant construction is expected, at least over the next two-three years. Activity level will be robust in the U.S. The most pivotal challenge in finding optimal sites for new facilities is and will continue to be talent. A quantitative and structured approach should be followed to ensure any potential location can readily support attainment of HR objectives. Also, selected locations must score well on determinants such as sites/buildings, utility cost/infrastructure, accessibility and overall business costs. Incentives can be important as a tiebreaker among well-qualified locations, should not constitute the driver for choosing a new location.

When looking overseas for new sites, the geography of markets to be served will delimit the initial search territory. Then, depending on objectives/requirements (e.g., importance of labor cost vs. location within an industry ecosystem) a systematic process should be followed. This will start out at the country level and progress into a metro (or regional) and then the city level. Among key factors will be trading blocks, tariffs/barriers to entry talent pool, labor costs, other operating costs, infrastructure, labor legislation, potential/social risk, available sites/buildings, economic zones and accessibility.

A multi-discipline team following a methodical study approach will produce desired results on site selection projects for medical device manufacturers. Above all, the team must be confident the final selection allows the company to staff the operation with best-of-class talent at an affordable price. T&ID