How can IT companies succeed in this fast-paced environment? How does corporate site selection factor into long-range planning and growth? We examine three core drivers in site selection for IT:

1) Talent recruitment

2) Cost optimization

3) Innovation.

Site selection decisions won’t directly affect corporate or product strategy, but finding the best locations for your company’s operations will enable and empower the growth required by today’s successful IT firms.

The Never-Ending Search for the Best Talent in the World

Site selection for IT is fundamentally and primarily a search for the best talent. Competition for talent in places like Silicon Valley has reached a fever pitch. Unemployment rates for IT workers are effectively zero in most parts of the country.

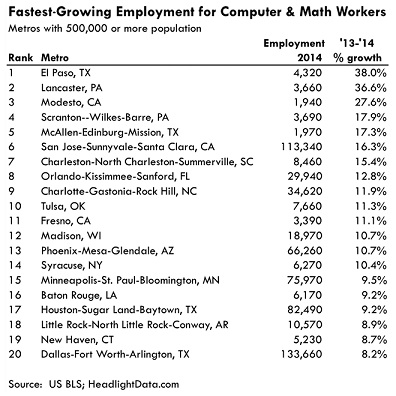

Growth has forced companies to look beyond the major markets for IT workers. In fact, few of the top-20 metros with the fastest-growing employment base for IT workers are in California or other traditional tech hubs. Surprising leaders are El Paso, Texas; Lancaster, Pennsylvania; Scranton, Pennsylvania; McAllen, Texas; and Charleston, South Carolina.

Some of this growth is certainly due to organic demand for more IT in their economies, but much of it comes from companies choosing to base IT and back-office operations in lower-cost locations. By basing their operations in towns with less-well-known tech industries, a growing number of firms are avoiding much of the difficulty in securing and retaining talent.

Still, many non-tech states face extreme shortages in IT workers. Many states seek to boost their technology sectors by generating higher levels of tech workers at colleges and universities. But does a growing supply of graduates equate to a growing availability of IT workers?

We looked closely at this issue. Because IT firms are highly interested in a young workforce that is familiar with the latest technologies, we examined how well the output of software graduates matches the demand for workers — and our results were surprising. By our estimate, about half of the 55,000 new jobs created for software programmers each year are filled by college graduates, while the rest are experienced professionals who learn the skills after college. Three states produce vastly more software graduates than their economy needs: Rhode Island, Arizona and Indiana. Colleges in these states are promising places to recruit a workforce ready to relocate.

Where are software graduates most likely to get snapped up quickly? Large states such as Virginia, Washington, New Jersey and Texas still don’t produce enough graduates for their booming technology sectors. And in several less-populous states such as New Mexico, Delaware, Alabama and Kentucky, talent production falls far short of what is needed to support even relatively small tech sectors.

Companies willing to explore locations off the well-beaten tech path can find significant talent. In addition to easier worker recruitment, these firms often will find the cost of obtaining skills extremely cost competitive.

The Impact of Costs on the IT Sector

Costs may not play a significant role for IT companies because IT companies often pay premium prices for workers and real estate to support their growth trajectory. In many regions with a high concentration of IT workers, fierce competition for talent contributes to extremely high labor costs. San Francisco’s average salary for computer and math workers is $105,000 annually, nearly 25 percent higher than the U.S. average. In just the last five years, this salary increased 45 percent faster than the U.S. average. Such wages are readily manageable by larger tech firms; companies such as Apple and Facebook can generate $1- to $2 million revenue per worker. Less-profitable companies, however, may not be able to compete with the wages offered by tech heavyweights in large metros.

While lower wages may signal a lower-quality or less-experienced software worker, regions with a large output of software graduates and low wages may prove to be ideal for IT companies seeking additional locations. Mid-size metros such as Louisville, Little Rock, Oklahoma City, Buffalo, Nashville and Salt Lake-Provo are worth examining.

For some IT companies, tax costs must be a consideration. Equipment-intensive data centers or technology manufacturing can be burdened with high taxes in some states but not others. Often, tax abatements play a role in smoothing out the variations in tax codes. Big incentives deals that catch headlines across the U.S. usually are a result of an abatement of a state tax that doesn’t exist in other states competing for the project. For example, Tesla’s $1.2 billion incentive price tag for Nevada was high due to a $725 million abatement of sales tax on equipment, which doesn’t exist in 32 other states.

IT-driven innovation is happening in every industry of the economy, and locating in communities with diverse industries often can help IT companies stay innovative themselves. Consider the fact that tech talent extends far beyond the traditional technology industry — more than 90 percent of software application developers do not work for software companies. Capital-intensive industries such as manufacturing and energy, for example, increasingly rely on software applications to reduce costs. In the manufacturing industry, which actually employs more software application designers than software companies, computer modeling allows companies to simulate product designs before they are physically prototyped (a much more expensive and lengthy process). In the energy sector, sophisticated analytical programs can identify potential equipment failures before they occur. Anticipating maintenance needs helps energy companies schedule equipment maintenance and improve operational efficiency.

IT companies should consider locations where highly concentrated industries can offer opportunities for innovative cross-pollination in addition to locating in regions that provide skilled, cost-competitive labor.

Be Ready to Grab Workers When Other Industries Downsize

Sometimes, the availability of IT workers can spike when an industry downsizes or structural changes occur that result in layoffs. For example, consider the case of Houston. As the global center for energy, Houston is a large consumer of IT talent. The number of software workers in the Houston region increased 50 percent faster than in San Jose between 2009 and 2014. With the downturn in the energy sectors due to falling prices, however, IT workers are becoming more available. Additionally, the cost of acquiring talent in Houston remains incredibly competitive; average salaries for computer and math sciences workers are nearly identical to the U.S. average, unlike most major metros.

Site Selection Process for IT Companies

Selecting a site for new or expanded information technology operations typically involves the following steps:

1. Identify the Successful Outcomes — The final intended outcome of the new location will drive the entire selection process. Relevant goals will include the strategic needs of the company, cost considerations and the expected time frame of selecting a location and beginning operations. As a result, the company’s management and financial team should work closely with site selection consultants early in the selection process to identify and prioritize.

2. Evaluate Supporting Incentives — As the IT industry involves many startup firms that may be undertaking their first major expansion or relocation, educating the company’s leadership on potential incentives is critical. The IT sector is heavily sought out by communities throughout the U.S. and many states and localities have developed specific incentive policies to help attract the industry. Site selection consultants can provide IT clients with invaluable information on existing incentives and necessary steps to secure assistance. Company management then can identify what types of assistance would generate the most impact to their bottom lines. For example, in capital-intensive IT sectors such as data centers, property tax abatements likely will be the most relevant incentives. Software companies, on the other hand, may prefer payroll-based tax credits. Some states offer grants or forgivable loans to relocating technology firms.

2. Evaluate Supporting Incentives — As the IT industry involves many startup firms that may be undertaking their first major expansion or relocation, educating the company’s leadership on potential incentives is critical. The IT sector is heavily sought out by communities throughout the U.S. and many states and localities have developed specific incentive policies to help attract the industry. Site selection consultants can provide IT clients with invaluable information on existing incentives and necessary steps to secure assistance. Company management then can identify what types of assistance would generate the most impact to their bottom lines. For example, in capital-intensive IT sectors such as data centers, property tax abatements likely will be the most relevant incentives. Software companies, on the other hand, may prefer payroll-based tax credits. Some states offer grants or forgivable loans to relocating technology firms.

3. Solicit Requests for Proposals (RFPs) — One of the first tasks of a site selection consultant is to quickly identify a short list of potential locations. The selection process involves carefully inventorying the needs of the company and then collecting a limited amount of demographic and economic data on possible investment locations. Depending on the specific needs of the company, the initial short list may include as few as five communities to as many as 15. Consultants will then identify additional information needed from each community, including workforce availability, available incentives and operational cost factors such as utilities, taxes and real estate. The site selection consultant then will issue an RFP requesting this information from prospective communities. Due to the need to maintain complete confidentiality, the RFP will be issued directly by the consultant and the client will remain unnamed.

4. Proposal Evaluation, Site Visit & Benchmarking — The results of completed proposals from each community should be measured against the selection criteria articulated during the initial phase of the site selection process. Incentives from individual state and localities rarely are directly comparable. The site selection consultant will likely have to apply each incentive proposal to a company’s operational reality to obtain an “apples-to-apples” comparison. The site selection consultant then will typically visit three to five communities with particularly attractive proposals. During these visits, the consultants will meet with local leaders from both the public and private sector to obtain a more nuanced understanding of each community’s strengths and weaknesses. Quantitative information from each proposal will integrated with qualitative information gleaned from site visits to establish a ranking of preferred localities.

5. Negotiating Final Terms with Communities — Final negotiations typically encompass any proposed incentive packages and any outstanding real estate issues in the selected site.

6. Winning Community and Site Selection — Once the final terms of each community’s proposal are formalized, company management will work with the site consultant to select the most compelling site. An announcement on the expansion or relocation should occur only after all relevant agreements have been signed. Once an agreement has been secured, the site selection consultant will work with the community to publicly announce the selection and trumpet the company’s investment choice.