The technology industry has become one of the most dominant drivers of the U.S. economy today, as it permeates more aspects of consumer life and business strategy. Urgency now exists for companies to identify the best technology workforce to ensure dominance in their field. Despite low levels of unemployment, there is still fear that technology and automation will soon start to displace workers at levels never before seen (at least those tasks that can be automated). When Marc Andreessen famously said in 2011, “Software is eating the world,” he could have continued the sentence with, “and is coming to eat your lunch.”

The technology industry has become one of the most dominant drivers of the U.S. economy today, as it permeates more aspects of consumer life and business strategy. Urgency now exists for companies to identify the best technology workforce to ensure dominance in their field. Despite low levels of unemployment, there is still fear that technology and automation will soon start to displace workers at levels never before seen (at least those tasks that can be automated). When Marc Andreessen famously said in 2011, “Software is eating the world,” he could have continued the sentence with, “and is coming to eat your lunch.”

Defining the technology industry is difficult in the age of pervasive ecommerce and business process optimization. This article reviews trends in new technologies and how they are changing the competitive landscape for technology producers – those industries such as software development and electronics manufacturing that deliver the technology products that everyone uses. It will also discuss trends in technology workforce, both where they are located today and where top technology graduates can be found. Finally, the article will offer strategic insights to help technology companies as well as technology-driven companies find their best locations for long-term success.

Technology Today and Tomorrow

Technology Today and Tomorrow

The technology industry is advancing rapidly – maybe more rapidly than in many years. Continued improvements in cloud-based technologies and data analytics will guide the new Internet of Things into maturity. Now, rapid advancements in Artificial Intelligence (AI) aim to permeate all manners of business and consumer activity.

While in development for decades, AI has found renewed acceptance as a transformative technology that is just beginning to benefit from high-speed computing and the booming amount of meta data. We all have watched the competition among a few leading companies develop autonomous vehicles, re-usable rocket ships, drones and many other futuristic vehicles. Industries from financial, health, automotive and cyber security are racing to use AI as a new layer in their business process and product development. Even countries have announced their desire to stake their claim in the future of AI: China, Russia, Europe and the U.S.

Regardless of AI’s rate of adoption, the relationship between hardware and software will be forever changed. More and more of our daily lives will be run through a smartphone app or via voice recognition services (currently in a very early stage). Things will tell us their needs or suggestions and we will talk back (the Internet of Things is all about communication). All of these future devices and services will need highly dynamic teams of workers to design, build, support and serve the customer base. As such, the demand for technology workers is at an all-time high and will remain high for many years.

Where to Find Technology Workers

Today, there are nearly 12 million technology workers in the U.S. according to CompTIA. This value includes seven million workers inside technology companies as well as another five million STEM workers (non-health) working across all other industries. Most growth in the workforce is at IT companies and within the IT workforce.

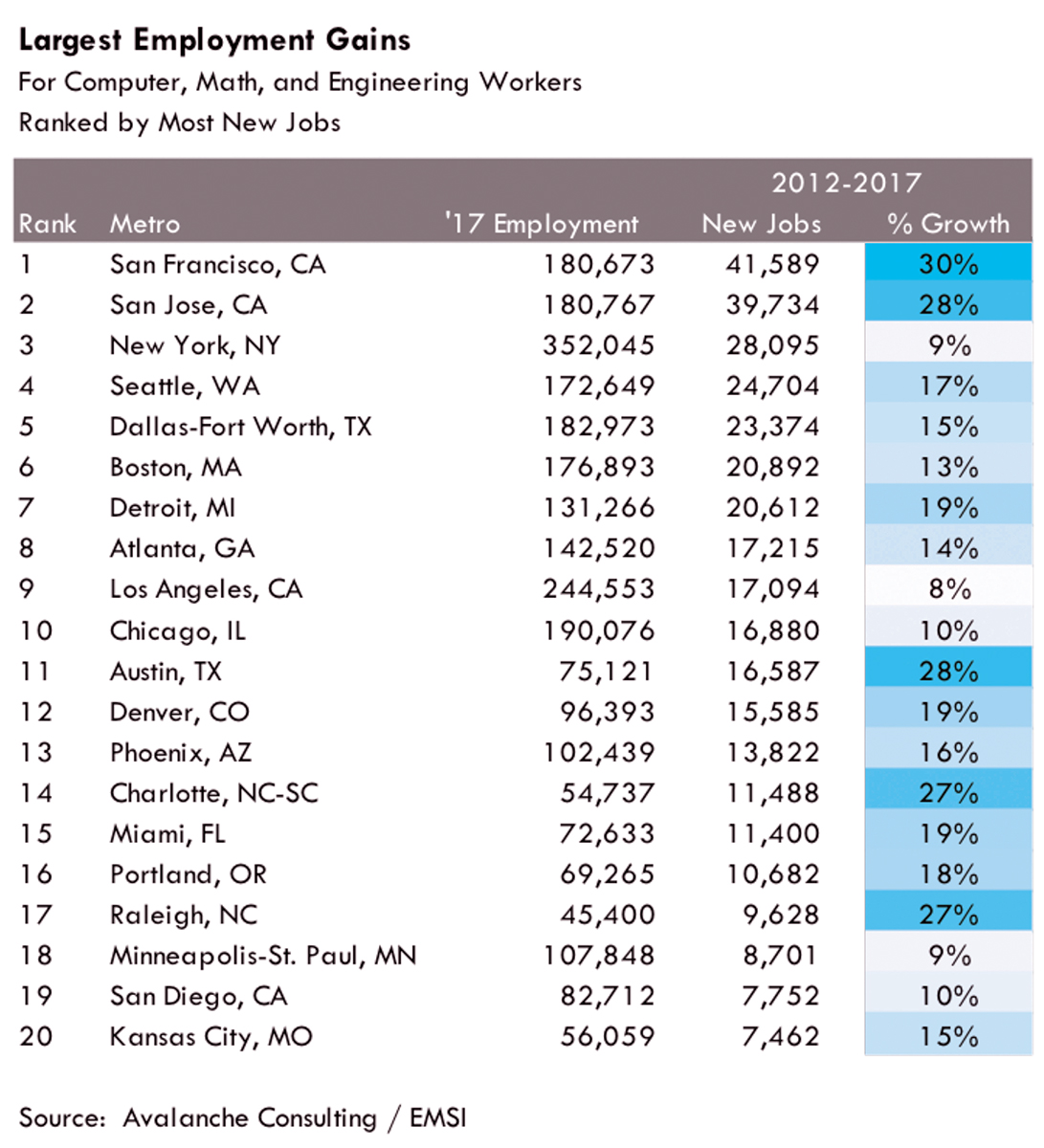

Where is the technology workforce growing the fastest? Most new jobs for computer, math and engineering workers are still being created in the usual major metros: San Francisco, San Jose, New York and Seattle. However, would you be surprised to hear that Dallas-Fort Worth ranked fifth in technology workforce expansion from 2012-2017? Detroit has seen a strong rebound (helped by resurgent auto sales) and Austin, Charlotte and Raleigh grew their technology workforce nearly 30 percent in five years (see chart below).

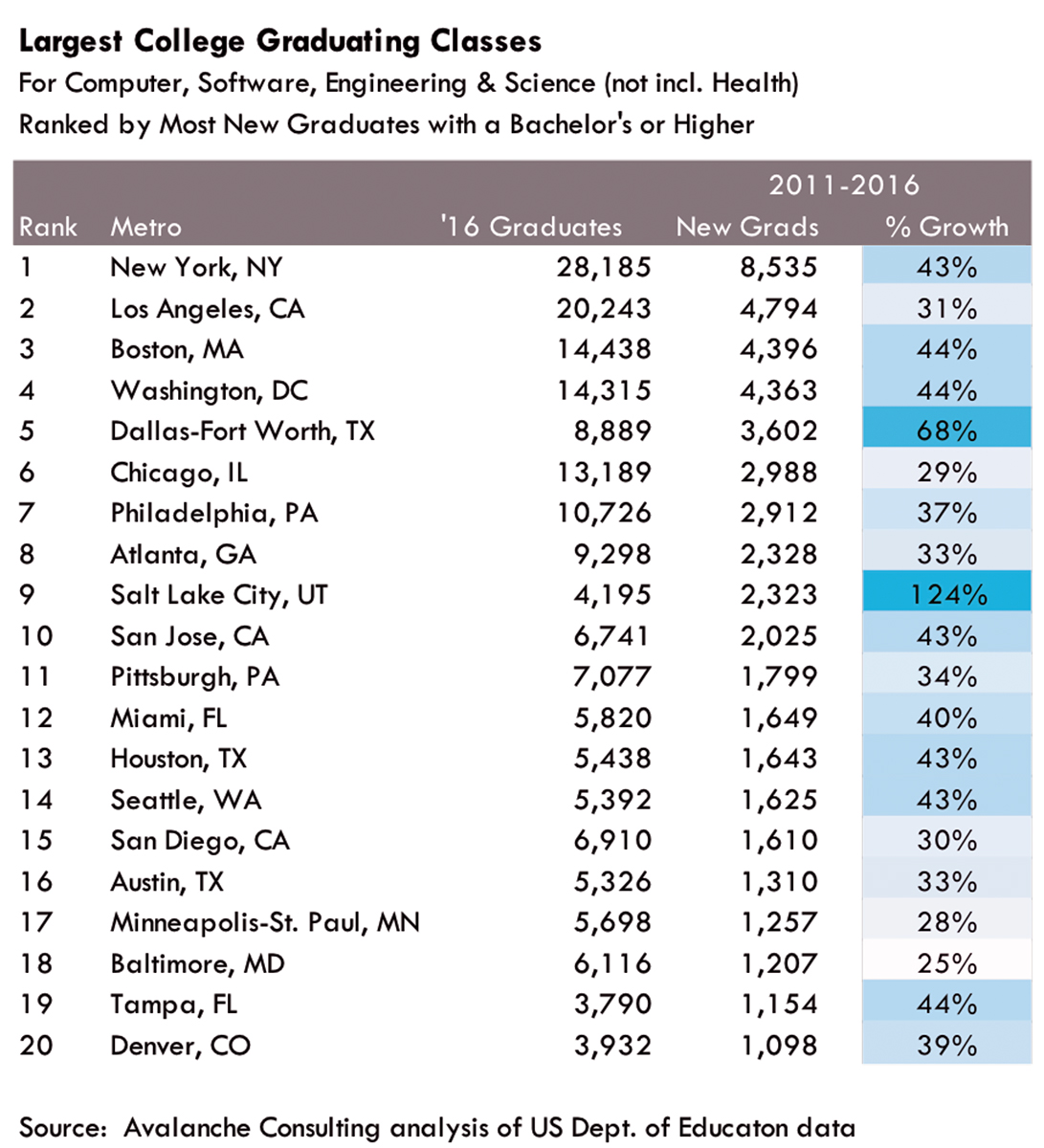

While a growing technology workforce is an indication of new potential labor for hire, another indicator is the output of college graduates from major universities. Again, New York and Boston deliver large numbers of graduates in computer, software, engineering and science (not including health). But places like Los Angeles; Washington, D.C.; and Dallas-Fort Worth have significantly grown their graduating classes in recent years. Salt Lake City has more than doubled its STEM graduates in the past five years. Look to these metros to find the next generation of workers.

While a growing technology workforce is an indication of new potential labor for hire, another indicator is the output of college graduates from major universities. Again, New York and Boston deliver large numbers of graduates in computer, software, engineering and science (not including health). But places like Los Angeles; Washington, D.C.; and Dallas-Fort Worth have significantly grown their graduating classes in recent years. Salt Lake City has more than doubled its STEM graduates in the past five years. Look to these metros to find the next generation of workers.

Much can be learned from Amazon’s HQ2 site search. If you are making a long-term decision on your corporate location strategy (like Amazon), and if you are planning to dominate your industry or attack new markets using a tech-savvy workforce (like Amazon), why not look where Amazon is looking? Priorities are clear: markets that are growing, with a research university, attractive to Millennials and have a plan for dense, multi-modal development. Many on their Top 20 short list are expected, but consider how up-and-coming tech centers like Columbus, Indianapolis, Charlotte and Atlanta can serve corporate transformations.

With unemployment rates near zero for technology workers today, companies must also look at smaller markets to find workers. Ogen, Utah, outside of Salt Lake City had the fastest-growing IT workforce over the last five years, followed by Madison, Charleston, Knoxville and Provo. Mid-size metros with the fastest-growing engineering workforce are Winston-Salem, Provo and Ogden. Clearly, as Steve Case believes in the “Rise of the Rest,” we may start to hear of new technology powerhouses – small but mighty metros in middle America.

Cost Considerations are Still Important

Cost Considerations are Still Important

While many technology companies search for the best workers at any price, costs do play an important role in site selection for most. Finding cities that can attract workers, even if they are expensive, is one method. San Francisco will always attract the ambitious worker, but places like Austin attract workers that want to be able to afford a house (for now). Smaller metros like Indianapolis and Chattanooga are promoting their cities to a creative workforce that can earn a good salary and live well and affordably.

Capital-intensive industries such as data centers and technology manufacturing are highly sensitive to local property taxes and electricity rates. It is no surprise that many data centers for Facebook, Apple and Google have found a home in low-tax, low-cost North Carolina.

Air service is also a cost factor – involving not only the cost of travel but also the time spent in layovers. It is no wonder hub cities such as Atlanta and Charlotte have seen tremendous growth in their economies as well as their technology workforce.

Taxes also play an important role depending on a company’s stage of development. Companies are usually happy developing new products in states with high corporate income taxes while they aren’t making profits. Once profits are realized, however, locations matter greatly. High-income-tax states will continue to face headwinds as companies mature and seek to protect their income streams.

Site Selection Process for IT Companies

Site Selection Process for IT Companies

This section outlines the primary issues that affect a technology company’s expansion decision. The focus here is on information technology (IT), but many of these issues apply to other technology industries. Selecting a location for new technology operations typically involves the following steps:

Define Success – The site selection process should begin with the company’s ultimate goals, as these will drive all subsequent efforts. What are the company’s strategic needs? When does the client need to make a final decision? Are there specific considerations that must be addressed by the new location? Follow Amazon’s lead – be able to clearly articulate your goals in one to two pages. Define not only the what (requirements), but the why (aspirations).

Identify Financial Incentives – As many information technology companies are new to the site selection process, they are often unfamiliar with financial incentives available to relocating or expanding firms. Most incentives offered by cities and states are based on a rebate of property taxes, income taxes or payroll. For example, in Texas, a city may choose to abate the property taxes of a new corporate campus and the state may offer a percentage of payroll as a rebate. Some incentives will be up front and others will be provided each year over the term of the incentive deal. Site selection consultants should work with the client’s financial team to identify what types of financial assistance (now or later) that would provide the greatest positive impact to the company’s bottom line. Data centers, for example, are likely to benefit from property tax abatements. R&D tax credits, on the other hand, may be preferable for software firms.

Issue Requests for Proposals – Requests for proposals (RFPs) should be issued to a limited number of communities. The short list of potential locations should consist of five to 10 communities that meet certain criteria such as broad geographic considerations and labor requirements. For example, a software company located on the West Coast may require an East Coast location within relative proximity to a research university. Once the initial list of possible locations has been identified, the consultant will request more granular information from each community through a formal RFP. The RFP will focus on those issues most relevant to the client, including workforce availability, utility cost, tax rates and real estate availability. To ensure confidentiality, communities will not be provided with any identifying information about the client.

Negotiating Terms – Once a preferred location has been determined, any outstanding issues surrounding incentive packages and/or real estate acquisition should be finalized.

Select Site – The last step in the site selection process involves the careful consideration of each community’s proposal. The consultant should then collaborate with company management to select the most compelling site. The decision regarding the selection should remain private until the client secures a formal agreement with the community. Once accomplished, the site selection consultant should coordinate with local officials on a public unveiling of the community’s new corporate partner. T&ID

Blount County, Tennessee:

Pellissippi Place

It’s a concept rooted deep in human history: a vibrant community built on a compact, walkable scale with places for working, living, shopping and recreation, and a design that encourages casual interactions with friends and neighbors.

It’s called Pellissippi Place.

Pellissippi Place is a mixed-use community in East Tennessee with a business focus on technology research and development and commercialization. It is a collaborative effort of four local governments that are seeking to further R&D innovations in the Oak Ridge Technology Corridor/Innovation Valley.

Located in Blount County near the cities of Maryville and Alcoa, Pellissippi Place will foster innovation and product commercialization, and so much more. It’s unique in that all three components — business, commercial and residential — are being planned from the beginning.

All structures will be LEED-certified, following guidelines from the U.S. Green Building Council for the highest levels of energy efficiency in building design, construction and maintenance.