Despite the gloom and doom constantly spouted by talking heads during 2012, it was actually not that bad of a year for capital expansion projects throughout the U.S. Companies had stockpiled considerable amounts of cash during the previous two or three years, banks were cautiously looking to do deals again, and there was a level of pent-up demand for expansion projects in many industry sectors.

Financing structures were not much different from those used over the last decade or two, with companies using a variety of tools and techniques to pay for their projects, including traditional loans and bonds, government programs and their own assets.

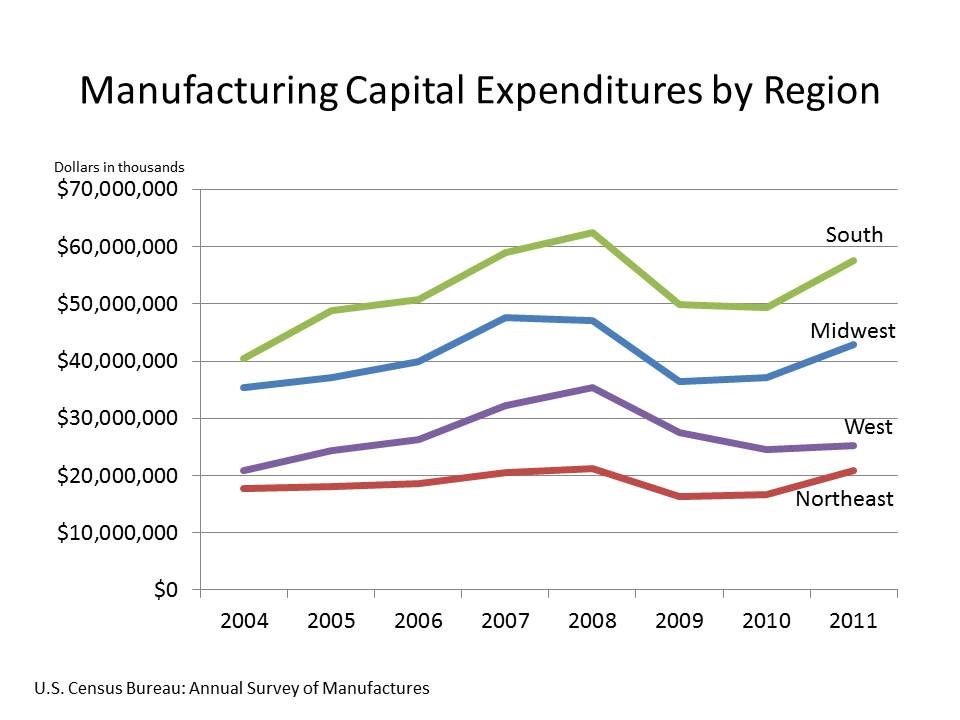

As evident in the chart below, capital expenditures by manufacturers have trended up since 2009 throughout the country. And according to a recent release from the Institute for Supply Management, capital expenditures in the manufacturing sector are projected to grow by more than seven percent in 20131.

Many large manufacturing companies have been stockpiling cash. In fact, the total liquid assets held by S&P 500 firms has grown from approximately $3.5 billion in 2008, to more than $6 billion as of the 3rd Quarter of 2012 — an increase of approximately 75 percent. Total liquid assets held by all non-financial firms in the U.S. rose approximately 25 percent, from nearly $1.4 trillion in 2008 to more than $1.7 trillion in 2012. These large cash balances are fueling expansion projects.

Bank Financing — Good Deals to be Had

It is safe to say that the banking world has been challenged over the last several years. The total number of commercial banks in the U.S. has declined by nearly 8,300, or almost 60 percent over the last few decades due to several factors, including approximately 3,000 failed institutions, closures for other reasons and consolidation activity. There are now approximately 6,000 commercial banks in the U.S. and while the lending environment has clearly seen better days, many of these banks are still willing to do deals.

I recently spoke with senior banking executives from some of the largest banks in the country, and they consistently indicated a desire to participate in good deals. Of course, while “good deals” these days might mean something completely different than several years ago, manufacturing projects are still interesting to banks as these projects tend to have equipment and inventory for collateral. Commercial banks face an ongoing challenge related to the low-interest-rate environment, and they will likely continue to be somewhat risk averse in the near future.

All of the banks I spoke with had a robust level of loan activity during 2012 – higher than in 2011 – and were optimistic about deal flow in 2013.

Government Financing Programs — A Case in Point

In addition to self-financing and traditional lending sources, veteran corporate site selectors know there exists a complex world of possibilities in the form of government financing programs. These can include loans, grants and other incentives from government and economic development organizations from federal to local and everything in between.

It is not unusual for the expansions for which Silverlode Consulting provides assistance to involve more than a dozen separate incentives and financing programs. One of our recent projects is a good example of the many elements that can be used on a single project.

A large, diversified manufacturing company was seeking to build a new production facility in the Midwest. The project was estimated to cost approximately $52 million, and would bring new jobs to the selected region.

This was a competitive site selection project, so confidential discussions with state and local officials in the finalist locations began early in the process. This is important as the negotiation and application process for many government programs can be complex and time consuming. The table below summarizes all of the government programs that were secured for this particular project:

|

Program |

Value |

|---|---|

|

Discretionary grant - State |

$ 2,500,000 |

|

Tax increment financing - county and local |

$ 3,625,000 |

|

Discretionary grant - local |

$ 150,000 |

|

Loan (partially forgivable) - county |

$ 1,500,000 |

|

Tax credits - state |

$ 1,170,000 |

|

Equipment loan - state |

$ 2,000,000 |

|

Waived fees - local |

$ 120,000 |

|

Discretionary grant - state |

$ 2,500,000 |

|

Total |

$11,065,000 |

The list outlined above comprised funding for a little more than 20 percent of the total cost of the project, with the remaining portion being a mix of traditional sources of financing.

Discretionary Grants — Deal-Closing Funds

Incentives vary significantly from state to state, county to county, city to city – sometimes even from one side of a street to another. Discretionary grants, sometimes called “deal-closing” funds, vary in availability across the country, and there exists a pendulum effect within many states in which they may be readily available one year, and then largely unavailable the next. This can be due to changes in administration or philosophy, budget issues or other factors. These grants should not be considered simply free money, as these programs can have strict performance requirements and “clawback” provisions.

Typically, discretionary grants can be used to offset hard project costs, and often are structured as reimbursements of eligible expenses. States may also offer grants for things such as training or infrastructure improvement, the value of which will depend on the specifics of the project. While there are also a large number of federal financing programs that exist in the U.S., many of these are for purposes other than facility expansions, and we rarely find readily accessible value at that level.

Grants may also be available at the county or municipal level. As many states have faced budget shortfalls over the last few years, county and local governments have been forced to play a larger role in creating inducements for competitive projects. In some regions of the country, local government entities may also have the ability to provide things such as free or low-cost land or buildings that can result in significant savings for a project.

Tax Credits and Tax Increment Financing — Good, yet Complicated

Many states can award tax credits for job creation or capital investment. Some of these programs are refundable credits, which can effectively work as grants depending on a company’s state tax liability. In these cases, the credits are first used to offset taxes and any remaining credit value is provided to the company in cash.

Tax increment financing is a tool that is allowable in some form in most states; however, the applicability to private investments varies greatly. This financing mechanism establishes a baseline for the property value of a project’s parcel(s) for some period of years, and the new property taxes above this baseline, which are generated by the improvements, are used to repay bonds issued to fund the project. For example, in the Silverlode project described above, the incremental new property taxes to be generated by the new building were estimated to be nearly $300,000 per year. By establishing a tax increment financing district, we were able to use 20 years of those incremental new taxes to finance a $3.625 million bond to be used for on-site infrastructure improvements for the project.

While it is fairly easy to describe the tax increment financing process, it is rarely easy to implement. These programs often involve several rounds of legislation, public notifications and hearings, school board approvals, etc., and can take many months to implement. In places where tax increment financing is overly complex to use or not a good fit for a particular project, property tax abatements may be available and slightly easier to secure.

Taking advantage of government sources of financing requires careful planning, patience and perseverance. Many companies that have not had experience working with tax and financial incentives programs are unpleasantly surprised at just how complex the process can be. It is not uncommon for us to hear from a CEO or CFO that they have a handle on the incentives because they are friends with the governor or a senator, a mayor, a council person. They make the mistake of proudly announcing their project and ringing up their high-placed acquaintance, only to learn that they are out of luck.

It is important to assemble a talented team to tackle the incentives process. Internally, this should probably include project management, state and local tax personnel, real estate, human resources and finance staff. External services providers such as legal, tax and accounting, and site selection and incentives consultants also tend to pay for themselves many times over on a complex expansion project.

The Definitive Process for Securing Financial Assistance

As mentioned above, the specific programs offered vary greatly across jurisdictions; however, the basic process for securing them does not. Maximizing the potential of tax and financial assistance programs requires a carefully choreographed approach, the elements of which are summarized in the chart below. The blue boxes represent tasks where government officials are usually involved, and the red box indicates the latest point where the identity the company may be disclosed.

Keep it Under Your Hat

It is often helpful for a number of reasons to begin both the site selection and incentives process without disclosing the identity of the company. For publicly traded firms this can be especially important as it may not be the right timing to have to answer analysts’ questions about a rumored expansion project, and for all firms it can help reduce the number of sales calls from service providers which tend to follow news of a potential project. As shown in the chart above, it is possible to get about halfway through the incentives process without identifying the company, although this typically requires the use of a consultant.

Mastering the Big Ask

Another critical step in the incentives negotiation process often mishandled even by experienced site selectors revolves around the development of an “ask.” There are essentially two ways to approach this. The first is basically to say to officials, “what can you give us?” It is worth noting, however, that economic development officials are generally charged with landing as many jobs as possible for as little cost as possible, and with this approach, it is quite likely that money may be left on the table. The other approach is to enter the initial meeting with a full understanding of:

-

What programs do the state and local governments have that might be applicable for the project?

-

What are the statutory rules and limits for these programs? This should not be confused with the administrative guidelines, as it is not uncommon for officials to not fully understand all that is possible within their own programs.

-

Many states’ premier incentives programs have limits in the number that can be awarded in a calendar or fiscal year. In these cases, it is important to know the status of those programs.

-

Many states have inducements that are structured as tax credits that may or may not be refundable. In states where tax credits are not refundable and it is unlikely the company will generate sufficient liabilities to take full advantage of them, it may be possible and worthwhile to negotiate for other types of assistance at some discounted rate in exchange for passing on the big credit program.

-

Who is in the meeting? What are the likely next steps for how this project will be managed by these agencies? How complex is the application process? How long is the approval process? What are the requirements under these programs with regard to hiring targeted groups, prevailing wage on building improvements, clawback provisions, etc.?

-

What are the shortcomings of the state/site? States can fund roadway, sewer and other infrastructure improvements if they are needed. If no needs are identified, no funding will be offered. Likewise, if labor availability or suitability is an identified need, states may be able to offer training grants, state-funded-and-managed job fairs, etc.

In many cases, we do not even begin to discuss actual incentives dollars in these first meetings. Rather, we seek to secure support of the Governor or other high-ranking officials so that when the project is delegated to their staff, it is treated as a high-priority project. In the rare cases where we do put numbers on the table early in the process, it is only after we have completed our comparative cost analyses and carefully determined the “gap” number that we are asking the state/local governments to fill. This approach helps to retain the leverage and tends to yield better results.

After experiencing one of our busiest years in a decade in 2012, we think 2013 looks even better. With the wide array of financing tools and strategies available, even the most challenging projects should find a way to get built.

______________________________

1http://www.ism.ws/about/MediaRoom/newsreleasedetail.cfm?ItemNumber=23332